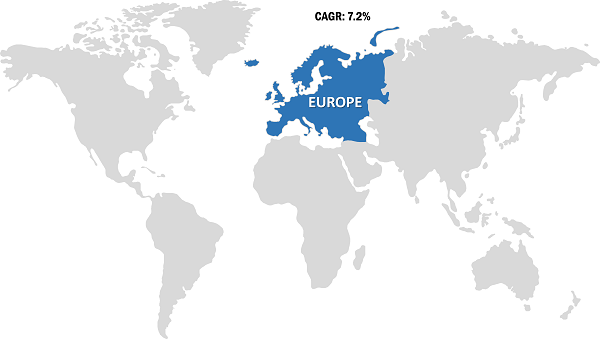

The Europe flatbread market is accounted to US$ 11,465.5 Mn in 2018 and is expected to grow at a CAGR of 7.2% during the forecast period 2019 – 2027, to account to US$ 21,295.9 Mn by 2027.

A flatbread is a bread made with water, flour, and salt, and then thoroughly rolled into flattened dough. Traditionally, flatbread is an unleavened bread that is made without yeast. Flour, water, and salt are the main ingredients used for making flatbread. Other ingredients such as corn, rye, millet, and barley are also used for making flatbread. Flatbread products made from whole grain have high amounts of fiber, an essential nutrient that can help prevent obesity and also help reduce the risk of constipation, diabetes, heart disease, and high cholesterol. Flatbreads are rolled out flat and cooked, usually in a brick oven. Flatbreads are the oldest form of bread products and are mainly consumed in Southern Europe and Turkey. Many different types of flatbreads, such as tortilla, naan, pita, Lebanese khubz, Greek pita, Turkish pide, among others, are consumed in Europe. They have become popular in many western countries, finding a new range of uses as sandwich wraps and pizza bases. Technology and innovative packaging options have widened food choices in the market, which is likely to bolster the flatbread market further in Europe.

Strategic insights for the Europe Flatbread provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 11,465.5 Million |

| Market Size by 2027 | US$ 21,295.9 Million |

| Global CAGR (2019 - 2027) | 7.2% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Flatbread refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Market Insights

Increasing demand for convenience food products

The demand for convenience foods such as wraps and rolls is growing at a faster pace due to changes in social and economic patterns, as well as an increase in urbanization, buying power and awareness about health foods, changes in food habits and meal patterns, and desire to taste new products. Convenience food products are rapidly gaining popularity among teenagers, children, working-class people, and people living in hostels. The significant shift of people toward convenience foods in developing countries, such as the France, Germany, Turkey, and Spain, is driving the demand for flatbread and favoring the flatbread market in the European region. Flatbread is available in frozen and ready to eat form, which makes them the most consumed convenience food among consumers. Flatbreads offer food manufacturers, restaurants, and institutions a simple and easy way to offer a variety of food options to customers. Currently, flatbread manufacturers across the European region are focused on appealing to consumers with artisanal approaches to bread that can provide support for pizzas and sandwiches, enclose succulent fillings in flavorful wraps, and even be baked into crispy toasted snack chips. Therefore, the increasing demand for flatbread for the preparation of various convenience foods is projected to drive Europe flatbread market growth.

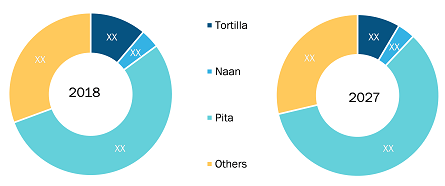

Product Insights

The Europe flatbread market is segmented on the basis of product type as – tortilla, naan, pita, and others. The tortilla segment in the Europe flatbread market is estimated to hold a leading share in the flatbread market, whereas the pita segment is known to grow at the fastest rate. Much like tortillas, pitas are also used to wrap falafel, kebabs, and falafel in a manner similar to sandwiches. Pita is a grain-based low-fat food that is considered to be rich in iron, vitamin B, and protein. As pita contains fewer empty calories as compared to white bread, it is increasingly consumed in different regions around the world. Modern commercial pita bread is manufactured on automated lines. Automation in the field of flatbread production has resulted in high production capacities, reducing process time, and reducing the unit cost of flatbread products such as pita bread. The availability of ready-made pita bread, which is marketed as cholesterol and trans-fat free, has been a significant draw for health-conscious consumers. The health benefits associated with pita bread is expected to spur the growth of the pita bread market and contribute to the expansion of the flatbread market in the European region.

Distribution Channel Insights

The Europe flatbread market is segmented on the basis of distribution channel as hypermarkets and supermarkets, bakeries, convenience stores, and others. The hypermarkets and supermarkets segment accounts for the largest share in the Europe flatbread market, while the convenience stores segment also contributes a significant share in the market. Convenience stores are stores that are located in a limited area, and are small in size as compared to hypermarkets and supermarkets. Unlike hypermarkets and supermarkets, the convenience stores are open till late at night. This adds an added bonus for the sales of any product, in this case, flatbreads. The longer working hours of the convenience stores proves to be beneficial for the manufacturers to reach the consumers who work late and pick up things in hurry. The manufacturers adopts various mediums of reaching out its consumer base. The rising number of convenience stores has allowed easy, improved and extensive distribution network for flatbreads which is expected to boost the growth of the segment.

Strategic insights for the Europe Flatbread provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 11,465.5 Million |

| Market Size by 2027 | US$ 21,295.9 Million |

| Global CAGR (2019 - 2027) | 7.2% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Flatbread refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

EUROPE FLATBREAD MARKET SEGMENTATION

Europe Flatbread Market - By Product

Europe Flatbread Market - By Distribution Channel

Company Profiles

List of 10 Companies-Europe Flatbread Market

The Europe Flatbread Market is valued at US$ 11,465.5 Million in 2018, it is projected to reach US$ 21,295.9 Million by 2027.

As per our report Europe Flatbread Market, the market size is valued at US$ 11,465.5 Million in 2018, projecting it to reach US$ 21,295.9 Million by 2027. This translates to a CAGR of approximately 7.2% during the forecast period.

The Europe Flatbread Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Flatbread Market report:

The Europe Flatbread Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Flatbread Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Flatbread Market value chain can benefit from the information contained in a comprehensive market report.