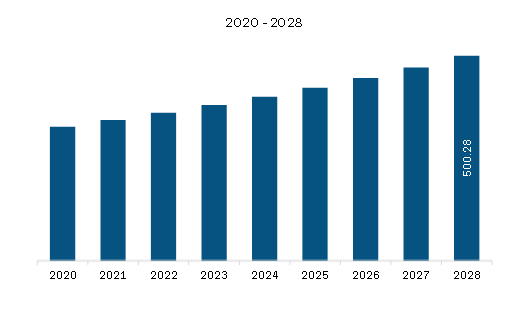

The non-alcoholic beverages market in Europe is expected to grow from US$ 360.55 million in 2022 to US$ 500.28 million by 2028. It is estimated to grow at a CAGR of 5.6% from 2022 to 2028.

Rising Popularity of Plant-Based Beverages

The vegan population has grown significantly over the past few years. People are readily switching to a vegan diet due to increased health and sustainability concerns. According to the International Food Information Council's 2021 Food and Health Survey, more than 4 out of 10 buyers believe plant-based food and beverages are healthier than conventional ones even when two products have similar ingredients and provide similar nutritional benefits. The demand for dairy alternatives is increasing promisingly due to the growing influence of veganism and the increasing lactose-intolerant population. Therefore, beverage manufacturers are increasingly launching products with plant-based claims to meet the growing demand. The products are made with oat milk and are certified vegan. For instance, in February 2021, Minor Figures, a UK-based beverage brand, launched a range of barista-quality canned tea and coffee with four variants—latte, matcha latte, chai latte, and mocha. Thus, the rising number of product launches under the plant-based beverage category is expected to drive the demand for non-alcoholic beverages in the coming years.

Market Overview

Germany, France, Italy, UK, Russia, and the Rest of Europe are the key contributors to the non-alcoholic beverages market in the Europe. Consumers are increasingly attracted to the health benefits of non-alcoholic beverages, increasing the demand for non-alcoholic beverages. Various manufacturers are introducing energy drinks which are a natural source of guarana extracts, vitamins B, and lack taurine. For instance, in April 2019, the first energy drink under the Coca-Cola brand was launched in Europe. Coca-Cola energy, which debuted in Spain and Hungary, features caffeine from naturally derived sources, guarana extracts, vitamins B, and lacks taurine. Moreover, the rise in fitness enthusiasts and growing consumer inclination toward a healthy lifestyle are the key drivers of the growth of non-alcoholic beverages. The younger generation in the region is engaging in physical fitness activities, thus, increasing the sales of non-alcoholic beverages, energy drinks, and sports drinks. Also, manufacturers are promoting these beverages on social media platforms. The younger generation in the region who are active on social & mass media platforms made the product category one of the most prominent beverage categories. Thus, these factors are driving the sales of non-alcoholic beverages in Europe. The growing participation of people in sports at the national and international level is likely to increase the number of athletes, which will boost the growth of the Europe non-alcoholic beverages market during the forecast period.

Europe Non-Alcoholic Beverages Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Europe Non-Alcoholic Beverages provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Non-Alcoholic Beverages refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Non-Alcoholic Beverages Strategic Insights

Europe Non-Alcoholic Beverages Report Scope

Report Attribute

Details

Market size in 2022

US$ 360.55 Million

Market Size by 2028

US$ 500.28 Million

Global CAGR (2022 - 2028)

5.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Packaging Type

By Category

By Distribution Channel

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Non-Alcoholic Beverages Regional Insights

Europe Non-Alcoholic Beverages Market Segmentation

The Europe non-alcoholic beverages market is segmented into type, packaging type, category, distribution channel, and country.

Based on type, the market is segmented into carbonated soft drinks, juices & nectars, bottled waters, dairy-based beverages, dairy alternative beverages, RTD tea & coffee, and others. The carbonated soft drinks segment registered the largest market share in 2022.

Based on packaging type, the market is segmented into bottles, cartons, cans, and pouches. The bottles segment held the largest market share in 2022.

Based on category, the market is bifurcated into sugar-free and conventional. The conventional segment held a larger market share in 2022.

Based on distribution channel, the market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The supermarkets & hypermarkets segment held the largest market share in 2022.

Based on country, the market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The rest of Europe dominated the market share in 2022.

The Coca-Cola Company; Nestle S.A; Red Bull; Califia Farms, LLC; Keurig Dr Pepper, Inc; Asahi Group Holdings, Ltd; Danone S.A; SUNTORY HOLDINGS LIMITED; Bolthouse Farms, Inc; and PepsiCo Inc are the leading companies operating in the non-alcoholic beverages market in the Europe region.

The Europe Non-Alcoholic Beverages Market is valued at US$ 360.55 Million in 2022, it is projected to reach US$ 500.28 Million by 2028.

As per our report Europe Non-Alcoholic Beverages Market, the market size is valued at US$ 360.55 Million in 2022, projecting it to reach US$ 500.28 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The Europe Non-Alcoholic Beverages Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Non-Alcoholic Beverages Market report:

The Europe Non-Alcoholic Beverages Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Non-Alcoholic Beverages Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Non-Alcoholic Beverages Market value chain can benefit from the information contained in a comprehensive market report.