Increasing focus by the government to strengthen military weapons and new developments in laser weapon by manufacturing companies boosting the market growth in Europe. For instance, European Commission initiated the European laser-weapon project with MBDA, a European missile-maker, with the funding of US$ 3.6 billion, which is developing the tactical advanced laser optical system (TALOS). This European defense agency initiated TALOS are expected to be deployed in European forces by 2027. The market players operating in Europe invest strongly in research and development activities to develop new products. For instance, in January 2019, Rheinmetall Defense, a European military technology contractor, introduced a new fully functional laser weapon system. The company claimed that the system can target and destroy nearby drones and mortar shells. Similarly, MBDA, a France-based company, is advancing its ship-borne laser weapon system with more accuracy for destroying tiny targets from miles away. The company is developing the advanced laser weapon systems for the UK under UK’s Dragonfire laser program. Other countries in Europe are upgrading their military weapons with advanced technologies having more accuracy and strength. The countries in the regions are developing more advanced weapon systems to strengthen their defense and military by forming partnerships with leading manufacturers and governments. For instance, the Defence Science & Technology Laboratory (DSTL) of the UK formed a partnership with the US Navy and British industry to develop future energy storage options for British warships. This development is expected to boost market growth by providing next-generation power to naval laser weapons. Such increasing focus toward the laser weapon systems and rising awareness about potential capabilities of the system is bolstering the market growth.

In case of COVID-19, Europe is highly affected specially the UK. The emergence of COVID-19 virus across the Europe region has led to lockdown scenarios has pushed led the industry experts to analyze that the defense equipment manufacturing industry would face 4 weeks to 12 weeks of lag in military electronic part supply chain. This disruption in supply chain has damaged the defense equipment manufacturing in 2020. The recovery period of impact of COVID-19 in defense industry is foreseen to be quicker as compared to various other industries. The European laser weapon systems market also had minimal impact on the market growth throughout 2020 as the manufacturers of LaWS continues their operations during Q3 and Q4 of 2020. Several other countries such as Russia, Germany, and others also had a major count of cases daily, owing to which countries initiated a lockdown and social striction. The defense systems in the developed countries in the regions are actively involved in the military developments and strengthening it, which is expected to support the market in the COVID-19 situation but with inadequate strength of workforce. Several countries also are focused on supporting the healthcare system in their countries, which lowered the military spending in 2020, thereby, somewhat hampering the businesses of laser weapon systems market.

Strategic insights for the Europe Laser Weapon Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

