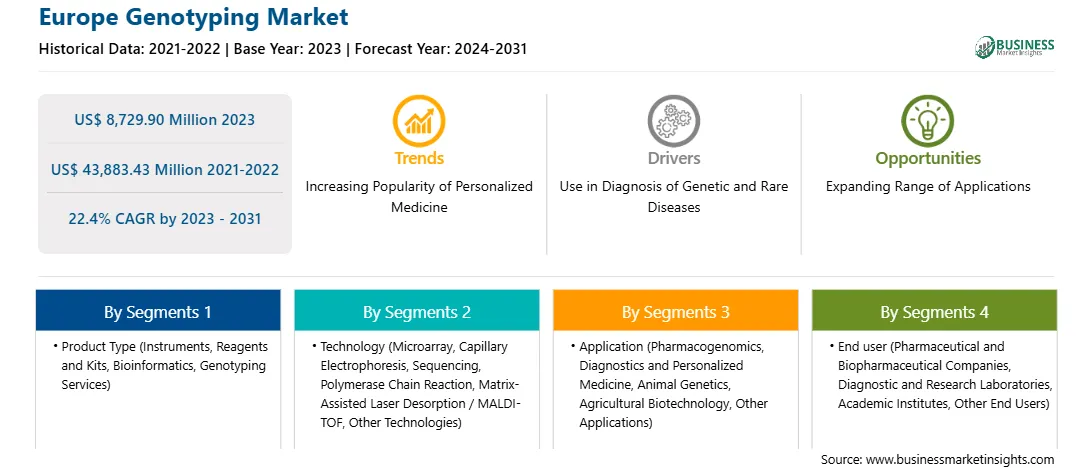

The Europe genotyping market was valued at US$ 8,729.90 million in 2023 and is expected to reach US$ 43,883.43 million by 2031; it is estimated to record a CAGR of 22.4% from 2023 to 2031.

Technological Advancements and Rising R&D Investments in Biotechnology and Pharmaceutical Industry Drives Europe Genotyping Market

Genotyping market players are focusing on increasing their investments in projects aimed at advancements in biotechnology to come up with better alternatives to conventional techniques.

Such technological breakthroughs have the potential to enable miniaturization, automation, and cost reduction. They can also aid in operational flexibility and multiparameter testing. All these benefits add to the uses and convenience of DNA sequencing, allowing clinicians to concentrate on higher-level decisions such as selecting and prioritizing therapeutic targets through various genotyping studies. Further, technological advancements in DNA sequencing, such as NGS, have enabled speedy, accurate sequencing, allowing for great productivity. Thus, the growing research and development activities, along with increasing government funding for genome-based projects, contribute to the genotyping market progress.

Europe Genotyping Market Overview

The Europe genotyping market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. The region holds the second-largest share of the global genotyping market and is expected to register a notable CAGR during the forecast period. Factors such as technological advancements, reducing prices of DNA sequencing procedures, increasing incidence of genetic diseases, and rising awareness of personalized medicine are among the factors aiding the growth of the Europe genotyping market.

Europe Genotyping Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the Europe Genotyping provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Genotyping refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Genotyping Strategic Insights

Europe Genotyping Report Scope

Report Attribute

Details

Market size in 2023

US$ 8,729.90 Million

Market Size by 2031

US$ 43,883.43 Million

Global CAGR (2023 - 2031)

22.4%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product Type

By Technology

By Application

By End user

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Genotyping Regional Insights

Europe Genotyping Market Segmentation

The Europe genotyping market is categorized into product type, technology, application, end user, and country.

Based on product type, the Europe genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the Europe genotyping market is segmented into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the Europe genotyping market is bifurcated into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the Europe genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the Europe genotyping market is segmented into the UK, Germany, France, Spain, Italy, and the Rest of Europe. Germany dominated the Europe genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, EUROFINS GENOMICS, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are some of the leading companies operating in the Europe genotyping market.

The Europe Genotyping Market is valued at US$ 8,729.90 Million in 2023, it is projected to reach US$ 43,883.43 Million by 2031.

As per our report Europe Genotyping Market, the market size is valued at US$ 8,729.90 Million in 2023, projecting it to reach US$ 43,883.43 Million by 2031. This translates to a CAGR of approximately 22.4% during the forecast period.

The Europe Genotyping Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Genotyping Market report:

The Europe Genotyping Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Genotyping Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Genotyping Market value chain can benefit from the information contained in a comprehensive market report.