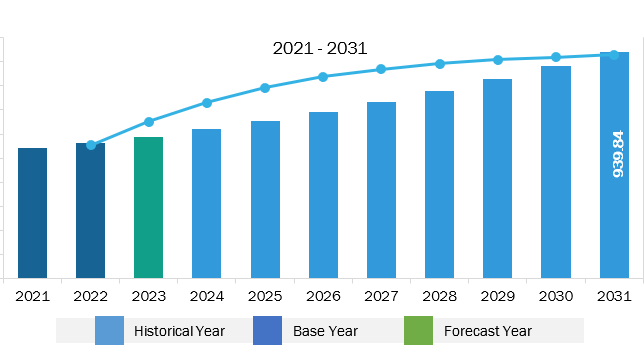

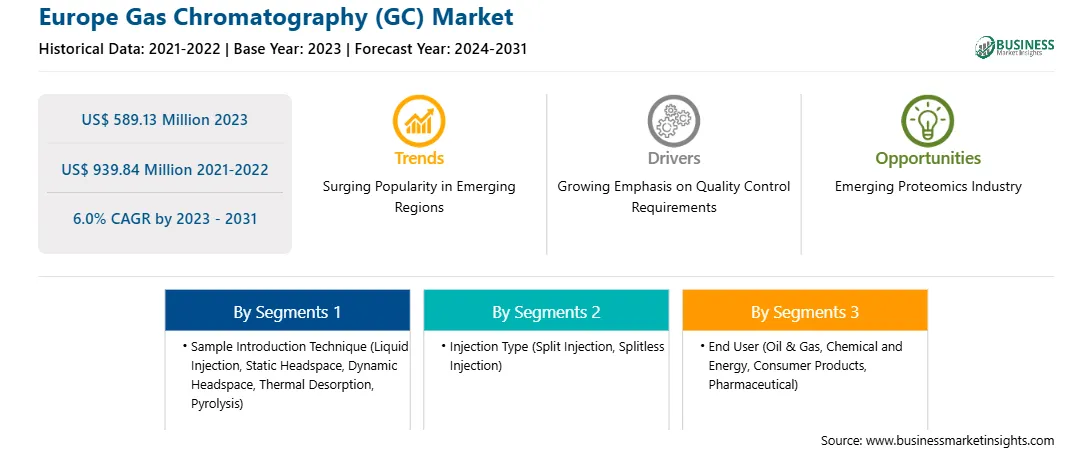

The Europe gas chromatography (GC) market was valued at US$ 589.13 million in 2023 and is expected to reach US$ 939.84 million by 2031; it is estimated to register a CAGR of 6.0% from 2023 to 2031.

Proteomics, a study of proteins and their functions, plays a crucial role in industries such as pharmaceuticals, biotechnology, and healthcare. Gas chromatography serves as a powerful analytical technique that enables the separation and analysis of complex mixtures, including proteins. Incorporating gas chromatography in proteomics opens new avenues for research and development. By utilizing gas chromatography in proteomic analysis, scientists can effectively separate and identify proteins, leading to a deeper understanding of their structure, function, and interactions. This information is vital for drug discovery, biomarker identification, and personalized medicine, among other applications. As proteomics continues to gain prominence in various industries, there is a need for precise and reliable tools to simplify the analytical processes. Gas chromatography offers high resolution, sensitivity, and reproducibility, making it an ideal choice for proteomic research. For instance, Creative Proteomics, offers a Finnigan TRACE DSQ GC-MS system with Electron Ionization (EI) and Chemical Ionization (CI) capability, allowing for identification of unknown compounds down to below part-per-billion levels. Thus, the flourishing field of proteomics presents significant opportunities for the gas chromatography market.

The Europe gas chromatography market is segmented into Germany, France, the UK, Italy, Spain, Russia, and the Rest of Europe. The St. Kitts and Nevis Bureau of Standards (SKNBS) was established in March 1999. The SKNBS is implementing the “Strengthening the National Quality Infrastructure: Training and Equipment for Conformity Assessment Project,” with funding from the European Union (EU). The project will focus on procuring and installing a gas chromatography/mass spectrometer (GC-MS) instrument at the SKNBS, along with managing consultancy services to train the chemistry laboratory staff to use the instrument. The Economic Partnership Agreement (EPA) and CSME Standby Facility Steering Committee approved the project for implementation in 2021. Thus, the EU initiatives fuel the Europe gas chromatography market growth. Countries in the region are highly focused on building power plants to meet the growing electricity demand from the residential, commercial, and residential sectors in an efficient way. In addition, governments are focused on building new power plants with the rising demand for renewable electricity. For example, in February 2022, the French President stated that the country would build 14 new nuclear reactors by 2050 to make France carbon neutral by 2050. Thus, the building of new power plants will require gas chromatographic determination of diagnostic components (gases such as Н2, СН4, С2Н6, С2Н4, С2Н2, СО, СО2, О2, and N2) to ensure efficient plants operations. This will further fuel the gas chromatography market growth in Europe.

Strategic insights for the Europe Gas Chromatography (GC) provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 589.13 Million |

| Market Size by 2031 | US$ 939.84 Million |

| Global CAGR (2023 - 2031) | 6.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Sample Introduction Technique

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Gas Chromatography (GC) refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe gas chromatography (GC) market is categorized into sample introduction technique, injection type, detector type, end user, and country.

Based on sample introduction technique, the Europe gas chromatography (GC) market is segmented into liquid injection, static headspace, dynamic headspace, thermal desorption, pyrolysis, and others. The liquid injection segment held the largest share of Europe gas chromatography (GC) market share in 2023.

In terms of injection type, the Europe gas chromatography (GC) market is segmented into split injection, splitless injection, and others. The split injection segment held the largest share of Europe gas chromatography (GC) market in 2023.

By detector type, the Europe gas chromatography (GC) market is divided into flame ionization detector, thermal conductivity detector, electron capture detector, thermionic specific detector, flame photometric detector, photo ionization detector, mass spectrometers, and others. The others segment held the largest share of Europe gas chromatography (GC) market in 2023.

Based on end user, the Europe gas chromatography (GC) market is categorized into oil and gas, chemical and energy, consumer products (polymer plastic), pharmaceutical, and others. The oil and gas chemical and energy segment held the largest share of Europe gas chromatography (GC) market in 2023.

By country, the Europe gas chromatography (GC) market is segmented into Germany, the UK, France, Norway, Italy, Denmark, the Netherlands, Spain, Finland, Sweden, and the Rest of Europe. Germany dominated the Europe gas chromatography (GC) market share in 2023.

Agilent Technologies Inc; Thermo Fisher Scientific Inc; Shimadzu Corp; Wasson-ECE Instrumentation; Merck KGaA; PerkinElmer, Inc. (Revvity Inc); Restek Corporation; VUV Analytics; and Da Vinci Laboratory Solutions are some of the leading companies operating in the Europe gas chromatography (GC) market.

The Europe Gas Chromatography (GC) Market is valued at US$ 589.13 Million in 2023, it is projected to reach US$ 939.84 Million by 2031.

As per our report Europe Gas Chromatography (GC) Market, the market size is valued at US$ 589.13 Million in 2023, projecting it to reach US$ 939.84 Million by 2031. This translates to a CAGR of approximately 6.0% during the forecast period.

The Europe Gas Chromatography (GC) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Gas Chromatography (GC) Market report:

The Europe Gas Chromatography (GC) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Gas Chromatography (GC) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Gas Chromatography (GC) Market value chain can benefit from the information contained in a comprehensive market report.