Orthopedic braces are medical devices used to treat musculoskeletal injuries. Braces are used to align correctly, position, stabilize, support, and protect the parts of the body (joints, muscles, and bones) as they heal from the orthopedic injury or trauma. During the process of rehabilitation and recovery, most of the medical practitioners prescribe braces.

Strategic insights for the Europe OTC Braces And Support provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

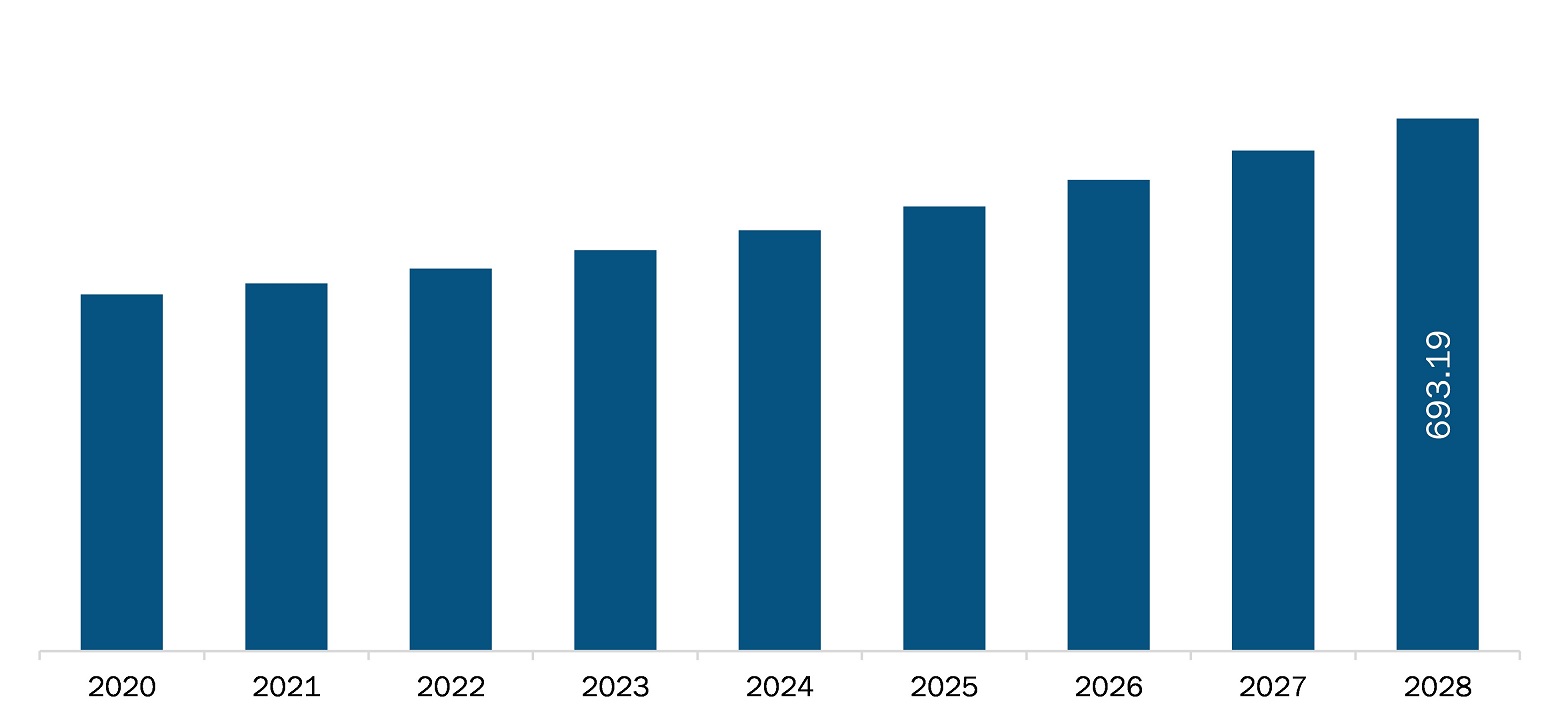

| Market size in 2020 | US$ 478.77 Million |

| Market Size by 2028 | US$ 693.19 Million |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe OTC Braces And Support refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe OTC braces and support market is expected to reach US$ 693.19 million by 2028 from US$ 478.77 million in 2020; it is estimated to register a CAGR of 5.4% from 2021 to 2028. The growth of the market is attributed to increasing awareness of braces and support, and rising demand for OTC braces and supports across the world. However, the availability of alternative therapies is restraining the market growth.