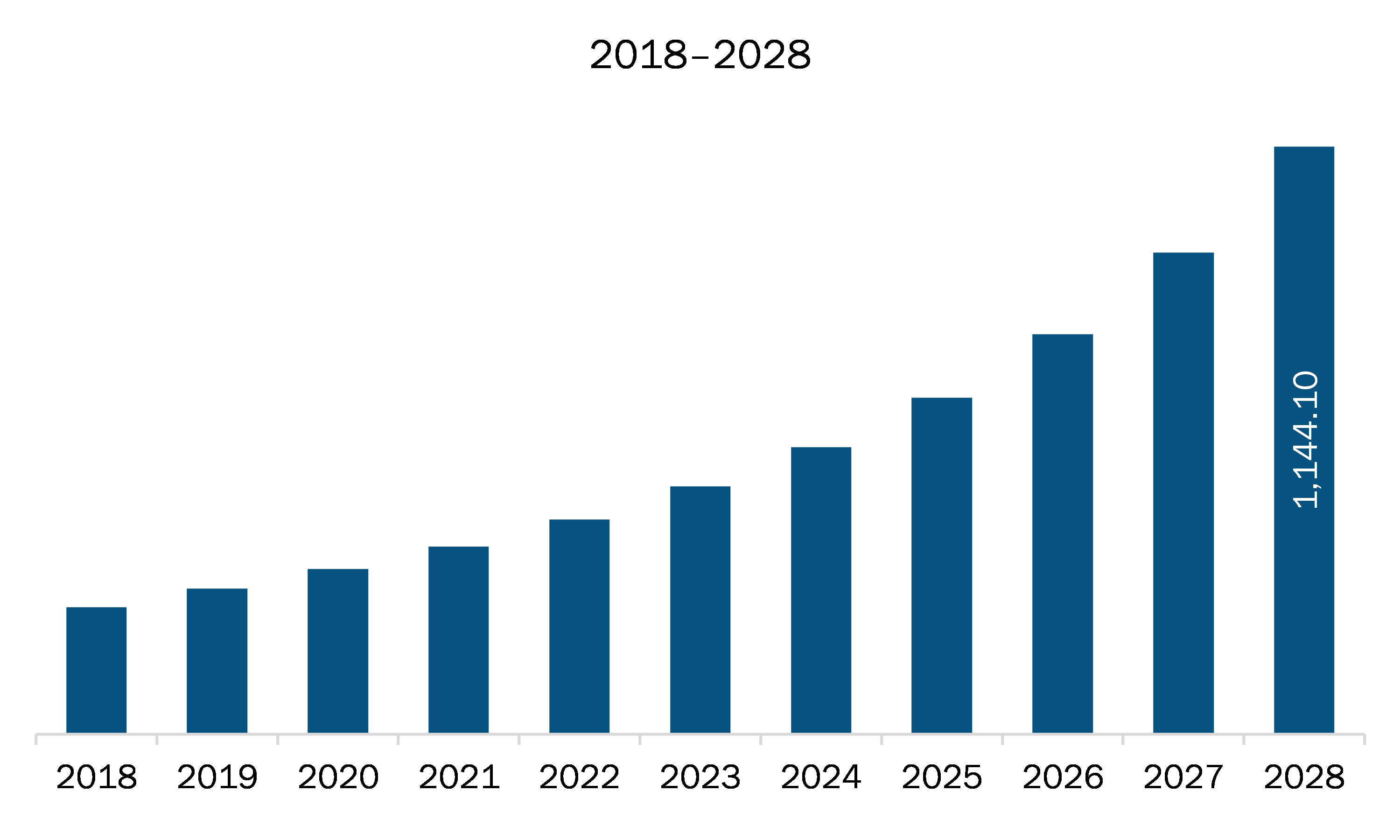

| Market size in 2021 | US$ 365.49 Million |

| Market Size by 2028 | US$ 1,144.10 Million |

| Global CAGR (2021 - 2028) | 17.7 % |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Laser Weapon Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe laser weapon systems market is expected to grow from US$ 365.49 million in 2021 to US$ 1,144.10 million by 2028; it is estimated to grow at a CAGR of 17.7 % from 2021 to 2028. Burgeoning demand of high-energy laser weapon system is expected to fuel the Europe laser weapon systems market. The leading market players across Europe region have introduced new high-energy laser weapon systems in the market, and it is getting positive response from customers owing to its enhanced power, energy, precision, and range. Laser weapon systems are increasingly deployed in the arsenals of several nations to strengthen the military defense power. Companies across Europe such as Raytheon Technologies and Lockheed Martin Corporation are offering the high-energy laser solution, while the companies such as Boeing, MBDA, and Rheinmetall AG are developing new systems with the adoption of inorganic strategies. For instance, in January 2021, MBDA and Rheinmetall are tasked by the German Navy to develop a high-energy laser weapon system over the next year. Such rising development in high-energy laser weapon systems is creating a new trend in the Europe market, as leading nations are focusing on deploying such system in their arsenals.

In terms of type, the fiber laser segment accounted for the largest share of the Europe laser weapon systems market in 2020. In terms of application, the ground-based segment held a larger market share of the Europe laser weapon systems market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe laser weapon systems market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Boeing; Elbit Systems Ltd.; L3Harris Technologies, Inc.; Lockheed Martin Corporation; MBDA; Northrop Grumman Corporation; Raytheon Technologies Corporation; and Rheinmetall AG.

The Europe Laser Weapon Systems Market is valued at US$ 365.49 Million in 2021, it is projected to reach US$ 1,144.10 Million by 2028.

As per our report Europe Laser Weapon Systems Market, the market size is valued at US$ 365.49 Million in 2021, projecting it to reach US$ 1,144.10 Million by 2028. This translates to a CAGR of approximately 17.7 % during the forecast period.

The Europe Laser Weapon Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Laser Weapon Systems Market report:

The Europe Laser Weapon Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Laser Weapon Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Laser Weapon Systems Market value chain can benefit from the information contained in a comprehensive market report.