The European continent comprises several developed and developing economies, such as Germany, France, Italy, the UK, and Russia. The presence of large-scale manufacturing plants and huge domestic consumption of food inclusions, propelled by prime focus of food and beverage manufacturers on product innovation through the use of novel ingredients to cater to changing taste habits of customers, make Europe the largest market for food inclusions. Furthermore, products such as fruits and nuts are becoming increasingly popular as they add a vibrant texture, color, appearance, increased flavor, and organoleptic properties. Nuts have huge demand in baking and confectionery products. According to the World Health Organization (WHO), 30–70% of adults in Europe are overweight, whereas 10–30% of adults are obese. Moreover, 1 in every 3 to 11 year-olds in the EU is overweight or obese. Such high prevalence of obesity or overweight conditions are attracting consumer focus toward protein-rich diet that has less quantity of refined sugar. Fruit and nut inclusions add flavor, texture, versatility, health benefits, and cost-effectiveness to a variety of products, including bakery and confectionery products, breakfast cereals, dairy and frozen desserts, and sweet and savory snacks. For instance, nuts such as almonds and walnuts are used as toppings on baked food and as inclusions in bars. Nuts such as almonds and walnuts have high nutrient content, including rich quantities of proteins, calcium, fibers, vitamin E, riboflavin, and niacin.

In Europe, currently France and Russia are the hardest-hit countries by the coronavirus outbreak. It is estimated to suffer an economic hit due to a lack of revenue from various industries, Russia as the country recorded the highest number of coronavirus cases followed by the France, UK, Italy, Spain, and Germany. Other member states have implemented drastic measures and travel restrictions, including partially closing their borders. This is anticipated to impact market growth in Europe.

Strategic insights for the Europe Food Inclusions provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

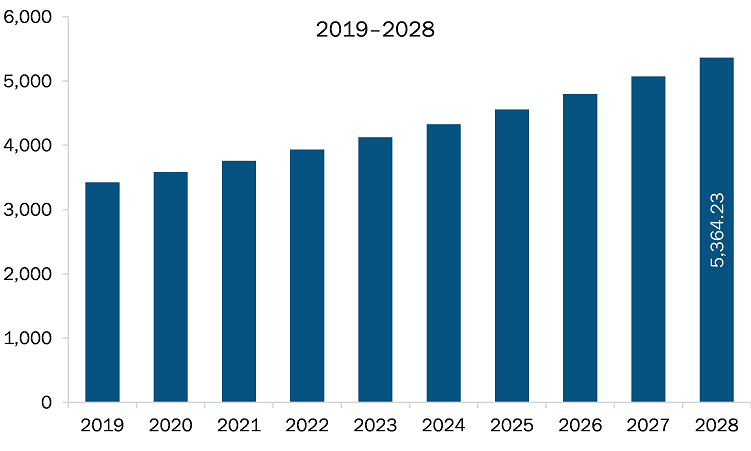

| Market size in 2021 | US$ 3,760.95 Million |

| Market Size by 2028 | US$ 5,364.23 Million |

| Global CAGR (2021 - 2028) | 5.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Food Inclusions refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The food inclusions market in Europe is expected to grow from US$ 3,760.95 million in 2021 to US$ 5,364.23 million by 2028; it is estimated to grow at a CAGR of 5.2% from 2021 to 2028. Changing consumer preference has always been major factor influencing the food & beverages industry. Continuous shifts in consumer preferences are propelling food manufacturers to introduce gluten-free, organic, dairy-free, and vegan diets products that meet dietary needs of various consumers. Further, the growing trend of veganism, especially in the western countries, is a major consumer trend influencing the growth of food inclusions market. According to data cited by the Sainsbury’s Future of Food report, the vegan and vegetarian population is expected to account for a quarter of the global population by 2025. Vegans and several flexitarians are opting for non-dairy products, such as plant-based ice creams and yogurts, which, in turn, is boosting the demand for non-dairy/plant-based food inclusions such as nuts, seeds, and fruits. Further, the rise in the prevalence of celiac diseases is driving a shift in consumer preference toward gluten-free products. According to data cited by The Institute for Functional Medicine, based on their 2020 meta-analysis, there has been an increase in the incidence of celiac disease by an average of 7.5% per year in the past decades. Thus, to cater to the rising demand for gluten-free products, food manufacturers are focusing on incorporating gluten-free food inclusions in their products. Thus, changing consumer preferences are giving rise to several key trends that are bound to affect the food inclusions market growth in the coming years.

In terms of type, the chocolate segment accounted for the largest share of the Europe food inclusions market in 2020. In term of form, the solid segment held a larger market share of the food inclusions market in 2020. Further, the bakery products segment held a larger share of the market based on application in 2020.

A few major primary and secondary sources referred to for preparing this report on the food inclusions market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ADM; AGRANA Beteiligungs-AG; Puratos; Barry Callebaut; Cargill, Incorporated; Kerry Group; Georgia Nut Company; Taura Natural Ingredients Ltd.; Sensient Technologies; and Meadow Foods among others.

The Europe Food Inclusions Market is valued at US$ 3,760.95 Million in 2021, it is projected to reach US$ 5,364.23 Million by 2028.

As per our report Europe Food Inclusions Market, the market size is valued at US$ 3,760.95 Million in 2021, projecting it to reach US$ 5,364.23 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The Europe Food Inclusions Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Food Inclusions Market report:

The Europe Food Inclusions Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Food Inclusions Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Food Inclusions Market value chain can benefit from the information contained in a comprehensive market report.