Braces are prominently used in developed and upper middle-income countries. Foundations such as the International Society for Prosthetics and Orthotics (ISPO) help create awareness regarding the use of orthopedic braces and supports. It is a non-government organization that aims to improve the quality-of-life of people with limb amputations or those with physical damages and injuries to limbs and spine by making them aware about the benefits of prosthetics and orthotics. The ISPO provides an effective platform to exchange and communicate all the aspects of science. The organization practices and educates the associates regarding the provision of prosthetic and orthotic care, rehabilitation engineering, and related areas. Therefore, the increasing awareness about orthopedic braces and supports is contributing to the market growth. Also, the trend of better-quality OTC braces and supports is likely to grow dramatically due to increasing popularity of e-commerce platforms. Moreover, innovative products, revolutionary technology, and successful events have created opportunities for the companies to continue the production of orthopedic braces and supports. Thus, they are likely to add value to their customers and increase customer base for their products in the coming years.

The European economy is severely affected due to the exponential growth of COVID-19 cases in the region. Also, the pandemic has halted the adoption of new medical device policy and delayed clinical trials and disrupted processes. For instance, the European Commission recently postponed the application date of the MDR for one year due to COVID-19 pandemic. The Medical Device Regulation (MDR) requires manufacturers to conduct post market clinical follow-up (PMCF) studies to demonstrate the continued safety and performance of their devices. This is expected to impact the product launch and ongoing clinical trials of medical devices, thereby impacting sales and growth of the market. In addition, disrupted supply chains, extended lockdowns, and cancelling of other medical procedures have also negativity affected the growth of the OTC braces and support market. The hospitals in the region are cancelling other surgical procedures to keep healthcare facilities free for COVID-19 patients. Moreover, the increasing COVID-19 infection among healthcare workers is leading to shortage of staff. These factors are negatively impacting the growth of the OTC braces and support market.

The Europe OTC braces and support market, based on product, is segmented into knee, back hip and spine, foot walkers and orthoses, neck and cervical, shoulder, elbow, hand and wrist, and facial. In 2020, the knee braces and support segment held the largest share of the market and is expected to grow at the highest CAGR during the forecast period.

The Europe OTC braces and support market, based on type, is segmented into soft and elastic braces and support, hard and rigid braces and support, & hinged braces and support. In 2020, the soft and elastic braces and support segment held the largest share of the market and expected to grow at the fastest rate during the coming years.

Based on application, the Europe OTC braces and support market is segmented into ligament injury repair, osteoarthritis, preventive care, compression therapy, and other applications. The ligament injury repair segment held the largest share of the market in 2020 and is expected to grow at the highest CAGR during the forecast period.

Based on end user, the Europe OTC braces and support market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others. The hospitals segment held the largest share of the market in 2020. However, the specialty clinics segment is estimated to register the highest CAGR during the forecast period.

A few of the primary and secondary sources referred to while preparing the report on the Europe OTC braces and support market are the French Society for Orthopedic Surgery (SOFCOT), Organization for Economic Co-operation and Development (OECD), and International Society for Prosthetics and Orthotics (ISPO).

The Europe OTC Braces And Support Market is valued at US$ 478.77 Million in 2020, it is projected to reach US$ 693.19 Million by 2028.

As per our report Europe OTC Braces And Support Market, the market size is valued at US$ 478.77 Million in 2020, projecting it to reach US$ 693.19 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The Europe OTC Braces And Support Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe OTC Braces And Support Market report:

The Europe OTC Braces And Support Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe OTC Braces And Support Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe OTC Braces And Support Market value chain can benefit from the information contained in a comprehensive market report.