As a greater number of nuclear power plants are nearing the end of the operational timeline, the operators and the governments are planning to decommission the facilities, and this activity is increasingly becoming mainstream, thereby driving the nuclear decommissioning services market. In the recent scenario, the decommissioning of nuclear facilities is outpacing the construction of newer facilities across the major regions. According to the World Nuclear Industry Status Report (WNISR), during the mid-2018, 115 nuclear reactors have been decommissioned, and ~70% of the world’s 173 reactors that have been permanently shut down. These statistics showcase the demand for decommissioning services, which is catalyzing the nuclear decommissioning services market. The average lifespan of nuclear power plants is 30 years; however, with refurbishments, several numbers of facilities continue to operate for another 20–30 years. Since the majority of the governments are inclining toward the construction of newer nuclear facilities with advanced technologies, the focus toward decommissioning of older facilities is higher, which is increasing the involvement of decommissioning service providers in the industry.

Strategic insights for the Europe Nuclear Decommissioning Service provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

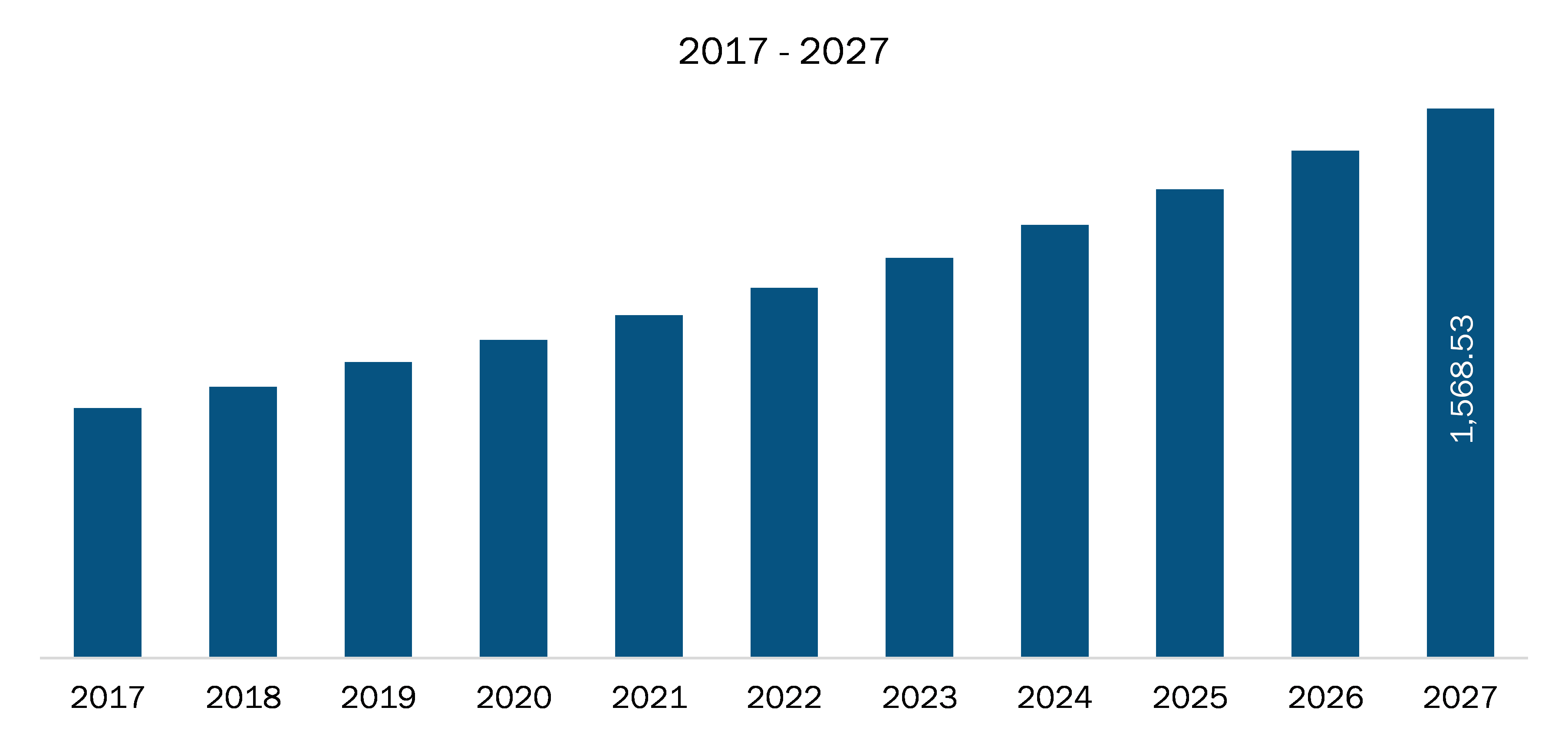

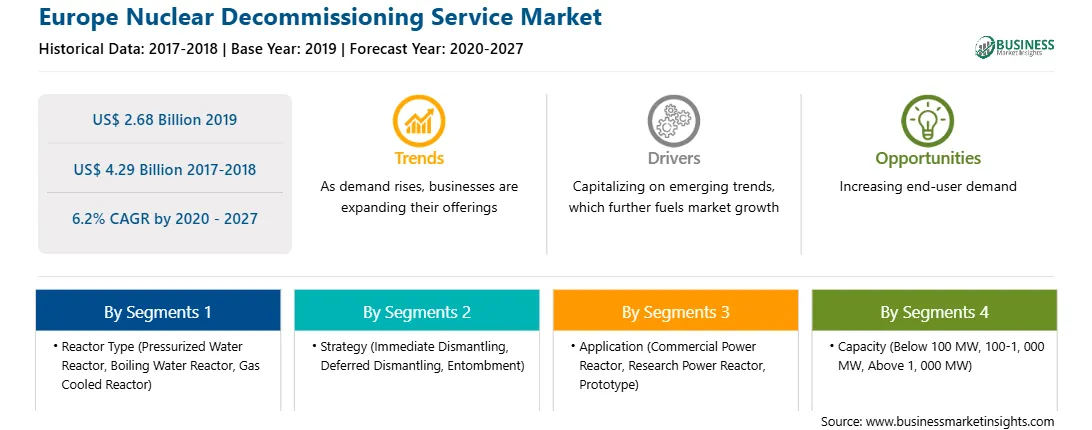

| Market size in 2019 | US$ 2.68 Billion |

| Market Size by 2027 | US$ 4.29 Billion |

| Global CAGR (2020 - 2027) | 6.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Reactor Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Nuclear Decommissioning Service refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The nuclear decommissioning service market in Europe was valued US$ 2.68 billion in 2019 and is projected to reach US$ 4.29 billion by 2027; it is expected to grow at a CAGR of 6.2% from 2020 to 2027. The Italian power generation and transmission sector comprise of nuclear power plants, which generates and