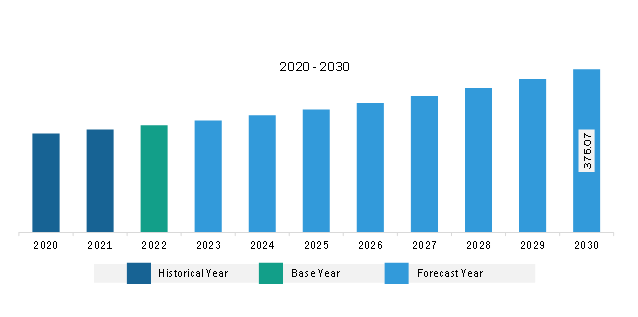

The Europe inertial sensors for land defense system market was valued at US$ 246.78 million in 2022 and is expected to reach US$ 376.07 million by 2030; it is estimated to record a CAGR of 5.4% from 2022 to 2030.

Microelectromechanical Systems (MEMS) refers to the fabrication of microscopic sensors, actuators, and transducers with moving mechanical parts at the microscopic scale. The utilization of MEMS technology in inertial sensors for land defense systems has expanded their range of applications. MEMS technology enables the production of inertial sensors on a microscopic scale, allowing for their integration into smaller land defense systems such as unmanned ground vehicles and soldier-worn devices. Additionally, the adoption of MEMS technology has led to cost reduction in sensor manufacturing, making inertial sensors more accessible and affordable. MEMS-based inertial sensors offer superior performance characteristics, including high sensitivity, accuracy, and stability, enhancing their suitability for precise motion sensing and navigation in land defense systems. For instance, in September 2023, EMCORE Corporation, a leading provider of inertial navigation solutions to the aerospace & defense industry, announced the launch of the TAC-440 MEMS Inertial Measurement Unit (IMU). This IMU is recognized as the world's smallest 1°/hour IMU and is available in an ultra-compact package of less than 5 cubic inches. Furthermore, the TAC-440 is designed to be a higher-performance replacement for the Honeywell 1930 and 4930 IMUs, offering improved form, fit, and function compatibility. Overall, the introduction of the TAC-440 MEMS Inertial Measurement Unit by EMCORE Corporation represents a significant advancement in the field of inertial navigation technology. Its small size, cost-effectiveness, improved performance, integration possibilities, and mass production capability make it a valuable asset for various land defense applications. MEMS technology also enables the integration of multiple sensors on a single chip, providing multi-axis motion sensing capabilities. Furthermore, the mass production capability of MEMS technology has substantially contributed to the widespread adoption of inertial sensors in land defense systems. Thus, advancements in MEMS technology have had a significant impact on the miniaturization, cost reduction, and improved performance of inertial sensors, which drives the market.

The market in Europe is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The inertial sensors for land defense systems market is witnessing substantial growth in Europe. Europe has a significant military base. The European Defense Agency (EDA) supports member states in areas such as capability planning, joint training, and technological research to increase interoperability and efficiency. For example, EDA's activities emphasize supporting member states in changing toward a more coherent European ability landscape through the collaborative modernization, upgrading, and purchase of military and fleet components such as main battle tanks and armored or infantry fighting vehicles. In addition, EDA supports Member States in pursuing activities that enhance military mobility. Better mobility of forces within and beyond the EU strengthens European security by enabling the EU member states to act faster, in line with their defense needs and responsibilities, both in the context of CSDP missions and operations and national and multinational activities. KNDS is among the European leaders in land defense. Its product range includes main battle tanks, artillery systems, armored vehicles, weapons systems (including robotics, ammunition, military bridges, training solutions, battle management systems, and protection solutions), and a wide range of equipment.

There are several upcoming land defense projects in Europe. For instance, in January 2024, The European Commission signed a grant agreement to launch the Land Tactical Collaborative Combat (LATACC) project coordinated by Thales to improve the collaborative capabilities of European coalition forces. The LATACC project brings together 34 industry players and research institutes (including core team members Thales, Rheinmetall, Leonardo, Indra, Saab, ISD, and John Cockerill Defense) from 13 European countries. The European Commission finances the project with US$ 53.37 million of funding from the European Defence Fund. Thus, inertial sensors are a critical component of modern land warfare in Europe, providing essential data for navigation, targeting, and platform stabilization in even the most challenging environments. Therefore, owing to the above parameters, the inertial sensors for land defense systems market is growing in the region.

Strategic insights for the Europe Inertial Sensors for Land Defense provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Inertial Sensors for Land Defense refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Inertial Sensors for Land Defense Strategic Insights

Europe Inertial Sensors for Land Defense Report Scope

Report Attribute

Details

Market size in 2022

US$ 246.78 Million

Market Size by 2030

US$ 376.07 Million

Global CAGR (2022 - 2030)

5.4%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Technology

By Application

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Inertial Sensors for Land Defense Regional Insights

The Europe inertial sensors for land defense system market is categorized into technology, application, and country.

Based on technology, the Europe inertial sensors for land defense system market is categorized into FOG, MEMS, and others. The FOG segment held the largest market share in 2022.

In terms of application, the Europe inertial sensors for land defense system market is segmented into stabilization missile systems, stabilization turret/ cannon systems, land navigation including land survey, missile GGM/ SSM, stabilization active protection systems, stabilization of optronic systems, and others. The stabilization missile systems segment held the largest market share in 2022.

By country, the Europe inertial sensors for land defense system market is segmented into the UK, France, Russia, Germany, Italy, and the Rest of Europe. The UK dominated the Europe inertial sensors for land defense system market share in 2022.

Collins Aerospace, Advanced Navigation Pty Ltd, Honeywell International Inc, Northrop Grumman Corp, SBG Systems SAS, Thales SA, GEM Elettronica SRL, and Exail SAS are among the leading companies operating in the Europe inertial sensors for land defense system market.

1. Collins Aerospace

2. Advanced Navigation Pty Ltd

3. Honeywell International Inc

4. Northrop Grumman Corp

5. SBG Systems SAS

6. Thales SA

7. GEM Elettronica SRL

8. Exail SAS

The Europe Inertial Sensors for Land Defense Market is valued at US$ 246.78 Million in 2022, it is projected to reach US$ 376.07 Million by 2030.

As per our report Europe Inertial Sensors for Land Defense Market, the market size is valued at US$ 246.78 Million in 2022, projecting it to reach US$ 376.07 Million by 2030. This translates to a CAGR of approximately 5.4% during the forecast period.

The Europe Inertial Sensors for Land Defense Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Inertial Sensors for Land Defense Market report:

The Europe Inertial Sensors for Land Defense Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Inertial Sensors for Land Defense Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Inertial Sensors for Land Defense Market value chain can benefit from the information contained in a comprehensive market report.