A laboratory developed test (LDT) is a type of in vitro diagnostic test that is designed and used within a single laboratory. These tests can be utilized to estimate or distinguish an extensive assortment of analytes materials such as proteins, chemical compounds like glucose or cholesterol, or DNA, from a specimen received from human anatomy. The expansion of automated in vitro diagnostics (IVD) methods for labs and dispensaries to render precise, and error-free analysis is anticipated to fuel the increment.

Strategic insights for the Europe Laboratory Developed Test provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5,664.43 Million |

| Market Size by 2028 | US$ 8,988.78 Million |

| Global CAGR (2021 - 2028) | 6.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Laboratory Developed Test refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

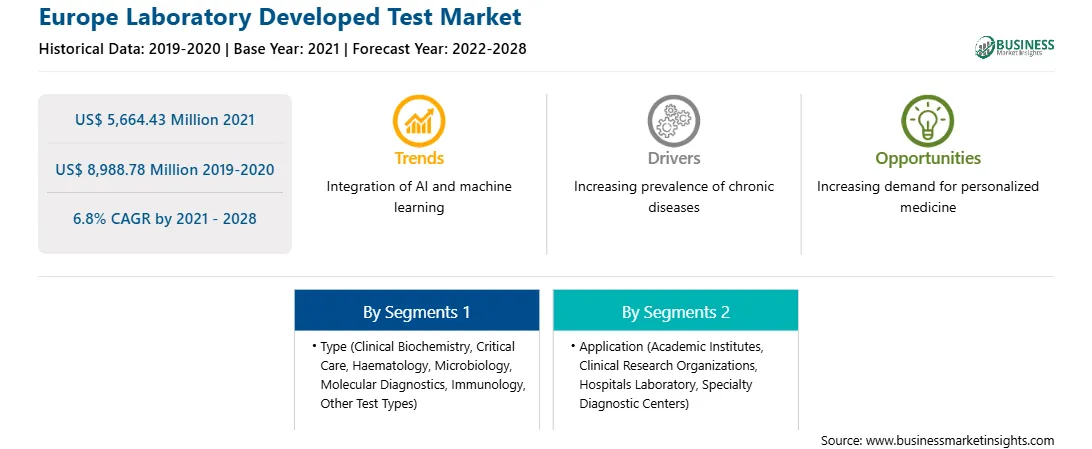

The European laboratory developed test market is projected to reach US$ 8,988.78 million by 2028 from US$ 5,664.43 million in 2021; it is estimated to grow at a CAGR of 6.8% from 2021 to 2028. The increasing incidence of cancer and genetic disorders and the growing number of product launches across Europe are factors propelling the laboratory developed testing market. However, the changing regulatory landscape is hampering the growth of the laboratory development test market.

LDTs are developed and used within laboratories and not distributed or sold to other laboratories or healthcare facilities. These tests are designed to overcome the challenge of the unavailability of commercial tests. Many LDTs are genetic tests developed for rare diseases. Thus, the frequency of development and introduction of new LDTs is high.In November 2020, Aditx Therapeutics, Inc received a CLIA certification for AditxtScore laboratory operations for immune monitoring, which allowed them to launch the AditxtScore test to diagnose COVID-19. The increasing emergence of SARS-CoV-2 variants has highlighted the need to identify, trace, and track mutations across the complete viral genome. In January 2021, Eurofins launched the NovaType test for detecting and monitoring new variants of SARS-CoV-2. This RT-PCR assay is clinically validated for identifying B.1.1.7 and B.1.351 variants with a short time. NovaType is already available as an LDT in Germany, and it will be made available in over 50 Eurofins laboratories worldwide for testing patients for COVID-19. Also, the rising demand for personalized medicine is offering significant growth opportunities for the players operating in the European laboratory developed test market.

Countries across Europe are witnessing a resurgence in COVID-19 cases after successfully mitigating the pandemic. Many countries are declaring more cases each day than the first wave in 2020. The governments of many countries are working toward scaling up testing capacity, which is further driving the laboratory developed test market. Many market players have launched products to meet the growing demand. For instance, in August 2020, Eurofins Technologies (Luxembourg) launched a range of testing kits for serology-based antibody detection by ELISA of patients exposed to COVID-19. These tests are designed to meet the region-specific requirements for COVID-19. Viracor Eurofins received Food and Drug Administration (FDA) and Emergency Use Authorization (EUA) for its SARS-CoV-2 laboratory developed test. Other Eurofins laboratories have developed alternative RT-PCR options to meet local regulatory obligations and mitigate reagent supply chain issues globally. However, other non-emergency tests witnessed a drop due to lockdown measures and overburdened healthcare institutions.

The Europe laboratory developed test market, by type, is segmented into clinical biochemistry, critical care, haematology, microbiology, molecular diagnostics, immunology, and other test types. The haematology segment was sub-segmented into coagulation and hemostasis, hemoglobin testing, blood count testing, and others. The molecular diagnostics segment is expected to hold the largest market share in 2021. However, the haematology segment is anticipated to register the highest CAGR during the forecast period.

The Europe laboratory developed test market, by application, is segmented into academic institutes, clinical research organizations, hospitals laboratory, specialty diagnostic centers, and others. The hospitals laboratory segment is expected to hold the largest market share in 2021. However, the specialty diagnostic centers segment is anticipated to register the highest CAGR during the forecast period.

A few of the primary and secondary sources referred to while preparing the European laboratory developed test market report are the German Diagnostics Industry Association (VDGH), Deutsche Akkreditierungsstelle GmbH (DAkkS), and Spanish Heart Foundation (FEC).

The Europe Laboratory Developed Test Market is valued at US$ 5,664.43 Million in 2021, it is projected to reach US$ 8,988.78 Million by 2028.

As per our report Europe Laboratory Developed Test Market, the market size is valued at US$ 5,664.43 Million in 2021, projecting it to reach US$ 8,988.78 Million by 2028. This translates to a CAGR of approximately 6.8% during the forecast period.

The Europe Laboratory Developed Test Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Laboratory Developed Test Market report:

The Europe Laboratory Developed Test Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Laboratory Developed Test Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Laboratory Developed Test Market value chain can benefit from the information contained in a comprehensive market report.