Diabetes, a life-threatening chronic disease with no specialized cure, is mainly caused by the body’s incapacity to produce or effectively utilize the hormone insulin. This incapacity prevents the body from adequately regulating blood glucose levels. The incidence and prevalence of diabetes are rapidly increasing across Europe. Type 2 diabetes is the most prevalent form of diabetes and has grown alongside cultural and societal changes. In high-income countries, up to 91% of adults with the disease have type 2 diabetes. According to the International Diabetes Federation (IDF), ~537 million people were living with diabetes in 2021, and the number is expected to reach 643 million by 2030 and 783 million by 2045. Diabetes increases the risk of premature death of individuals by leading to complications in several body parts. Primary complications include heart attack, stroke, kidney failure, leg amputation, vision loss, and nerve damage. Patients who have diabetes require frequent monitoring and external insulin administration. Thus, the rising prevalence of diabetes is driving the growth of the insulin market in Europe.

The Europe insulin market is subsegmented into Germany, France, the UK, Italy, Spain, and the Rest of Europe. The growth of the market in this region is expected to be the second largest after Germany. The prevalence of diabetes among all age groups in Europe is surging with the going commonness of obesity, unhealthy diet, and lacking physical inactivity. The prevalence of autoimmune type 1 Diabetes is rising in the region. Moreover, technologies such as insulin pumps, insulin pens, and continuous glucose monitoring devices are gaining significant acceptance in Europe. Europe has the world’s highest number of children with type 1 Diabetes. Type 1 diabetes is highly prevalent among children in the UK, Russia, and Germany. According to International Diabetes Federation (IDF), Germany has 7 million people diagnosed with diabetes, and it estimates that ~1.3 million people are expected to be living with undetected diabetes. According to the German Diabetes Centre (DDZ), diabetes would affect 12 million in the country by the end of 2040, and type 2 diabetes is anticipated to be a more prevalent type during the period.

Strategic insights for the Europe Insulin provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

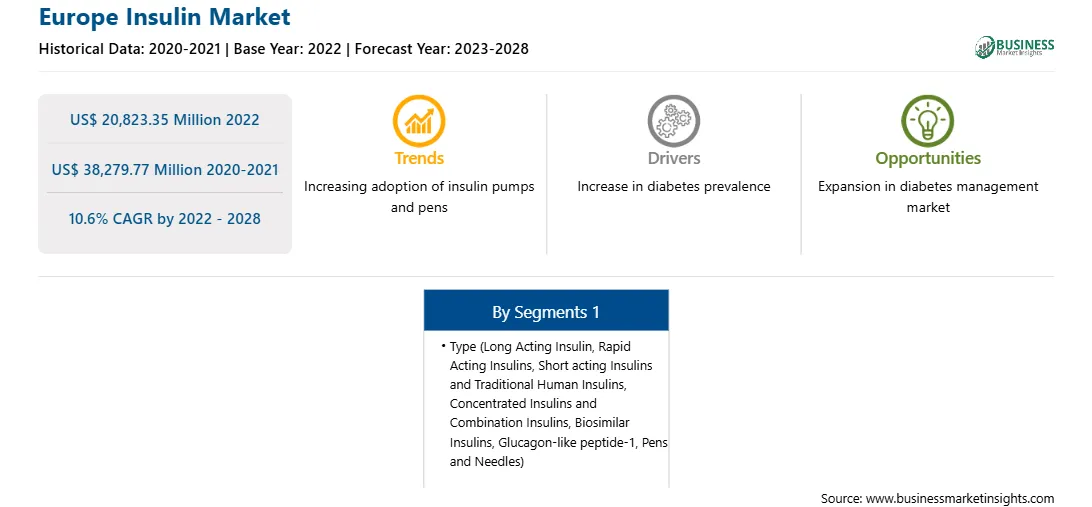

| Market size in 2022 | US$ 20,823.35 Million |

| Market Size by 2028 | US$ 38,279.77 Million |

| Global CAGR (2022 - 2028) | 10.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Insulin refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe insulin market is segmented into type and country. Based on type, the market is segmented into long acting insulin, rapid acting insulin, short acting insulin & traditional human insulin, concentrated insulin & combination insulin, biosimilar insulin, glucagon-like peptide-1 (GLP-1), pen & needle, and others. The long acting insulin segment registered the largest market share in 2022.

Adocia; Biocon; Eli Lilly and Company; GlaxoSmithKline plc.; Merck & Co., Inc.; Novo Nordisk A/S; Pfizer Inc.; Sanofi; Tonghua Dongbao Pharmaceutical Co., Ltd.; and Wockhardt are the leading companies operating in the insulin market in the region.

The Europe Insulin Market is valued at US$ 20,823.35 Million in 2022, it is projected to reach US$ 38,279.77 Million by 2028.

As per our report Europe Insulin Market, the market size is valued at US$ 20,823.35 Million in 2022, projecting it to reach US$ 38,279.77 Million by 2028. This translates to a CAGR of approximately 10.6% during the forecast period.

The Europe Insulin Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Insulin Market report:

The Europe Insulin Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Insulin Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Insulin Market value chain can benefit from the information contained in a comprehensive market report.