According to recent studies, European energy demand has increased significantly, with natural gas gaining traction as the preferred fuel. In the energy and power sector, fired heaters play an important part in natural gas-fueled furnaces, which keeps their demand high. According to data from Eurostat, The EU's energy demand for oil and petroleum products peaked in 2019 at 545.6 Mtoe. In 2019, the demand for natural gas was 335.9 Mtoe. Moreover, studies also reveal that in 2019, gross onshore natural gas consumption in the EU climbed by 4.2% over 2018, reaching a level not seen since 2010. Thus, the increasing demand for natural gas is creating lucrative opportunities for fired air heaters in the particular industry. One of Europe's largest manufacturing industries is the chemicals industry. It plays a critical role in supplying innovative materials and technology solutions to boost Europe's industrial competitiveness as an "enabling industry." As a result of key issues such as greater competition from other nations and rising costs, the sector is undergoing a fast structural transformation. Nonetheless, the business has swiftly rebounded from the economic downturn and has remained quite stable in terms of overall sales. The expansion of the petrochemical and chemical industries has resulted in a significant increase in demand for machinery and equipment used in these industries, which has prompted the usage of fired heaters to improve combustion performance in the region.

The construction and chemical industries, coupled with the air transport industry, play an important role in economic growth and employment in many European countries, which was strongly impacted by supply chain disruptions and technological challenges due to COVID-19 pandemic. The European construction industry witnessed inefficiencies and activity delays with the initial spread of COVID-19 in the region. Following a challenging start to the year, the construction industry in Western Europe fell by 6.4% in 2020. This reduced demand severely impacted the regional fired air heaters market affecting the manufacturers, both in building and maintaining the product. The EU construction industry is anticipated to recover gradually due to a slower economic recovery and the importance of international services. Studies depict that the construction industry faced a downfall of almost 25% at the initial stages of COVID-19 pandemic in the region. However, the European manufacturing industry foresees faster recovery of the industry. According to the studies, in July 2021, industrial production in the European Union climbed by 8.3% over the same month the previous year. Owing to this, the company has been ramping up its production volumes to deliver a higher number of orders. Moreover, the region's retrieval of the construction industry is further expected to augment market growth in the coming years. Since the spring, economic activity has increased dramatically, with growth expected to reach 5.7% in 2021.

Strategic insights for the Europe Fired Air Heaters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