transmits only 8% of the country's overall electricity generation and transmission. The country had 4 reactors and has been decommissioning the reactors following the Chernobyl incident. Italy relies heavily on imports and is the world's second-largest net importer of electricity. Sogin S.p.A., a government-owned nuclear decommissioning service provider, has been engaged in dismantling and decommissioning several nuclear power plants in the country.

In terms of reactor type, the pressurized water reactor segment accounted for the largest share of the Europe nuclear decommissioning service market in 2019. Whereas, by capacity, the beyond 1,000 MW segment held a larger market share of the nuclear decommissioning service market in 2019. Further, based on country, France held the largest share of the Europe market.

A few major primary and secondary sources referred to for preparing this report on the nuclear decommissioning service market in European region are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Babcock International Group PLC, Onet SA, Orano, Studsvik AB, NUVIA Group, PreussenElektra GmbH, NUKEM Technologies GmbH, GNS Gesellschaft fur Nuklear-Service GmbH, Atkins, and Sogin S.p.A.

The Europe Nuclear Decommissioning Service Market is valued at US$ 2.68 Billion in 2019, it is projected to reach US$ 4.29 Billion by 2027.

As per our report Europe Nuclear Decommissioning Service Market, the market size is valued at US$ 2.68 Billion in 2019, projecting it to reach US$ 4.29 Billion by 2027. This translates to a CAGR of approximately 6.2% during the forecast period.

The Europe Nuclear Decommissioning Service Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Nuclear Decommissioning Service Market report:

The Europe Nuclear Decommissioning Service Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Nuclear Decommissioning Service Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Nuclear Decommissioning Service Market value chain can benefit from the information contained in a comprehensive market report.