Floors coating systems used in indoor and outdoor sports arenas need the right combination of properties such as excellent point elasticity, skid resistance, surface elasticity, and rebound properties. They should also be extremely durable, while displaying excellent optical characteristics and compatibility with commonly used coloring materials and additives. High-performance polyurethane floor coatings impart excellent elasticity and good grip to surfaces while allowing players to be agile and move skillfully on the court, which makes it a preferred material for coating floors in indoor sports halls; tennis, volleyball, and basketball courts; and wrestling and gymnastic halls. The rising expenditure by government and private construction companies in building sports complexes and arenas has led to the development of numerous sports facilities in urban as well as suburban areas, which are likely to generate a high demand for specialized high-performance indoor flooring materials in the coming years.

Due to the COVID-19 outbreak, Russia, UK, France, Italy, Spain, and Germany are some of the worst affected member states in the European region. Businesses in the region face severe economic difficulties as they had to suspend their operations or substantially reduce their activities. Due to business lockdowns, travel bans, and supply chain disruptions, the region experienced an economic slowdown in 2020 and, most likely, in 2021. According to world meter till 24th March 2021 there were 2,732,130, 4,319,128, 4,424,087, cases have been registered in Germany, UK, and France. The member states of Europe, such as Italy, Spain, and Germany, have implemented drastic measures and travel restrictions to limit the spread of coronavirus among its citizens. European countries represent a major market for indoor flooring adoption due to good wages of people. Since several European countries are in the phase of lockdowns, the installation of indoor floor got hampered. Covid-19 first manifested itself in Europe as a “supply-side” shock, as Chinese producers cut their exports dramatically. China is the world's largest provider of capital products, responsible for a considerable portion of Europe's car industry electronics imports as well as the bulk of primary elements of the clean energy industry, such as photovoltaic panels. This impact is expected to continue in the coming weeks, undermining Greenfield development programmers in the works, and will escalate through many European countries as non-strategic businesses are shut down. This business climate, in our opinion, may bring uncertainty, but it may also bring rewards, such as new investments entering the market, an ability to produce alpha, or potentially higher entry rates in a market that has seen a rise in average valuations in the recent past, as has been the case with other asset groups.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe indoor flooring market. The Europe indoor flooring market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the Europe Indoor Flooring provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

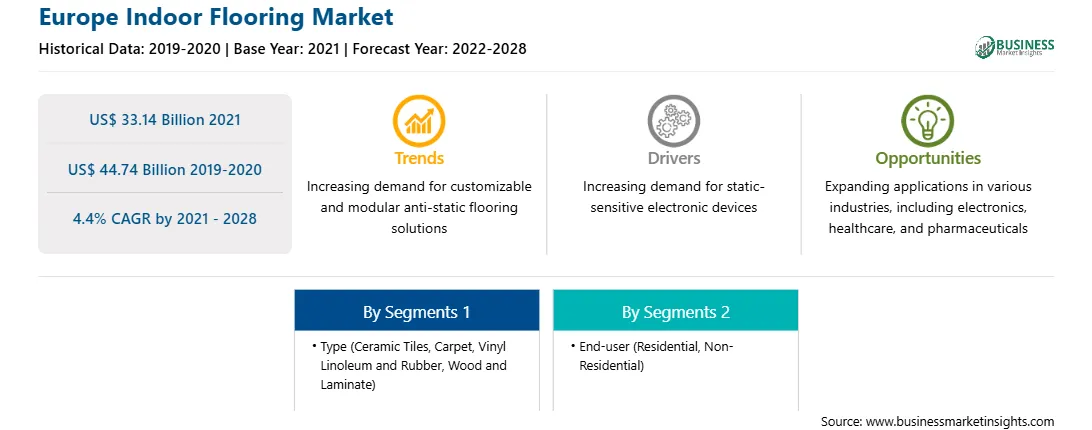

| Market size in 2021 | US$ 33.14 Billion |

| Market Size by 2028 | US$ 44.74 Billion |

| Global CAGR (2021 - 2028) | 4.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Indoor Flooring refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

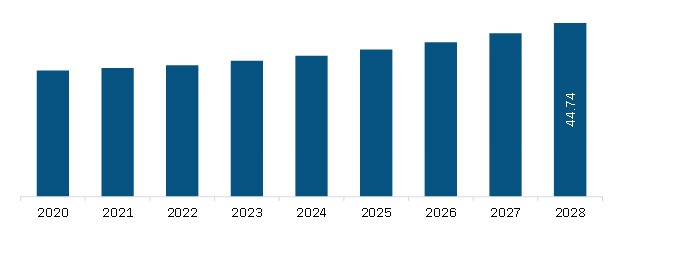

The Europe Indoor Flooring Market is valued at US$ 33.14 Billion in 2021, it is projected to reach US$ 44.74 Billion by 2028.

As per our report Europe Indoor Flooring Market, the market size is valued at US$ 33.14 Billion in 2021, projecting it to reach US$ 44.74 Billion by 2028. This translates to a CAGR of approximately 4.4% during the forecast period.

The Europe Indoor Flooring Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Indoor Flooring Market report:

The Europe Indoor Flooring Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Indoor Flooring Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Indoor Flooring Market value chain can benefit from the information contained in a comprehensive market report.