The Europe home sequential compression devices market includes the consolidated markets for France, Germany, United Kingdom, Spain, Italy, and Rest of Europe. Europe occupies a significant position in the global home sequential compression devices market and is expected to record vigorous growth rate during the forecast period. The growth of the market is attributed by the increasing incidence of diabetes increases the internal risk factors such as swelling of legs, ankles, and feet, which will lead to venous disorders. Such rising incidence rates of diabetes and other related chronic diseases, in turn, increases the patient pool, which drives the compression therapy market growth.

The European economy is severely affected due to the exponential growth of COVID-19 cases in the region. Spain, Italy, Germany, France, and the UK are among the most affected European countries. As per the Worldometer, as of July 1st, 2021, Spain, the UK, Italy, Germany, and France recorded 3,808,960; 4,800,907; 4,259,909; 3,736,223; and 5,775,301, respectively. Resulting from these situations, the regional government has announced the local restrictions in countries and ordered them to follow the lockdown rules. However, the demand for home medical devices has been increasing as there is fear of COVID-19 infection outside. The COVID-19 pandemic has resulted in diversion of healthcare resources including workforce, critical supplies, emergency, and intensive care unit (ICU) facilities to the management of patients infected with SARS-CoV-2 virus. Elective interventions and surgical procedures in most European countries have been postponed and operating room resources have been diverted to manage the pandemic. Limitations on direct personal contact and physical (social) distancing have influenced access to care. Patients with venous and lymphatic disorders or vascular anomalies continue to need expert care within current public health constraints. In addition, there is growing evidence that COVID-19 may predispose patients to both arterial and venous thromboembolic (VTE) disease and extensive coagulopathies further complicating the prognosis of the affected patients. To facilitate triage in this situation European Venous Forum (EVF) and European College of Phlebology (ECoP) in collaboration with various international organizations has developed Venous and Lymphatic Triage and Acuity Scale (VELTAS) to rationalize and harmonize the management of these patients during this difficult period. Such a factors will support home sequential compression device adoption and will have positive impact on market.

Strategic insights for the Europe Home Sequential Compression Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

