Europe comprises Germany, France, Italy, the UK, Russia, Netherlands, Belgium, and Rest of Europe. Instrument testing and calibration plays a crucial role in sensitive industries such as – the Aerospace and Defense industry, Medical Device, Pharmaceutical, Food and Beverage and others. Europe is one of the prominent regions when it comes to the healthcare and aerospace and defense industry. EU member states purchase around 80% of their Defense equipment from the domestic market. The robust growth of the European Aerospace and Defense sector creates a great opportunity for the calibration service providers in the region. Further, the pharmaceutical industry is innovative industry and is supported by robust regulatory and innovation-supportive incentives environment. The complex devices/instruments used in these field are expected to function without an error. Thus, growing manufacturing industries in Europe is likely to favor the growth of the market.

Europe witnessed a varying impact of the COVID-19 pandemic across its economically diverse countries. Countries such as Germany, the UK, the Netherlands, and France imposed stringent government restrictions and closed their borders to curb the virus spread. Additionally, Italy, Russia, and Spain witnessed a significant surge in COVID-19 confirmed cases, which led them to shutdown businesses and manufacturing operations for a few months. However, numerous European countries witnessed swift recover from quarter 4 of 2020. Irrespective of the surge in the number of cases and shutting down of business operations for months, manufacturers had to continue the production of essential products, resume it earlier than other businesses. Further, since manufacturing facilities in the region were completely shut down for months, the manufacturers of instrument calibrators faced several challenges related to procuring raw material and keeping up with the overall stock. However, since the beginning of 2021, governments of various countries in Europe have expedited the vaccination process, and currently the number of COVID-19 cases in the region is reducing. Seeing this, the government authority has now opened up the economy, and various industries are now functional with more stringent sanitation guidelines. This scenario is propelling the demand for advanced instrument calibrators across Europe.

Strategic insights for the Europe Instrument Calibrator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

