The growing importance of eco-friendly practices and sustainability is increasing the demand for refrigeration systems that use environmentally friendly refrigerants. This shift in end-user preferences drives the market players to develop and offer more energy-efficient and environmentally conscious solutions. There is a rise in environmental concerns and regulations aimed at reducing the impact of traditional refrigerants, such as hydrofluorocarbons (HFCs), on the ozone layer and climate. As regulations and awareness about climate change continue to become more stringent, businesses are adopting these systems to align with greener practices and reduce their carbon footprint. Hence, the adoption of natural refrigerants, such as hydrocarbons (propane and isobutane) and ammonia, is increasing across the globe. These substances have substantially lower Global Warming Potential (GWP) than HFCs. Industries are increasingly transitioning to these alternatives to adhere to environmental regulations and minimize their carbon footprint.

Moreover, many companies are investing in innovative technologies that utilize these eco-friendly refrigerants. For instance, CO2-based refrigeration systems, known as transcritical CO2 systems, are widely deployed in supermarkets and cold storage facilities. These systems use CO2 as a refrigerant, which has an extremely low GWP and zero ozone depletion potential. By implementing such systems, businesses can showcase their commitment to sustainability while benefiting from reduced energy consumption and operating costs.

The European Federation of Pharmaceutical Industries and Associations estimated that companies in the EU, Norway, Switzerland, and the UK spent US$ 49.07 billion on R&D in 2021 compared to US$ 45.25 billion in 2020. The European pharmaceutical and process industries are responsible for developing products that simplify and improve human life, from manufacturing medicines to producing materials and chemicals. To do this, high-efficiency cooling, reliable, and heating systems are essential. In the pharmaceutical industry, refrigeration systems operate simultaneously for cooling, freezing, heat pumps, process and production, heating, hot water, and combinations. Various players are expanding their business in Europe in the pharmaceutical industry. In November 2022, Envirotainer, one of the market leaders in secure cold chain solutions for the shipment of pharmaceuticals, extensively expanded its production site in Rosersberg, Sweden.

The food & beverages industry in Europe is also growing significantly. Preserving the quality of food, beverages, juices, and ciders is important. Thus, various companies in Europe are introducing new refrigeration systems. In December 2020, Daikin expanded the availability of its transport refrigeration solutions (Zanotti) into the main Northern European markets of France, Belgium, the Netherlands, and Germany. In 2016, Italian manufacturer Zanotti was acquired by Daikin. The company has decades of experience in industrial and commercial refrigeration and transporting fresh and frozen products. With the increasing pharmaceutical and food & beverages industries, the deployment of refrigeration systems is increasing. Hence, the demand for industrial refrigeration equipment in Europe is increasing.

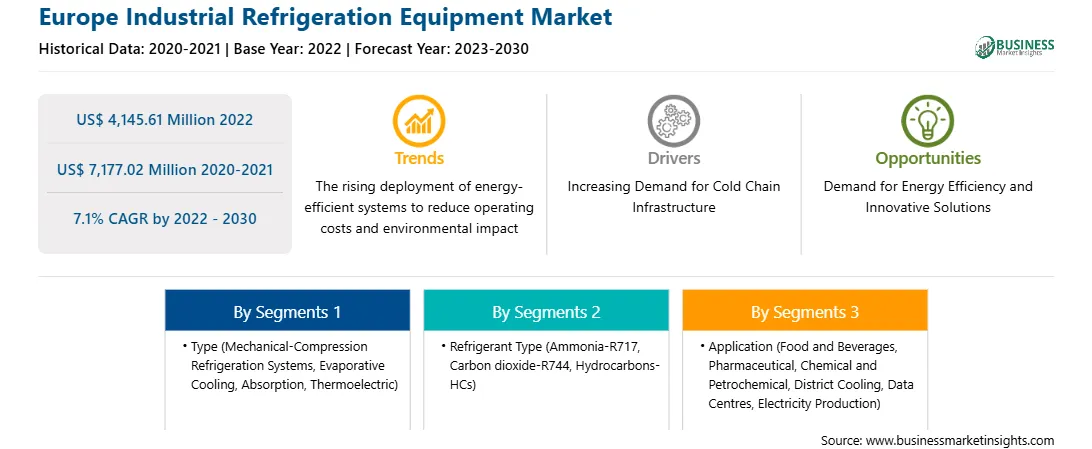

The Europe industrial refrigeration equipment market is segmented into type, refrigerant type, application, and country.

Based on type, the Europe industrial refrigeration equipment market is segmented into mechanical-compression refrigeration systems, evaporative cooling, absorption, thermoelectric. The mechanical-compression refrigeration systems segment registered the largest Europe industrial refrigeration equipment market share in 2022.

Based on refrigerant type, the Europe industrial refrigeration equipment market is segmented into ammonia – R717, carbon dioxide (CO2) – R744, and hydrocarbons – HCs. The ammonia – R717 segment held the largest Europe industrial refrigeration equipment market share in 2022.

Based on application, the Europe industrial refrigeration equipment market is segmented into food and beverages, pharmaceutical, chemical and petrochemical, district cooling, data centres, electricity production, and others. The food and beverages segment held the largest Europe industrial refrigeration equipment market share in 2022.

Based on country, the Europe industrial refrigeration equipment market has been categorized into the UK, Germany, France, Italy, Russia, Norway, Austria, and the Rest of Europe. The UK dominated the Europe industrial refrigeration equipment market in 2022.

Samifi France SAS, Johnson Controls International Plc, Jean Paumier et Fils Ets, Danfoss AS, Honeywell International Inc, Copeland LP, Evapco Inc, BITZER Kuhlmaschinenbau GmbH, and Carrier Global Corp. are some of the leading companies operating in the industrial refrigeration equipment market in the region.

Strategic insights for the Europe Industrial Refrigeration Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 4,145.61 Million |

| Market Size by 2030 | US$ 7,177.02 Million |

| Global CAGR (2022 - 2030) | 7.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Industrial Refrigeration Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe Industrial Refrigeration Equipment Market is valued at US$ 4,145.61 Million in 2022, it is projected to reach US$ 7,177.02 Million by 2030.

As per our report Europe Industrial Refrigeration Equipment Market, the market size is valued at US$ 4,145.61 Million in 2022, projecting it to reach US$ 7,177.02 Million by 2030. This translates to a CAGR of approximately 7.1% during the forecast period.

The Europe Industrial Refrigeration Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Industrial Refrigeration Equipment Market report:

The Europe Industrial Refrigeration Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Industrial Refrigeration Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Industrial Refrigeration Equipment Market value chain can benefit from the information contained in a comprehensive market report.