Lung cancer is among one of the main causes of mortality across the world. Lung cancer screening is a critical component of cancer prevention approaches. The prognosis of lung cancer patients is better when the disease is diagnosed early, so people at high risk of lung cancer are prompted to undergo routine checkups to detect the formation of cancerous growth in their lungs.

As per research conducted by the cancer journal Annals of Oncology, around 1,261,990 cancer patients are expected to die in 2023 in the EU region. Lung cancer death rates would increase by over 1% to 13.6 per 100,000. As more UK women started smoking earlier than those in the EU, there will be a 13.8% decrease in the death rate from lung cancer among women in the UK, although the death rate of 16.2 per 100,000 is still higher than among women in the EU. In the UK, lung cancer currently claims more per 100,000 than breast cancer, which claims 13.5 per 100,000.

When the researchers particularly examined lung cancer death rates in five EU nations in addition to the UK, they discovered that while rates are expected to decline for men in the most populous six nations (France, Germany, Italy, Poland, and Spain), they will increase for women in France, Italy, and Spain by about 14%, 5.6%, and 5%, respectively. The researchers discovered that among women in various age groups, expected mortality rates from lung cancer decreased among those between the ages of 25 and 64 but increased among those between the ages of 65 and over 75, leading to an increase overall. Also, according to the National Center for Biotechnology Information (NCBI), each year, ~41,000 new diagnoses of lung cancers and 34,000 deaths are recorded in Italy. Thus, the rising incidence of lung cancer worldwide is contributing to the initiation of lung cancer screening programs, which is, in turn, driving the market growth.

The Europe lung cancer screening market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. The regional growth is attributed to various factors, such as the increasing incidence of lung cancer and awareness of side lung cancer screening and diagnosis among people. Also, rising government support for screening has led to the further growth of the market.

The increasing prevalence of lung cancer has made its screening extremely important for early detection. Lung cancer screening is suggested for older adults who are long-time smokers and do not have any symptoms related to lung cancer. Physicians use a low-dose computerized tomography (LDCT) scan or X-ray for screening.

According to an article titled “Lung Cancer in Germany,” published in the Journal of Thoracic Oncology, in June 2022, cancer is among the second most frequent cause of death in Germany, accounting for 25% of all deaths. In men, lung cancer ranks second after cardiovascular disease, accounting for 6.5% of all-cause mortality. With an age-standardized incidence rate of 52.1 and 32.7 and (per 100,000) in men and women, respectively, lung cancer ranks second in men and third in women (accounting for 13.3% and 9.4% of all newly diagnosed cancers, respectively). The average age of cancer diagnosis is 70 years (men) and 69 years (women); 52% of all patients present with stage IV. The incidence rates in women and men have converged since the 1990s because of long-term changes in smoking habits. Currently, every fourth man (27.0%) and every fifth woman (20.8%) in Germany smokes regularly

Strategic insights for the Europe Lung Cancer Screening provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Lung Cancer Screening refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Lung Cancer Screening Strategic Insights

Europe Lung Cancer Screening Report Scope

Report Attribute

Details

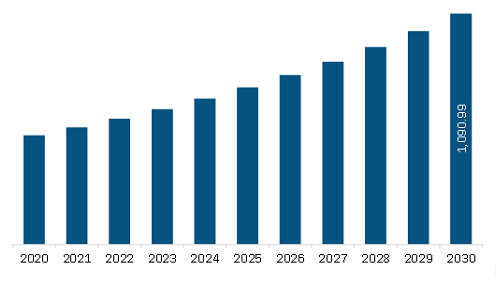

Market size in 2022

US$ 593.25 Million

Market Size by 2030

US$ 1,090.99 Million

Global CAGR (2022 - 2030)

7.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Cancer Type

By Technology

By Age Group

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Lung Cancer Screening Regional Insights

Europe Lung Cancer Screening Market Segmentation

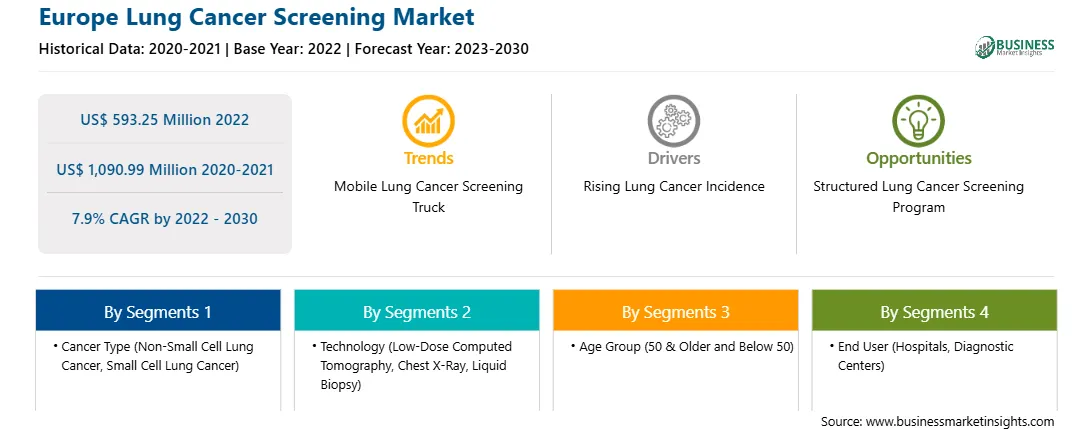

The Europe lung cancer screening market is segmented into cancer type, technology, age group, end user, and country.

Based on cancer type, the Europe lung cancer screening market is segmented into non–small cell lung cancer (NSCLC), and small cell lung cancer. The non–small cell lung cancer (NSCLC) segment held a larger share of the Europe lung cancer screening market in 2022.

Based on technology, the Europe lung cancer screening market is segmented into chest X-ray, low dose computed tomography (LDCT), liquid biopsy, and others. Low dose computed tomography (LDCT) segment held the largest share of the Europe lung cancer screening market in 2022.

Based on age group, the Europe lung cancer screening market is segmented into 50 and older, and below 50. 50 and older segment held the larger share of the Europe lung cancer screening market in 2022.

Based on end user, the Europe lung cancer screening market is segmented into hospital, diagnostic centre, and others. Hospital segment held the largest share of the Europe lung cancer screening market in 2022.

Based on country, the Europe lung cancer screening market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. Germany dominated the Europe lung cancer screening market in 2022.

Siemens AG, Koninklijke Philips NV, Canon Inc, Medtronic, GE HealthCare, Nuance Communications Inc, and Intelerad Medical Systems are some of the leading companies operating in the Europe lung cancer screening market.

The Europe Lung Cancer Screening Market is valued at US$ 593.25 Million in 2022, it is projected to reach US$ 1,090.99 Million by 2030.

As per our report Europe Lung Cancer Screening Market, the market size is valued at US$ 593.25 Million in 2022, projecting it to reach US$ 1,090.99 Million by 2030. This translates to a CAGR of approximately 7.9% during the forecast period.

The Europe Lung Cancer Screening Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Lung Cancer Screening Market report:

The Europe Lung Cancer Screening Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Lung Cancer Screening Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Lung Cancer Screening Market value chain can benefit from the information contained in a comprehensive market report.