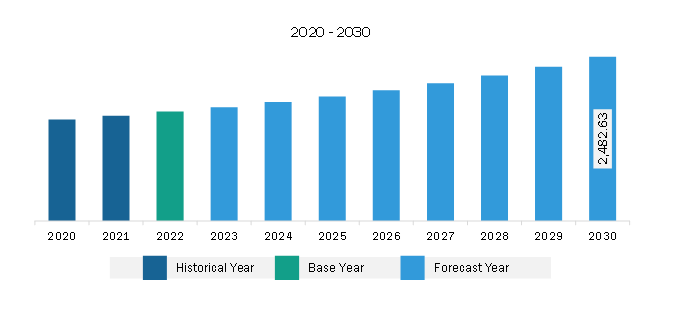

The Europe hot melt adhesives market was valued at US$ 1,655.42 million in 2022 and is expected to reach US$ 2,482.63 million by 2030; it is estimated to register a CAGR of 5.2% from 2022 to 2030.

The use of hot melt adhesives in construction possesses certain advantages over other typical adhesives like solvent-based adhesives. These benefits are the ability to bind different substrates together and a high flexibility. Hot melt adhesives used for road marking are a proprietary & innovative technology and an application process that creates a retro-reflective marking effect on bitumen base roads or concrete surfaces to offer safe night driving. The utilization of polybutene in hot melt adhesives benefits thermoplastic road marking paints since it dries fast with strong adhesion to the road surface. Polybutene further offers good UV and thermal resistance, which helps to reduce the brittle point and modify the softening point, along with an increase in the total hardness of the finishing road mark. A hot melt kettle heats up the road, marking material up to 200°C, and it is then sprayed over the road surface. After it cools down, the paint becomes wear-resistant, quite reflective, and bright. For easy identification of road markings, even in the dark, reflective glass beads are further added since they improve brightness along with durability. Many companies are contributing to hot melt road marking product manufacturing with their novel products. However, as compared to other applications of hot melt adhesives, the road marking application segment will offer growth opportunities for the market players. After the COVID-19 pandemic, it is presumed that construction activities are going to rise again in various economies, and the projects that were postponed will be resumed, which will further influence the market growth for hot melt adhesives.

Further, JiangSu Faer Wax Industry Co., Ltd is offering hot melt marking paint, which is a type of road marking material created by utilizing thermoplastic petroleum resin as the binder, high-quality fillers, and additives as auxiliary. This road marking material has the advantages of quick-drying, smooth construction, good reflection capacity, and long service lifespan, among others. KEMAT Polybutenes company is also offering hot melt road marking paints. KEMAT polybutenes offer an excellent pour-point, which enhances the road marking paint flow even in winter. KEMAT delivers the largest range of viscosities, combining the Polybut along with Polybol Polybutenes with a very narrow MW distribution for the road marking paints. Thermoplastic road marking materials are utilized in several places, such as car parking and roads. The common colors available for road marks are white and yellow. Yellow pigments consist of yellow lead, while white pigments are mostly zinc oxide, titanium dioxide, and lithopone.

Economically strong countries such as the UK, Germany, and Russia are at the forefront of implementing technologically advanced solutions. In addition, manufacturing and packaging industries are heavily contributing to the GDP of various countries in the region. Hot melt adhesive manufacturers are contributing to the market growth in Europe through their innovative products. A few of the major players operating in Europe's hot melt adhesive market are Exxon Mobil Corporation, Intercol BV, H.B. Fuller Company, 3M, Arkema Group, Henkel AG & Co. KGaA, and Sika AG. The market giants are focused on new and improved product offerings to meet the demand for industry-specific requirements. Exxon Mobil is offering hot melt adhesives with low-viscosity grade Vistamaxx polymers (e.g., 8380, 8780, and 8880) that facilitate superior performance compared to ethylene-vinylor (EVA) and amorphous polyalphaolefin (APAO). Low-viscosity Vistamaxx is a high-performance, low-odor performance polymer with high mileage hot melt adhesives suitable for packaging, hygiene products, and assembly applications.

In February 2013, FEICA, the industry association of the European sealant & adhesives industry, published a guidance document regarding the food contact material status declaration for adhesives. The document aims to guide adhesive manufacturers in ensuring compliance with Regulation EC 1935/2004. It further summarizes the relevance of Regulation EC 1935/2004, 2023/2006, and 10/2011 for adhesives and provides insight into European national legislation. On August 4, 2020, a new restriction, mainly on diisocyanates, was published through the Official Journal of the European Union (2020/1149). The aim of the new EU Regulation is to ensure better protection of workers as well as to ensure the application of best practices throughout the EU in terms of health and safety. It mainly targets respiratory problems and skin allergies, which can potentially occur by diisocyanates, and needs new minimum training before the usage of diisocyanates with mixtures containing diisocyanates. Polyurethane is formed by facilitating the reaction between polyol and diisocyanates, and it is further mixed to create different types of polyurethane applications. Bostik, a major hot melt adhesive market player, is handling the diisocyanates products safely and taking precautionary measures for the workers. Through this step, the company focuses on enhancing and harmonizing the level of protection given to employees and workers handling diisocyanates across Europe.

Strategic insights for the Europe Hot Melt Adhesives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Hot Melt Adhesives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Hot Melt Adhesives Strategic Insights

Europe Hot Melt Adhesives Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,655.42 Million

Market Size by 2030

US$ 2,482.63 Million

Global CAGR (2022 - 2030)

5.2%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Type

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Hot Melt Adhesives Regional Insights

The Europe hot melt adhesives market is categorized into product type, type, application, and country.

Based on product type, the Europe hot melt adhesives market is segmented into glue sticks, glue slugs, and others. The glue sticks segment held the largest market share in 2022.

In terms of type, the Europe hot melt adhesives market is segmented into ethylene vinyl acetate, polyolefins, polyamides, polyurethanes, styrene block copolymers, and other. The ethylene vinyl acetate segment held the largest share of Europe hot melt adhesives market in 2022.

By application, the Europe hot melt adhesives market is divided into packaging, construction, automotive, furniture, footwear, electronics, and others. The packaging segment held the largest share of Europe hot melt adhesives market in 2022.

Based on country, the Europe hot melt adhesives market is categorized into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe hot melt adhesives market share in 2022.

H.B. Fuller Company; Henkel AG & COMPANY, KGAA; Arkema; 3M; Sika AG; Jowat SE; Hexcel Corporation; The Dow Chemical Company; Beardow Adams; Gorilla Glue Company; and Adhesive Technologies, Inc. are among the leading companies operating in the Europe Hot Melt Adhesives market.

1. H.B. Fuller Company

2. Henkel AG & COMPANY, KGAA

3. Arkema

4. 3M

5. Sika AG

6. Jowat SE

7. Hexcel Corporation

8. The Dow Chemical Company

9. Beardow Adams

10. Gorilla Glue Company

11. Adhesive Technologies, Inc.

The Europe Hot Melt Adhesives Market is valued at US$ 1,655.42 Million in 2022, it is projected to reach US$ 2,482.63 Million by 2030.

As per our report Europe Hot Melt Adhesives Market, the market size is valued at US$ 1,655.42 Million in 2022, projecting it to reach US$ 2,482.63 Million by 2030. This translates to a CAGR of approximately 5.2% during the forecast period.

The Europe Hot Melt Adhesives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Hot Melt Adhesives Market report:

The Europe Hot Melt Adhesives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Hot Melt Adhesives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Hot Melt Adhesives Market value chain can benefit from the information contained in a comprehensive market report.