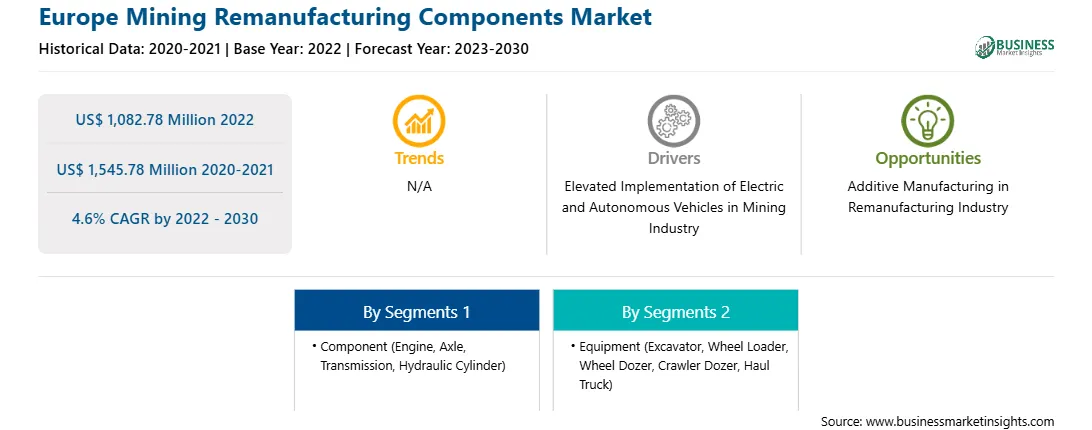

The Europe mining remanufacturing components market was valued at US$ 1,082.78 million in 2022 and is expected to reach US$ 1,545.78 million by 2030; it is estimated to register a CAGR of 4.6% from 2022 to 2030. Growth in Mining Industry Drives Europe Mining Remanufacturing Components Market

Governments and organizations in countries such as Australia, China, the Czech Republic, Portugal, the US, Canada, and others are actively promoting exploration and mining activities. In November 2023, a tentative agreement was achieved between the European Parliament and the Council about the Critical Raw Materials Act (CRMA). The regulation will affect businesses in a variety of ways, including the manufacturing sector, investors, non-EU players, and the mining and processing industries. By early 2024, the CRMA may rank among the fastest-passed EU regulations ever. Its goal is to secure Europe's supply of resources such as magnesium, lithium, nickel, and other elements needed for the green transition and strategic industries. Also, in January 2023, the state-owned mining firm in Sweden, LKAB, declared that it had found over one million tons of rare earth oxides in the country's northern region. It is the largest known deposit in Europe. This growth in mining has directly affected the demand for equipment in the industry, such as wheel loaders and wheel dozers, ultimately driving the demand for mining remanufacturing components.Europe Mining Remanufacturing Components Market Overview

The significant consumption of brown coal in Europe, particularly in countries such as Germany, Poland, Bulgaria, Czechia, Romania, and Greece, is expected to have a positive impact on the mining remanufacturing components market in Europe. Germany, being the largest consumer of brown coal in the EU, accounted for 45% of the total consumption in 2022. This high demand for brown coal, primarily used for power production, creates opportunities for the mining remanufacturing sector to provide essential components and equipment for mining operations.

In 2021, the majority of brown coal (~92%) was utilized for power generation. This indicates a consistent need for mining equipment and components to support the extraction and processing of brown coal for electricity generation. As the demand for brown coal remains steady, the mining remanufacturing components market can expect a continuous demand for products and services.

Additionally, the use of hard coal, particularly coking coal, in the steel & iron industry further contributes to the market growth. Coking plants in the EU consumed 37.19 million metric tonnes of coking coal in 2021 to produce 31 million tonnes of coke oven, which is essential for steel production. The stability and slight rise in coking plant activity in 2021 indicate a continued need for mining remanufacturing components to support the coal-to-coke conversion process.

Thus, the substantial consumption of brown coal and hard coal in Europe, particularly for power production and steel manufacturing, creates a favorable environment for the growth of the mining remanufacturing components market. The demand for mining equipment and components is expected to remain strong, providing opportunities for businesses operating in this sector to thrive and expand their operations.

Europe Mining Remanufacturing Components Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Europe Mining Remanufacturing Components provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Mining Remanufacturing Components refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Mining Remanufacturing Components Strategic Insights

Europe Mining Remanufacturing Components Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,082.78 Million

Market Size by 2030

US$ 1,545.78 Million

Global CAGR (2022 - 2030)

4.6%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Equipment

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Mining Remanufacturing Components Regional Insights

Europe Mining Segmentation

The Europe mining remanufacturing components market is categorized into component, equipment, industry, and country.

Based on component, the Europe mining is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest Europe mining share in 2022.

In terms of equipment, the Europe mining is segmented into excavator, wheel loader, wheel dozer, crawler dozer, haul truck, and others. The crawler dozers segment held the largest Europe mining share in 2022.

By industry, the Europe mining is divided into coal, metal, and others. The metal segment held the largest Europe mining share in 2022.

By country, the Europe mining is segmented into France, Germany, Italy, the UK, Russia, and the Rest of Europe. Germany dominated the Europe mining share in 2022.

Atlas Copco AB, J C Bamford Excavators Ltd, Caterpillar Inc, Epiroc AB, Swanson Industries Inc, Komatsu Ltd, Liebherr-International AG, AB Volvo, and Hitachi Construction Machinery Co Ltd are some of the leading companies operating in the Europe mining .

1. Atlas Copco AB

2. J C Bamford Excavators Ltd

3. Caterpillar Inc.

4. Epiroc AB

5. Swanson Industries Inc

6. Komatsu Ltd

7. Liebherr-International AG

8. AB Volvo

9. Hitachi Construction Machinery Co Ltd

The Europe Mining Remanufacturing Components Market is valued at US$ 1,082.78 Million in 2022, it is projected to reach US$ 1,545.78 Million by 2030.

As per our report Europe Mining Remanufacturing Components Market, the market size is valued at US$ 1,082.78 Million in 2022, projecting it to reach US$ 1,545.78 Million by 2030. This translates to a CAGR of approximately 4.6% during the forecast period.

The Europe Mining Remanufacturing Components Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Mining Remanufacturing Components Market report:

The Europe Mining Remanufacturing Components Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Mining Remanufacturing Components Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Mining Remanufacturing Components Market value chain can benefit from the information contained in a comprehensive market report.