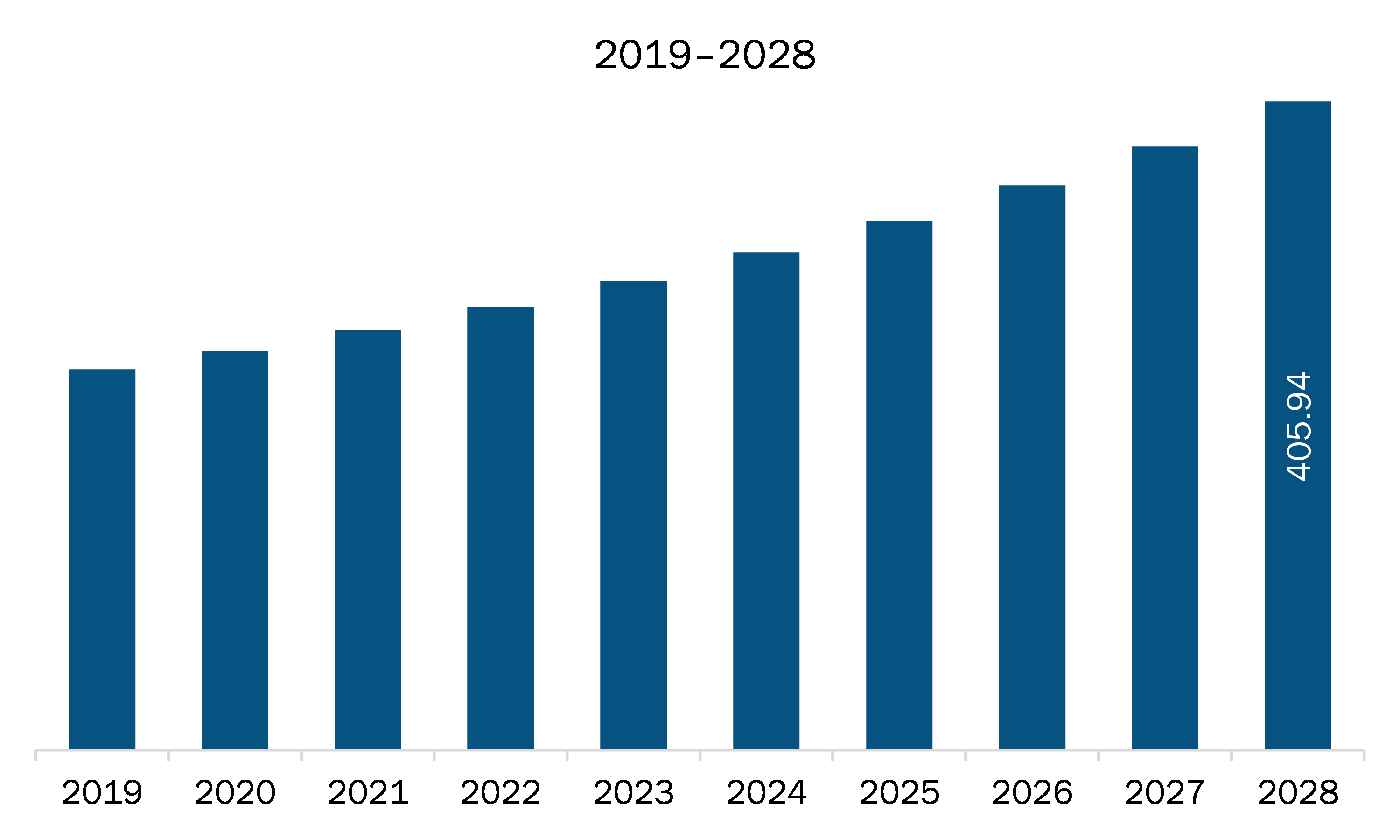

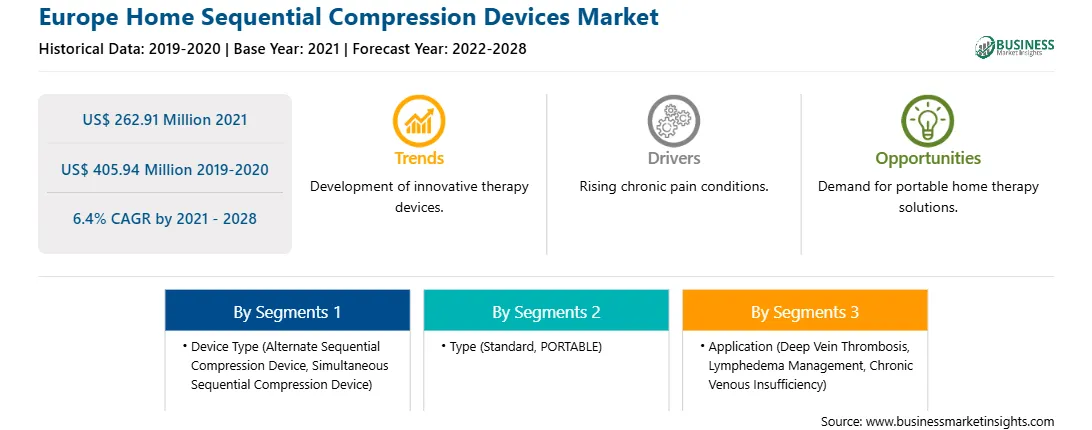

| Market size in 2021 | US$ 262.91 Million |

| Market Size by 2028 | US$ 405.94 Million |

| Global CAGR (2021 - 2028) | 6.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Device Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Home Sequential Compression Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The home sequential compression devices market in Europe is expected to grow from US$ 262.91 million in 2021 to US$ 405.94 million by 2028; it is estimated to grow at a CAGR of 6.4% from 2021 to 2028. The home sequential compression devices market is characterized by the presence of various small and big companies. The market players adopt strategies such as new product launches, regional expansion, and technological advancements to increase their market share. Market players are investing in R&D to develop advanced technologies and gain more revenue share. For instance, in 2016, Cool Systems, Inc. developed ACCEL technology, helping integrate pneumatic compression and cold therapy. Also, the NormaTec recovery system designed by Normatec in 2016 uses the latest pulse technology for dynamic compression therapy. Moreover, Profore, a compression system developed by Smith & Nephew in 2015 comprises an extra padding layer to protect vulnerable areas such as the Achilles tendon and pretibial crest. Similarly, in December 2020, Tactile Medical has received 510(k) clearance for two new indications for the Flexitouch Plus system: phlebolymphedema and lipedema. Further, in June 2018, Arjo acquires ReNu Medical. ReNu Medical is a privately owned US company specializing in green reprocessing for single-use non-invasive medical devices. Moreover, in May 2019, Mego Afek ltd. has announced preliminary data for Lympha Press PCD-51 for the treatment of chronic venous stasis ulcers. In Addition, in July 2020, Breg, Inc. and UK-based distributor Joint Operations LLP entered a partnership to expand the delivery of its premium, high-value medical devices in the UK and Ireland market. Thus, these many advances in sequential compression devices are likely to act as a future trend in the market.

The Europe home sequential compression devices market is segmented on the bases of device type, type, application, and country. The Europe home sequential compression devices market, by type is segmented into alternate sequential compression device (ASCD), simultaneous sequential compression device (SSCD). The simultaneous sequential compression device (SSCD) segment held the largest share of the market in 2021. Europe home sequential compression devices market based on the type is segmented into standard and portable. In 2021, the standard segment is likely to hold the largest share of the market. The Europe home sequential compression devices market by application, is segmented into deep vein thrombosis (DVT), lymphedema management, chronic venous insufficiency (CVI) and others. The deep vein thrombosis (DVT), segment is likely to hold the largest share of the market in 2021. The Europe home sequential compression devices market, by country is segmented into France, Germany, Italy, UK, and Russia.

A few major primary and secondary sources referred to for preparing this report on the home sequential compression devices market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AIROS Medical; Arjo Medical Devices; Breg Inc.; Cardinal Health Inc; DJO Global, Inc.; DSMAREF CO.LTD; and Mego Afek ltd.are.

The Europe Home Sequential Compression Devices Market is valued at US$ 262.91 Million in 2021, it is projected to reach US$ 405.94 Million by 2028.

As per our report Europe Home Sequential Compression Devices Market, the market size is valued at US$ 262.91 Million in 2021, projecting it to reach US$ 405.94 Million by 2028. This translates to a CAGR of approximately 6.4% during the forecast period.

The Europe Home Sequential Compression Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Home Sequential Compression Devices Market report:

The Europe Home Sequential Compression Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Home Sequential Compression Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Home Sequential Compression Devices Market value chain can benefit from the information contained in a comprehensive market report.