Europe Military Optronics Surveillance and Sighting Systems Market

No. of Pages: 149 | Report Code: TIPRE00026767 | Category: Aerospace and Defense

No. of Pages: 149 | Report Code: TIPRE00026767 | Category: Aerospace and Defense

Market Introduction

The Europe military optronics surveillance & sighting systems market is further segmented into Germany, France, Italy, UK, Russia, and the Rest of Europe. Military optronics surveillance and sighting systems market in the Europe region majorly comprises of developed economies such as France, Italy, Germany, United Kingdom, Russia, and many others. BERTIN INSTRUMENTS, HENSOLDT, Thales Group, Safran, and Ultra Electronics Holdings plc. are some of the big players that offer night vision devices, optronics surveillance, integrated observation equipment, handheld thermal imagers and other surveillance systems. HENSOLDT is all set to help Frontex maritime surveillance project. The innovative leading edge sensor technology offered by HENSOLDT will further strengthen Frontex maritime surveillance in the Mediterranean Sea and also contribute towards the protection of Europe’s south eastern border. ARGOS-II HD electro optical infrared system from the HENSOLDT is going to be deployed on two tethered aerostats for providing extensive security surveillance. In 2019, Switzerland’s Federal Office for Defense Procurement, Armasuisse, has selected Safran Vectronix AG, a subsidiary of Safran Electronics & Defense for providing next generation night vision goggles (NVG) and infrared handheld multifunction binoculars for the nation’s armed forces.

The COVID-19 outbreak across Europe have had a substantial impact on military capabilities. The armed forces have been a critical component of national crisis response across the European countries. Initially, this covered general military support, such as assistance with command and control, repatriation of citizens, logistics, disinfection of public spaces and also in some countries, support to police and internal security. In addition, in many countries, the armed forces supported the nursing and social care system. This experience identified some friction in the processes of managing demand in national health systems and at European level that would have also constrained strategic casualty regulation and evacuation in the event of major conflict in Eastern Europe. Moreover, the requirement of continuous surveillance for military operations has driven the military optronics surveillance and sighting systems market across European countries during FY 2020. Moreover, a few of the countries across Europe are also disclosing their plans for the acquisition of and investments in defense technologies across their respective armed forces, which is also expected to aid in the growth of the market during the forecast period.

Market Overview and Dynamics

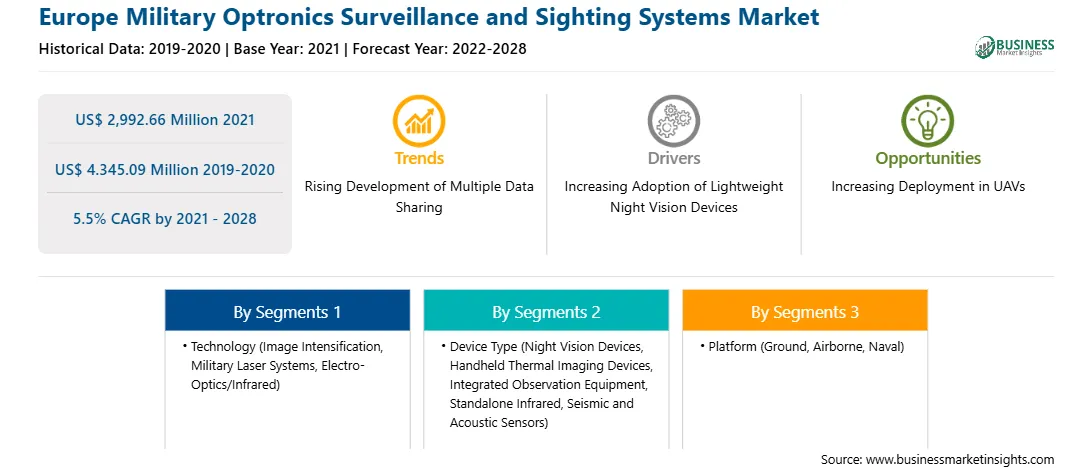

The military optronics surveillance and sighting systems market in Europe is expected to grow from US$ 2,992.66 million in 2021 to US$ 4.345.09 million by 2028; it is estimated to grow at a CAGR of 5.5% from 2021 to 2028. Europe is a quick adopter of all the latest technological advancements. In North America, major countries such as the UK and Germany are well equipped with latest surveillance instruments. Lockheed Martin Corporation, Thales Group, Raytheon Technologies Corporation, Rafael Advanced Defense Systems Ltd. and HENSOLDT are among the key players operating in the military optronics surveillance and sighting systems market. Enhancing military modernization initiatives across the world and advancement in integration of next-generation technologies such as artificial intelligence in defense systems are among the factors driving the market growth of military optronics surveillance and sighting systems. Owing to distinct rules, regulations, norms and policies of different countries, trade barriers in this market act as restraining factor to an extent.

Key Market Segments

Europe military optronics surveillance and sighting systems market is segmented into technology, device type, platform, and country. The Europe military optronics surveillance and sighting systems market on the basis of technology is segmented into image intensification, military laser systems, electro-optics/infrared. electro-optics/infrared segment held the largest market share in 2020. Based on device type, the Europe military optronics surveillance and sighting systems market is segmented into night vision devices, handheld thermal imaging devices, integrated observation equipment, standalone infrared, seismic and acoustic sensors, and others. Seismic and acoustic sensors segment held the largest market share in 2020. On the basis of platform, the Europe military optronics surveillance and sighting systems market is segmented into ground, airborne, naval. Ground segment held the largest market share in 2020. Based on country, the Europe military optronics surveillance and sighting systems market is segmented into Germany, France, Italy, UK, Russia, and rest of Europe. Russia held the largest market share in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the military optronics surveillance and sighting systems market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are HENSOLDT, Israel Aerospace Industries, L3Harris Technologies Inc., Lockheed Martin Corporation, Rafael Advanced Defense Systems Ltd., Raytheon Company, Safran S.A., Teledyne FLIR LLC, Thales Group, and Ultra Electronics Holdings plc.

Reasons to buy report

Europe

Military optronics surveillance and sighting systems Market

Segmentation

Europe Military

Optronics Surveillance and Sighting Systems

Market -

By technology Type

Europe Military Optronics Surveillance and Sighting Systems Market - By

Device Type

Europe Military Optronics Surveillance and Sighting Systems Market – By Platform

Europe Military Optronics Surveillance and Sighting Systems Market – By

Country

Europe Military Optronics Surveillance and Sighting Systems Market - Company Profiles

Strategic insights for the Europe Military Optronics Surveillance and Sighting Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,992.66 Million |

| Market Size by 2028 | US$ 4.345.09 Million |

| Global CAGR (2021 - 2028) | 5.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Military Optronics Surveillance and Sighting Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe Military Optronics Surveillance and Sighting Systems Market is valued at US$ 2,992.66 Million in 2021, it is projected to reach US$ 4.345.09 Million by 2028.

As per our report Europe Military Optronics Surveillance and Sighting Systems Market, the market size is valued at US$ 2,992.66 Million in 2021, projecting it to reach US$ 4.345.09 Million by 2028. This translates to a CAGR of approximately 5.5% during the forecast period.

The Europe Military Optronics Surveillance and Sighting Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Military Optronics Surveillance and Sighting Systems Market report:

The Europe Military Optronics Surveillance and Sighting Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Military Optronics Surveillance and Sighting Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Military Optronics Surveillance and Sighting Systems Market value chain can benefit from the information contained in a comprehensive market report.