The Europe liquid nitrogen market was valued at US$ 3,409.70 million in 2023 and is expected to reach US$ 4,962.85 million by 2031; it is estimated to register a CAGR of 4.8% from 2023 to 2031.

Rising Demand for Liquid Nitrogen in Food & Beverages Industry Drives Europe Liquid Nitrogen Market

The growing food & beverages industry across various economies boosts the demand for liquid nitrogen. In the food & beverages sector, liquid nitrogen is majorly used to chill, freeze, cool, and preserve products. It is utilized in freezing baked goods, meat, poultry, and fish, along with prepared foods, fruits, and vegetables, while retaining their original color, scent, and flavor. Preservation involves cooling the food product or freezing it with the help of liquid nitrogen, thereby improving the product’s shelf-life. It is also used for storage and transportation of perishable food products. Compared to traditional mechanical freezers, liquid nitrogen has minimal adverse environmental effects and requires limited initial equipment investment. Moreover, the adoption of cryogenic freezing in the food & beverages industry is increasing due to growing concerns over the safety of food products. Cryogenic freezing does not affect the final product's quality and is more environmentally friendly and time efficient. Cryogenic freezing system use liquid nitrogen as the refrigerant. Thus, the preference for liquid nitrogen among various food and beverage manufacturers is increasing owing to the rising adoption of cryogenic freezing.

Additionally, liquid nitrogen infusions are one of the latest eye-catching food trends. With the ability to create fog-like effects and flash-freeze foods, liquid nitrogen has recently found applications in ice cream, snacks, and cocktails. Moreover, as per the Food & Drink Federation, the food & beverages industry is the biggest manufacturing sector in the UK; the food and beverage output increased by 8% in 2022 from 2021. Also, Russia has become the eighth largest market for processed food, with a trading volume of 27.5 metric tons, and drinks (alcoholic and soft), with a trading volume of 26 billion liters, as per the International Trade Administration (ITA). The increased volume shows significant demand for food and beverages across various countries.

Europe Liquid Nitrogen Market Overview

The growing demand from the metal fabrication and steel industries drives the Europe liquid nitrogen market. During the metal fabrication process, liquid nitrogen is used in steel production as a carrier and purge gas. Liquid nitrogen is a key component in the heat-treating process and is used to prevent oxidation during steel production. According to the European Steel Association, Europe is among the largest producers of steel. For instance, the region produces approximately 152 metric tons of steel annually. The region registered over 500 steel production facilities across the 22 European Member States as of 2023. Moreover, according to the American Frozen Food Institute, in 2022, frozen food sales increased by 8.6% to reach US$ 72.2 billion. Liquid nitrogen plays a vital role in the freezing and cooling of food products, which helps produce Individually Quick Frozen (IQF) foods. It also reduces spoilage of the frozen food products. Thus, the increasing consumption of frozen foods propels the demand for liquid nitrogen in Europe.

Europe Liquid Nitrogen Market Revenue and Forecast to 2031 (US$ Million)

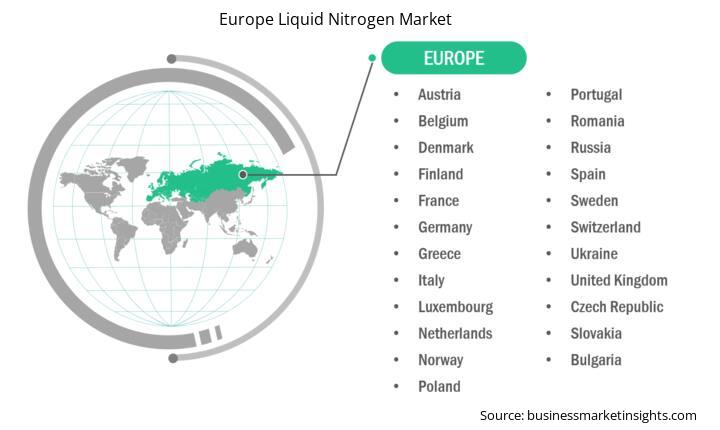

Strategic insights for the Europe Liquid Nitrogen provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Liquid Nitrogen refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Liquid Nitrogen Strategic Insights

Europe Liquid Nitrogen Report Scope

Report Attribute

Details

Market size in 2023

US$ 3,409.70 Million

Market Size by 2031

US$ 4,962.85 Million

Global CAGR (2023 - 2031)

4.8%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Manufacturing Method

By End-use Industry

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Liquid Nitrogen Regional Insights

Europe Liquid Nitrogen Market Segmentation

The Europe liquid nitrogen market is categorized into manufacturing method, end-use industry, and country.

Based on manufacturing method, the Europe liquid nitrogen market is bifurcated into cryogenic distillation and pressure swing adsorption. The cryogenic distillation segment held a larger Europe liquid nitrogen market share in 2023.

In terms of end-use industry, the Europe liquid nitrogen market is segmented into aerospace and defense, automotive, chemical, food and beverage, metal fabrication, pharmaceutical, electronics and semiconductors, and others. The metal fabrication segment held the largest Europe liquid nitrogen market share in 2023.

By country, the Europe liquid nitrogen market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe liquid nitrogen market share in 2023.

Linde Plc, L’Air Liquide SA, Air Products and Chemicals Inc, SOL SpA, Praxair Technology Inc, Nippon Sanso Holdings Corp, Ube Corporation, Air Water Inc, Osaka Gas Co Ltd, Messer SE & Co KGaA, and Matheson Tri-Gas Inc are some of the leading companies operating in the Europe liquid nitrogen market.

The Europe Liquid Nitrogen Market is valued at US$ 3,409.70 Million in 2023, it is projected to reach US$ 4,962.85 Million by 2031.

As per our report Europe Liquid Nitrogen Market, the market size is valued at US$ 3,409.70 Million in 2023, projecting it to reach US$ 4,962.85 Million by 2031. This translates to a CAGR of approximately 4.8% during the forecast period.

The Europe Liquid Nitrogen Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Liquid Nitrogen Market report:

The Europe Liquid Nitrogen Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Liquid Nitrogen Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Liquid Nitrogen Market value chain can benefit from the information contained in a comprehensive market report.