The market's growth is attributed to advancements in sutures and an increase in cases of chronic wounds and surgeries. However, the noninvasive alternatives to stitches are likely to hinder the market's growth during the forecast period.

According to the American College of Surgeons, globally, 1–2% of people are likely to suffer from a chronic wound once in their lifetime. Apart from sharp injuries, the cases of work-related injuries or occupational injuries are rising worldwide. Poor working conditions are the major cause of the rise in the occurrence of chronic wounds. According to the International Labor Organization, ~2.3 million people suffer from work-related accidents every year. These wounds affect patients' health and quality of life. The burden of chronic wounds eventually underlines the need for advanced wound care management to reduce the financial burden on national healthcare systems substantially. Various countries spend significant amounts on treating injuries and avoiding associated risks. Therefore, with a surge in the occurrence of chronic wounds, the demand for hospital sutures is also increasing worldwide.

Further, the number of cardiovascular, general, orthopedic, gynecological, and cancer surgeries performed in hospitals is increasing tremendously worldwide. For instance, according to a research article published by PubMed.gov, the number of isolated heart transplants in Germany reached ~340 surgeries in 2020, accounting for a 2.1% increase compared to 2019. Moreover, the growing geriatric population is primarily responsible for severe health conditions requiring surgeries as the treatment option. Surgeries for hernias and cataracts are more common among older adults. Further, the rise in aesthetic surgery is more common among people working in the entertainment industry. These surgeries are performed on patients who require the replacement of a body part due to an injury or a deformity. Therefore, a rise in the number of surgeries being performed at hospitals or similar healthcare centers is driving the demand for sutures.

Strategic insights for the Europe Hospital Suture provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,047.27 Million |

| Market Size by 2028 | US$ Million |

| Global CAGR (2021 - 2028) | 6.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Hospital Suture refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

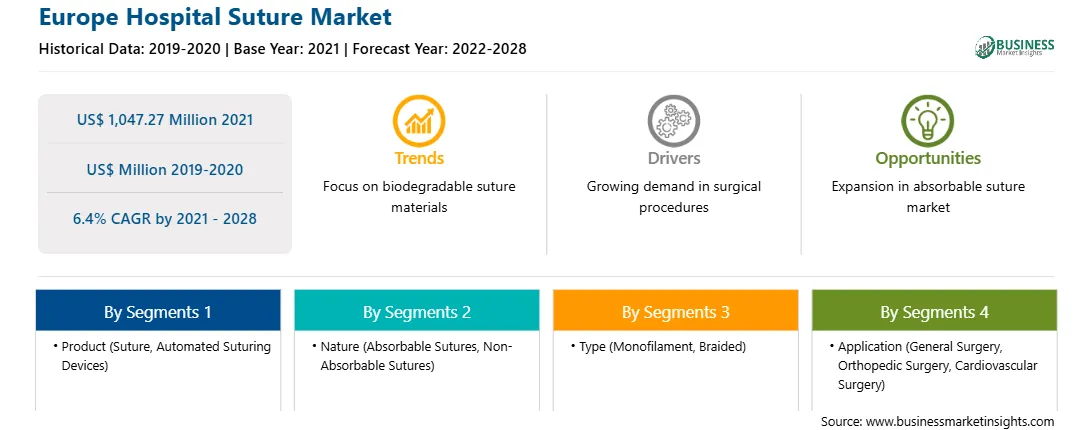

Based on product, the Europe hospital suture market is divided into sutures, automated suturing devices, and others. In terms of nature, the market is segmented into absorbable sutures and non-absorbable sutures. Based on type, the market is divided into monofilament and braided. In terms of application, the market is categorized into general surgery, cardiovascular surgery, orthopedic surgery, and others. Geographically, the Europe hospital suture market is divided into Germany, Italy, the UK, Spain, France, and the Rest of Europe.

Assut Medical Sarl, Péters Surgical., SERAG-WIESSNER GmbH & Co. KG Zum Kugelfang, DemeTECH Corporation, Teleflex Incorporated, Smith & Nephew, B. Braun Melsungen AG, Johnson and Johnson Services, Inc., Medtronic; and W. L. Gore and Associates, Inc. are among the leading companies operating in the

Europe hospital suture market.

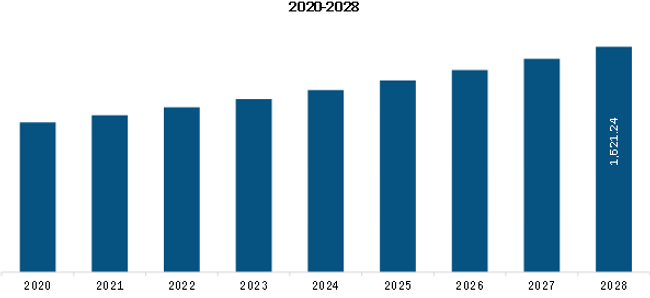

The Europe Hospital Suture Market is valued at US$ 1,047.27 Million in 2021, it is projected to reach US$ Million by 2028.

As per our report Europe Hospital Suture Market, the market size is valued at US$ 1,047.27 Million in 2021, projecting it to reach US$ Million by 2028. This translates to a CAGR of approximately 6.4% during the forecast period.

The Europe Hospital Suture Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Hospital Suture Market report:

The Europe Hospital Suture Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Hospital Suture Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Hospital Suture Market value chain can benefit from the information contained in a comprehensive market report.