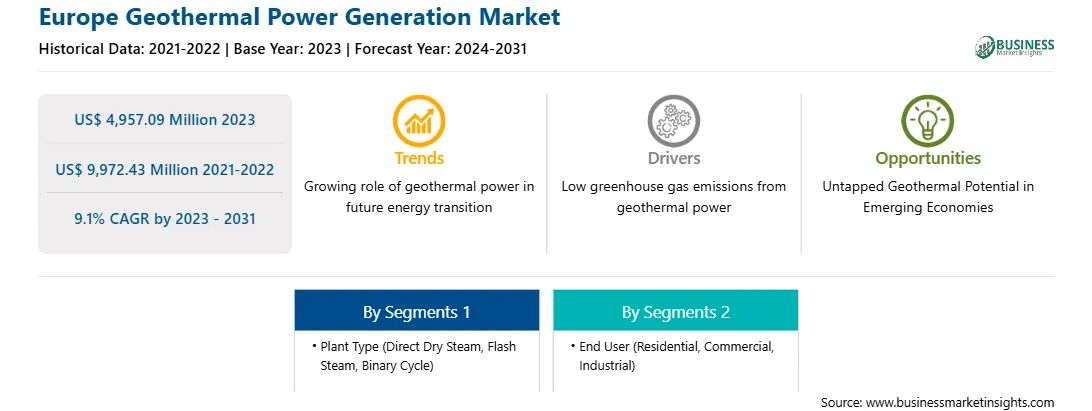

The Europe geothermal power generation market was valued at US$ 4,957.09 million in 2023 and is expected to reach US$ 9,972.43 million by 2031; it is estimated to register a CAGR of 9.1% from 2023 to 2031. Surge in Investment and Government Support toward Geothermal Power Generation Drives Europe Geothermal Power Generation Market

Wind farms and photovoltaic projects successfully complement investments in geothermal projects. This is owing to the challenges associated with utilizing wind and solar energies for power generation; for example, wind turbines are ineffective on calm days and the output of solar panels is reduced at night and on cloudy days. Natural geothermal energy is available for commercial use 24 hours a day, regardless of weather conditions. The development of the geothermal energy sector requires huge capital investments that fail to be completely financed from public funds only. This development also requires the active participation of the private sector. Investments in geothermal energy projects help diversify the global energy mix, protect power grids from the instability of conventional renewable sources (wind and solar energy), and reduce energy costs. According to the ESFC Investment Group, over the last decade, the turnover of geothermal industry has exceeded US$ 4 billion per year, and the global fleet of geothermal power plants surpassed more than 500 plants of various sizes. The increased interest of investors in this area is due to the unlimited resources hidden in the depths of the planet.Europe Geothermal Power Generation Market Overview

The Europe geothermal power generation market is segmented into Turkey, Iceland, Italy, Russia, and the Rest of Europe. Europe accounted for the second largest market share in the geothermal power generation market worldwide owing to the presence of geothermal energy-producing countries, including Turkey, Italy, and Iceland. In addition, a rise in awareness about renewable power generation and associated investments in the region, owing to the targets set by governments of European countries to reduce carbon emissions, is expected to boost the market growth in the coming years. Moreover, ongoing geopolitical wars in the region, such as Russia-Ukraine and Israel-Hamas, have disrupted the supply chain of oil and gas products between Europe and other regions across the globe. This has further increased investment toward renewable power-generating technologies, which is likely to fuel market growth from 2023 to 2031.

Strategic insights for the Europe Geothermal Power Generation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Geothermal Power Generation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Geothermal Power Generation Market Revenue and Forecast to 2031 (US$ Million)

Europe Geothermal Power Generation Strategic Insights

Europe Geothermal Power Generation Report Scope

Report Attribute

Details

Market size in 2023

US$ 4,957.09 Million

Market Size by 2031

US$ 9,972.43 Million

Global CAGR (2023 - 2031)

9.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Plant Type

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Geothermal Power Generation Regional Insights

Europe Geothermal Power Generation Market Segmentation

The Europe geothermal power generation market is categorized into plant type, end user, and country.

Based on plant type, the Europe geothermal power generation market is segmented into direct dry steam, flash steam, and binary cycle. The flash steam segment held the largest market share in 2023.

In terms of end user, the Europe geothermal power generation market is categorized into residential, commercial, and industrial. The industrial segment held the largest market share in 2023.

By country, the Europe geothermal power generation market is segmented into Turkey, Iceland, Italy, Russia, and the Rest of Europe. Turkey dominated the Europe geothermal power generation market share in 2023.

Turboden SpA, Toshiba Energy Systems and Solutions Corp, Berkshire Hathaway Inc, NIBE Industrier AB, General Electric Co, Fuji Electric Co Ltd, Carrier Global Corp, and Danfoss AS. are some of the leading companies operating in the Europe geothermal power generation market.

The Europe Geothermal Power Generation Market is valued at US$ 4,957.09 Million in 2023, it is projected to reach US$ 9,972.43 Million by 2031.

As per our report Europe Geothermal Power Generation Market, the market size is valued at US$ 4,957.09 Million in 2023, projecting it to reach US$ 9,972.43 Million by 2031. This translates to a CAGR of approximately 9.1% during the forecast period.

The Europe Geothermal Power Generation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Geothermal Power Generation Market report:

The Europe Geothermal Power Generation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Geothermal Power Generation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Geothermal Power Generation Market value chain can benefit from the information contained in a comprehensive market report.