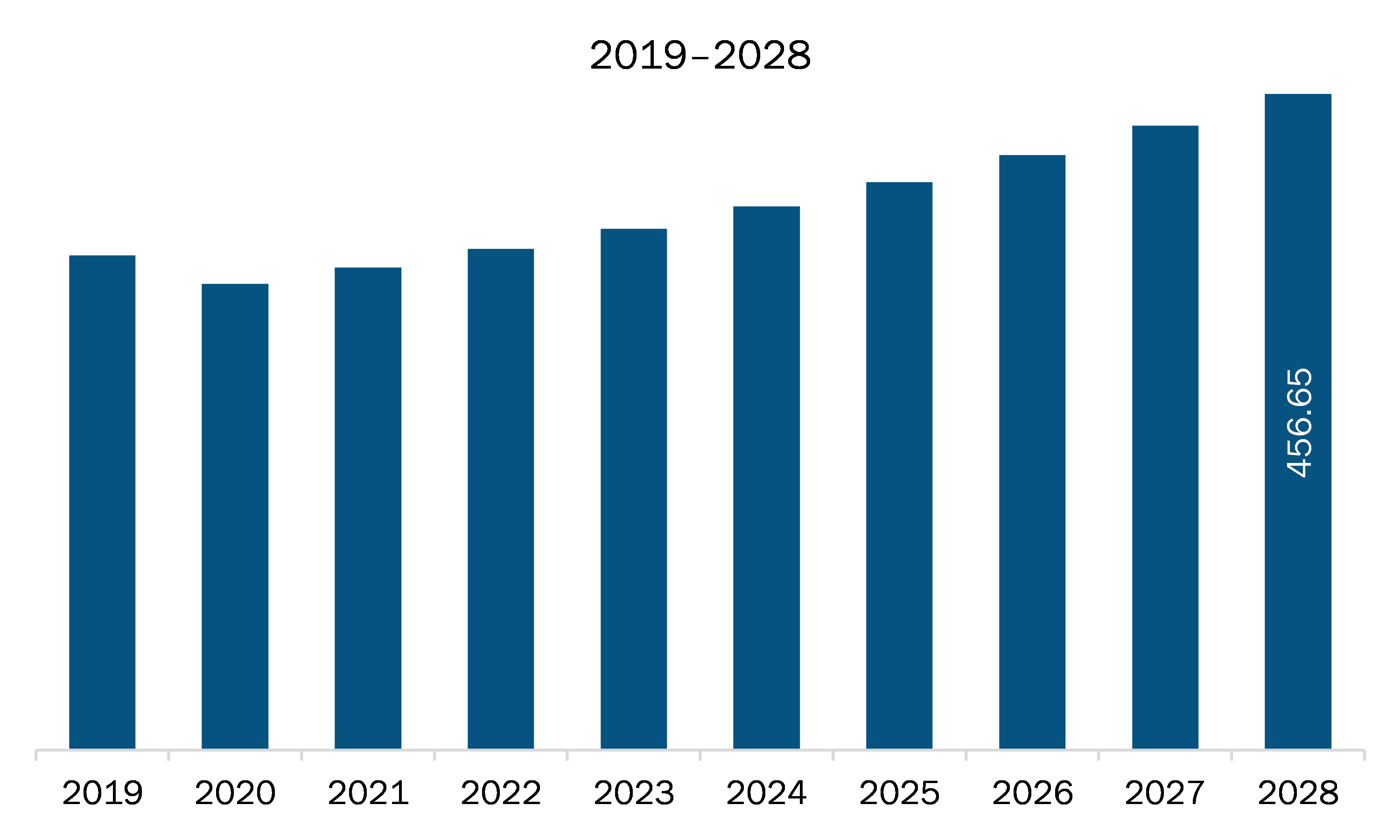

| Market size in 2021 | US$ 335.87 Million |

| Market Size by 2028 | US$ 456.65 Million |

| Global CAGR (2021 - 2028) | 4.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Instrument Calibrator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The instrument calibrator market in Europe is expected to grow from US$ 335.87 million in 2021 to US$ 456.65 million by 2028; it is estimated to grow at a CAGR of 4.5% from 2021 to 2028. Government regulatory authorities such as the Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) require strict adherence to regulates emissions of various manufacturing plants, among other processes. Companies that use mercury in their manufacturing processes need to calibrate sensors that monitor plant emissions to ensure the absence of mercury in the discharge, as it can harm the adjacent environment and ecosystems. The FDA regulates to calibrate regular basis on chemical makeup of drugs. So, test and measurement of the equipment are done to verify correct measurements and the operation of manufacturing equipment that controls the errors while manufacturing the chemical makeup of drugs.

Europe instrument calibrator market is segmented into product type, modularity, industry vertical and country. Based on product type, the Europe instrument calibrator market is segmented into temperature calibrator, pressure calibrator, electrical calibrator, and multifunction process calibrator. Pressure calibrator segment held the largest market share in 2020. The modularity segment is classified into benchtop, and portable. Portable segment held the largest market share in 2020. Based on industry vertical, the Europe instrument calibrator market is categorized into automotive, aerospace and defense, electronics, food, and beverage, pharmaceutical, oil and gas, and others. Oil& gas segment held the largest market share in 2020.

Based on country, the Europe instrument calibrator market is segmented into Belgium, France, Germany, Italy, Netherlands, Russia, UK, and rest of Europe. Germany held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the instrument calibrator market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Additel; AMETEK Inc.; Baker Hughes Company; Beamex Oy Ab; Calmet; Fluke Corporation; Spectris; WIKA Alexander Wiegand SE & Co. KG; and Yokogawa Electric Corporation.

The Europe Instrument Calibrator Market is valued at US$ 335.87 Million in 2021, it is projected to reach US$ 456.65 Million by 2028.

As per our report Europe Instrument Calibrator Market, the market size is valued at US$ 335.87 Million in 2021, projecting it to reach US$ 456.65 Million by 2028. This translates to a CAGR of approximately 4.5% during the forecast period.

The Europe Instrument Calibrator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Instrument Calibrator Market report:

The Europe Instrument Calibrator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Instrument Calibrator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Instrument Calibrator Market value chain can benefit from the information contained in a comprehensive market report.