The European ocular drug delivery market is segmented into Germany, UK, France, Italy, Spain, and rest of Europe, and Germany held the largest share in the market. Germany's extensively increasing geriatric population represents a lucrative opportunity for increased adoption of ocular drug delivery market in the country. As per the Aging Readiness & Competitiveness Initiative, Germany’s population aged 65 and older is projected to grow by 41% to 24 million by 2050, accounting for nearly one-third of the total population. Also, high numbers of patients are living with eye disorders are driving the growth of the market. As per the European Vision Institute EEIG, around 30,000 people in Germany were affected by hereditary retinal disorders. Increasing digitalization and the extensive use of small mobile devices have led to defective vision at younger ages, supporting sales of contact lenses. Furthermore, the country has technological solid support for medical devices; the country has several companies that are dedicated to working for sophisticated medical devices. In addition, the presence of market players in the country is likely to boost product awareness and product reach in the market. Novaliq is a German ophthalmic pharmaceutical company and is developing the first water-free technology for ocular drug delivery. Novaliq is focused on developing the technology for use in treatments for dry eye disease. The company’s products are centered on its proprietary water-free technology, EyeSol for topical ocular drug delivery

The European region has been massively hit by the COVID-19 spread, with most countries being in lockdown. Routine healthcare services were cancelled, and patients were recommended to avoid hospital visits to minimize the risk of COVID-19 transmission, leading to significant disruption to the provision of healthcare service and patient care. Ophthalmology represents one of the busiest and heavily outpatient-oriented specialties, with around 7.5 million outpatient appointments and over 500,000 surgical procedures being conducted every year in the United Kingdom. The lockdown has resulted in the cancellation of thousands of ophthalmic visits and surgeries; this has potentially led to permanent and significant harm to patient’s vision. Additionally, as per the recent survey – ‘Psychosocial impact of COVID-19 pandemic lockdown on people living with eye diseases in the UK’ which was conducted among the public with eye diseases, highlighted a significant negative psychosocial impact of lockdown on patients with visual impairment, with approximately 50% of the patients express fear of sight loss due to delayed review or treatment.

Strategic insights for the Europe Ocular Drug Delivery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

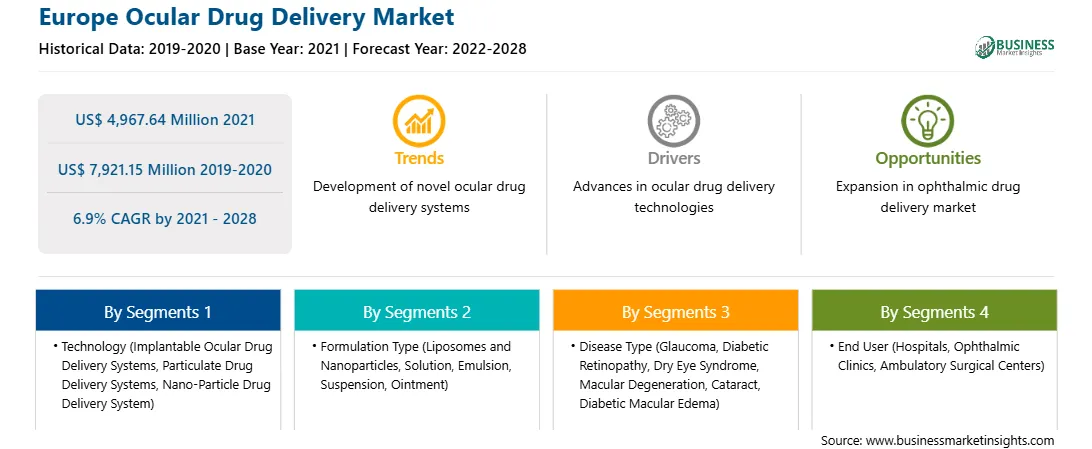

| Market size in 2021 | US$ 4,967.64 Million |

| Market Size by 2028 | US$ 7,921.15 Million |

| Global CAGR (2021 - 2028) | 6.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Ocular Drug Delivery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The ocular drug delivery market in Europe is expected to grow US$ 7,921.15 million by 2028 from US$ 4,967.64 million in 2021. The market is estimated to grow at a CAGR of 6.9% from 2021 to 2028. Cataract, glaucoma, age-related macular degeneration, diabetic retinopathy, and unaddressed refractive error are among the leading causes of blindness or low vision. Most of the population have or had some eye disorder in their lifetime. As per the World Health Organization (WHO) report "Blindness and vision impairment" published in February 2021, around 2.2 billion people worldwide have a near or distance vision impairment. It has also estimated that the leading cause of vision loss or low vision is cataract (94 million) and uncorrected refractive errors (88.4 million). Further, the other common causes of vision loss are glaucoma (7.7 million), corneal opacities (4.2 million), diabetic retinopathy (3.9 million), and trachoma (2 million). As per the Royal National Institute of Blind People in 2017, in the UK, there were around 350,000 people registered as blind and partially sighted; about 173,735 were registered for severely sight impaired; and 176,125 were registered for sight-impaired. Therefore, the growing prevalence of eye disorders is driving the ocular drug delivery market.

Europe ocular drug delivery market is segmented based on technology, formulation type, disease type, end user. Based on technology, implantable ocular drug delivery systems segment accounted for the highest share in 2021. Based on formulation type, solution segment accounted for the highest share in 2021. Based on disease type, cataract segment accounted for the highest share in 2021. Based on end user hospitals segment accounted for the highest share in 2021.

A few major primary and secondary sources referred to for preparing this report on ocular drug delivery market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report AbbVie Inc.; Bausch Health Companies Inc.; Novartis AG; Clearside Biomedical, Inc.; Envisia Therapeutics; GRAYBUG VISION, INC among others.

The Europe Ocular Drug Delivery Market is valued at US$ 4,967.64 Million in 2021, it is projected to reach US$ 7,921.15 Million by 2028.

As per our report Europe Ocular Drug Delivery Market, the market size is valued at US$ 4,967.64 Million in 2021, projecting it to reach US$ 7,921.15 Million by 2028. This translates to a CAGR of approximately 6.9% during the forecast period.

The Europe Ocular Drug Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Ocular Drug Delivery Market report:

The Europe Ocular Drug Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Ocular Drug Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Ocular Drug Delivery Market value chain can benefit from the information contained in a comprehensive market report.