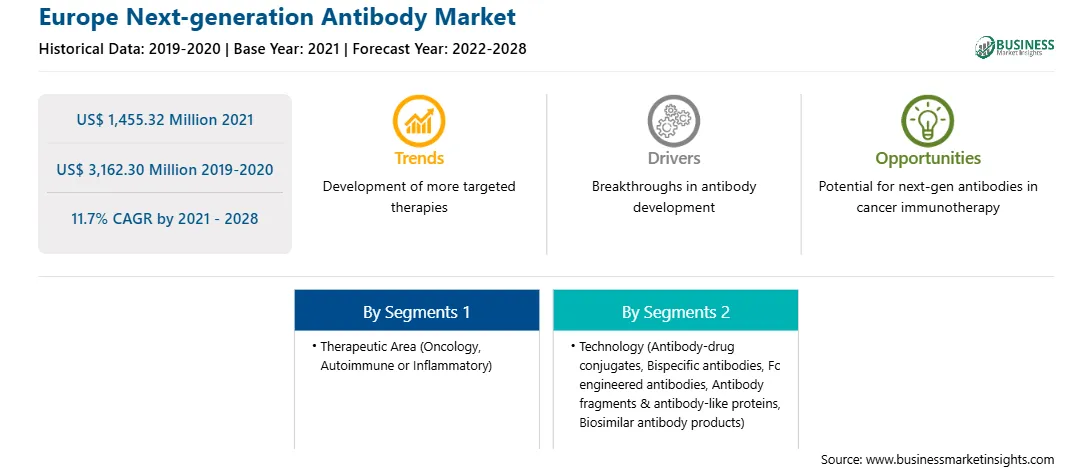

The increasing prevalence of cancer and growing demand for next-generation antibody therapeutics for its treatment is propelling the Europe next-generation antibody market. However, complications associated with the manufacturing and approvals of next-generation antibodies are expected to restrict the market growth during the forecast period.

Rising developments in biotechnology have led to increasing acceptance for next-generation antibodies therapeutics, which is further driving its use in autoimmune, inflammatory, and chronic treatment diseases. Next-generation antibody treatments have resulted from the application of sophisticated technologies in antibody therapeutics, such as antibody-drug conjugates (ADCs), glycoengineered antibodies, and specific antibodies (BsAbs). Therefore, applications of next-generation antibodies are being widely studied to treat various chronic diseases.

The rising demand for these antibodies has resulted in a rapid increase in the approval of ADCs and other next-generation antibodies therapeutics. For instance, in May 2020, Takeda Pharmaceutical Company Limited announced the FDA approval of ALUNBRIG (brigatinib) for adult patients with anaplastic lymphoma kinase-positive (ALK+) metastatic non-small cell lung cancer (NSCLC) as detected by an FDA-approved test. ALUNBRIG's current indication has been expanded to encompass the first-line setting with its approval. It is a next-generation tyrosine kinase inhibitor (TKI) designed to target ALK molecular abnormalities.

Similarly, in 2019, Genentech announced FDA accelerated approval of Polatuzumab vedotin-piiq, a CD79b-directed antibody-drug conjugate indicated in combination with bendamustine and a rituximab product for adult patients with relapsed or refractory diffuse large B-cell lymphoma.

Moreover, rising investments in next-generation antibodies from biopharmaceutical and pharmaceutical companies to manufacture and develop these next-generation antibodies are driving the market. In addition, contract manufacturing and development organizations (CDMOs) forge a link to next-generation antibody conjugates to offer even more comprehensive ADC capabilities. CDMOs are developing site-specific linker technologies, expanding their payload options, and planning for indications other than cancer. For instance, in September 2020, MilliporeSigma has announced a US$ 65 million expansion of its highly potent active pharmaceutical ingredient (HPAPI) and active pharmaceutical ingredient production capabilities and capacity at its Madison (WI) location.

Similarly, in July 2019, REGENXBIO and Neurimmune AG have signed a licensing, development, and commercialization collaboration to develop innovative AV gene treatments, employing NAV vectors to deliver human antibodies against chronic neurodegenerative disorders, such as tauopathies.

Therefore, the next-generation antibody market is anticipated to proliferate in the forecast period due to the rising clinical trials approvals and high adoption of next-generation antibody therapeutics to treat various diseases.

The European economy is severely affected due to the exponential growth of COVID-19 cases. Spain, Italy, Germany, France, and the UK are among the most affected European countries, and the number of deaths is also high. Several companies experienced severe losses in the last quarter of 2019. They also negatively influenced the first and second quarters of 2020. Hence, the impact of COVID-19 on the European market was immediate and drastic. The next-generation antibody supply chain, which is already logistically complicated, faced new challenges. The next-generation antibody market has also witnessed some shortfall at the beginning of the COVID-19 crisis due to disruption in supply chain and demand due to lockdown announced by most European countries. However, the requirement for next-generation antibodies is expected to increase due to supportive government initiatives over the next few years.

Strategic insights for the Europe Next-generation Antibody provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,455.32 Million |

| Market Size by 2028 | US$ 3,162.30 Million |

| Global CAGR (2021 - 2028) | 11.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Therapeutic Area

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Next-generation Antibody refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

EUROPE NEXT-GENERATION ANTIBODY MARKET SEGMENTATION

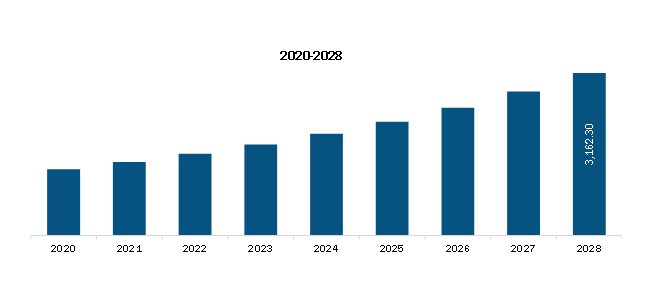

The Europe Next-generation Antibody Market is valued at US$ 1,455.32 Million in 2021, it is projected to reach US$ 3,162.30 Million by 2028.

As per our report Europe Next-generation Antibody Market, the market size is valued at US$ 1,455.32 Million in 2021, projecting it to reach US$ 3,162.30 Million by 2028. This translates to a CAGR of approximately 11.7% during the forecast period.

The Europe Next-generation Antibody Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Next-generation Antibody Market report:

The Europe Next-generation Antibody Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Next-generation Antibody Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Next-generation Antibody Market value chain can benefit from the information contained in a comprehensive market report.