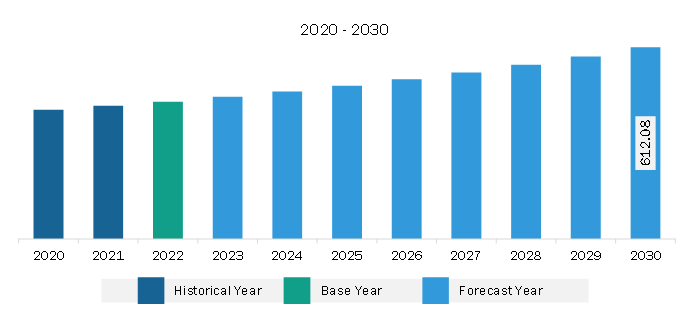

The Europe hydrogen compressor market was valued at US$ 438.68 million in 2022 and is expected to reach US$ 612.08 million by 2030; it is estimated to register a CAGR of 4.3% from 2022 to 2030.

With rising urbanization and rapid industrial growth, energy consumption across the globe has proliferated. Thus, to meet this huge demand for power, there is a rapid increase in the launch of hydrogen-generated power projects. According to the Ember Climate Organization, total global energy demand reached ~13,393 TWh in the first quarter of 2022, an increase from 13,004 TWh compared to 2021. Such an increase in demand for energy and power, owing to rising residential and industrial manufacturing requirements, is driving the demand for hydrogen compressors. Renewable energy plays a significant role in making electricity. Per the International Energy Agency (IEA), the global demand for electricity is anticipated to increase by 2.1% annually by 2040. Therefore, development in the renewable energy & power sector is surging the demand for power generation projects worldwide, thereby boosting the demand for hydrogen compressors.

There is a rise in investments in the renewable energy sector due to increased government initiatives and funding, which promotes the adoption of hydrogen compressors. Per the IEA, global investments in the renewable energy sector reached US$ 358.0 billion in the first six months of 2023, an increase of 22% rise compared to the start of last year and an all-time high for any six months. Renewable energy companies compared to last year, 2022. The venture capital firms and private equity companies are expanding their operations in the renewable energy sector, reaching US$ 10.4 billion in the first quarter of 2023. China accounted for the largest market share in the first quarter of 2023, with investment reaching US$ 177 billion, increased by 16% compared to the first quarter of 2022. Also, the US secured an investment of ~US$ 36 billion, followed by Germany, with an investment of US$ 11.9 billion for the expansion of the renewable energy sector. Further, many hydrogen production projects are being launched due to government support and funding. According to the International Energy Agency Organization and McKinsey Report, globally, more than 680 large-scale investment projects announced with investments of US$ 240 billion by 2022. The report estimates that investment is expected to reach US$ 700 billion by 2030 to achieve the net-zero target. Also, investment in building hydrogen fuel stations across the globe is rising, owing to a surge in investments in fuel cell technology by private equity firms and venture capital. For instance, in March 2022, H2 Mobility Germany's fueling station network planned an investment of US$ 121 million for the next five years for building the hydrogen infrastructure for fuel cell vehicles in the country. Thus, rising investments in renewable energy and hydrogen generation projects owing to government support and funding are anticipated to create ample opportunity for the market growth in the coming years.

Europe is growing moderately with government support and initiatives for clean hydrogen production. From 2021 to 2027, the EU government's budget announced an investment of ~US$ 578 billion for climate spending. The European Commission also launched a budget of US$ 847.2 billion for the production of renewable hydrogen from the climate change innovation fund. Hydrogen compressor is widely used in renewable energy with government support and initiatives. Rising investments across the oil & gas industry further drive the Europe hydrogen compressor market growth. The region's oil & gas sector has several giant projects across the region, creating massive demand for hydrogen compressors. A few of the projects include Johan Sverdrup and Johan Castberg oil field Development in Norway, Lochnagar and Rosebank oil and gas exploration in the UK, and Aphrodite Gas Field in Cyprus. Also, several projects of hydrogen electrolyzers were launched in Europe with capacities of 441 MW in several countries, such as Italy, Germany, Cyprus, and Greece. Hydrogen compressors are used in hydrogen electrolysis projects to store the generated energy efficiently. Thus, this compressor is an optimal choice for energy & power projects. Apart from energy & power, utilities, food & beverages, and chemical industries are also growing efficiently in Europe. Also, there is a rise in renewable energy projects in order to reduce energy costs. For instance, in 2022, Amazon Inc. planned an investment of ~US$ 2.5 billion for adding 39 new renewable energy projects across European countries. The company planned to add over 1 GW of clean energy capacity to Europe's grid. Amazon also planned more than 160 solar and wind energy projects across 13 countries, including Germany, France, Italy, Poland, and other countries in Europe. These projects are expected to offer 5.8 GW of clean energy capacity, powering 4.7 million European residents annually. The EU Commission planned to invest more than US$ 550 billion for the hydrogen production. Hydrogen compressor is used as a major component in hydrogen gas production. It is used as a renewable, clean, zero-emission energy.

Strategic insights for the Europe Hydrogen Compressor provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 438.68 Million |

| Market Size by 2030 | US$ 612.08 Million |

| Global CAGR (2022 - 2030) | 4.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Hydrogen Compressor refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe hydrogen compressor market is categorized into type, stage, end user, and country.

Based on type, the Europe hydrogen compressor market is bifurcated into oil-based and oil-free. The oil-based segment held a larger market share in 2022.

In terms of stage, the Europe hydrogen compressor market is bifurcated into single-stage and multi-stage. The multi-stage segment held a larger market share in 2022.

By end user, the Europe hydrogen compressor market is segmented into chemicals, oil and gas, automotive and transportation, renewable energy, refueling stations, and others. The oil and gas segment held the largest market share in 2022.

By country, the Europe hydrogen compressor market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe hydrogen compressor market share in 2022.

Atlas Copco AB; Burckhardt Compression AG; Gardner Denver Nash, LLC; HAUG Sauer Kompressoren AG; Howden Group; Hydro-Pac, Inc.; Lenhardt & Wagner GmbH; NEUMAN & ESSER GROUP; and PDC Machines Inc. are among the leading companies operating in the Europe hydrogen compressor market.

The Europe Hydrogen Compressor Market is valued at US$ 438.68 Million in 2022, it is projected to reach US$ 612.08 Million by 2030.

As per our report Europe Hydrogen Compressor Market, the market size is valued at US$ 438.68 Million in 2022, projecting it to reach US$ 612.08 Million by 2030. This translates to a CAGR of approximately 4.3% during the forecast period.

The Europe Hydrogen Compressor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Hydrogen Compressor Market report:

The Europe Hydrogen Compressor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Hydrogen Compressor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Hydrogen Compressor Market value chain can benefit from the information contained in a comprehensive market report.