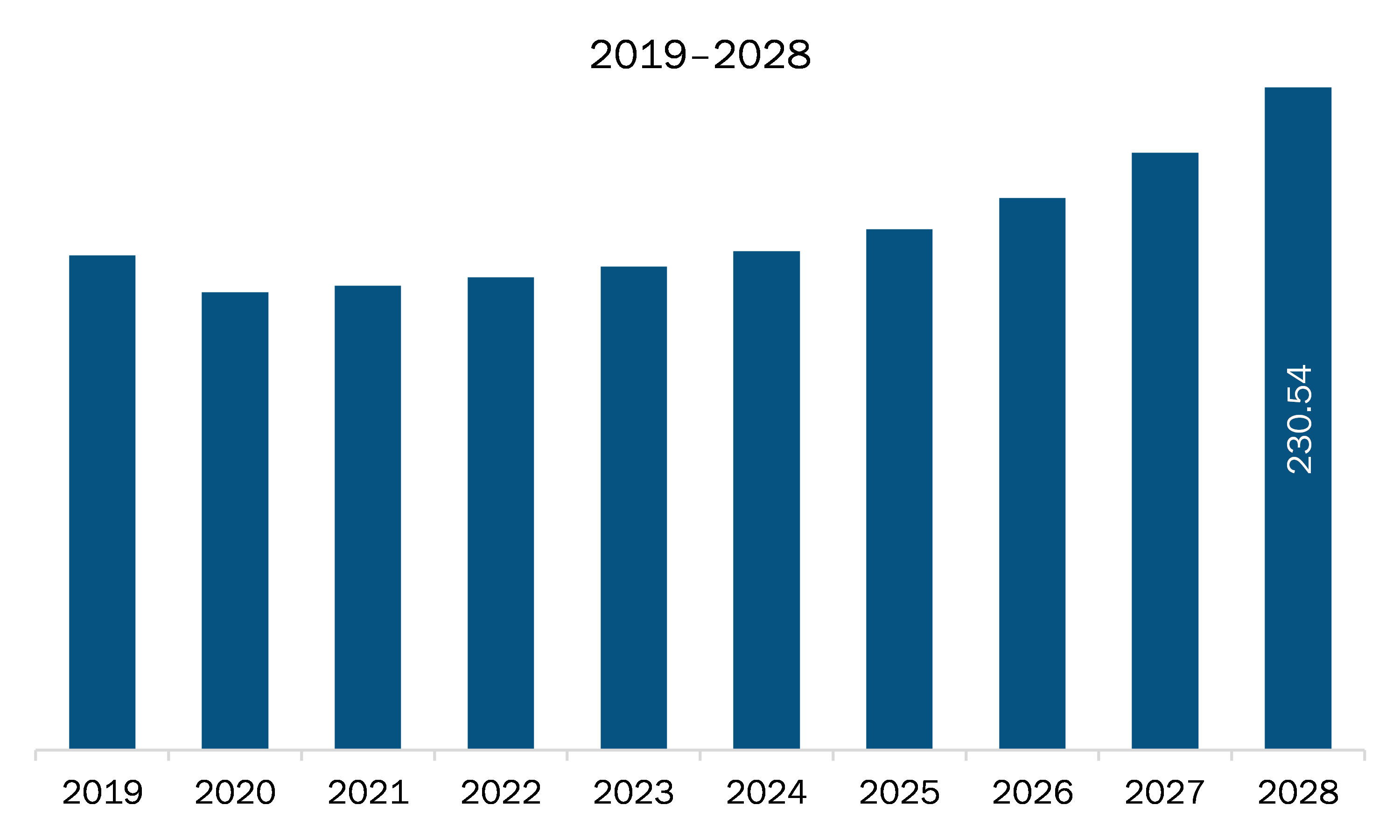

| Market size in 2021 | US$ 161.50 Million |

| Market Size by 2028 | US$ 230.54 Million |

| Global CAGR (2021 - 2028) | 5.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Fired Air Heaters refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe fired air heaters market is expected to grow from US$ 161.50 million in 2021 to US$ 230.54 million by 2028; it is estimated to grow at a CAGR of 5.2% from 2021 to 2028. The construction industry is one of the industries which continue to grow year on year, with the rising demand for industrial complexes. The use of fired air heaters is becoming more popular in the construction industry. Outside the buildings, there are usually natural gas, propane, or diesel-fired heaters. The fuel is burned in an enclosed combustion chamber with combustion air drawn in from outside the structure. The flame heats a heat exchanger, which indirectly warms outside air that is fan-driven into the building via air ducts. Warm air can be distributed throughout the work area using these ducts, installed as needed. Electricity is required to run these units, and they are less efficient than direct-fired units. However, the additional safety they give often outweighs these disadvantages. Because the burner and fuel supply are outside the building, the risk of a fire is reduced. They also provide fresh air to the work area, lowering carbon monoxide and oxygen depletion concerns. Furthermore, government intervention and recommendations are improving the market. Furthermore, rising development activity in several economies is propelling the market for fired air heaters even higher. Thus, growth in the construction sector will drive the demand for fired air heaters across the Europe region.

In terms of type, the direct fired air heater segment accounted for the largest share of the Europe fired air heaters market in 2020. In terms of end-user, the chemicals segment held a larger market share of the Europe fired air heaters market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe fired air heaters market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ALLMAND BROS., INC; Pirobloc, S.A.; SIGMA THERMAL, INC; Wacker Neuson SE; and Zeeco, Inc.

The Europe Fired Air Heaters Market is valued at US$ 161.50 Million in 2021, it is projected to reach US$ 230.54 Million by 2028.

As per our report Europe Fired Air Heaters Market, the market size is valued at US$ 161.50 Million in 2021, projecting it to reach US$ 230.54 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The Europe Fired Air Heaters Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Fired Air Heaters Market report:

The Europe Fired Air Heaters Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Fired Air Heaters Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Fired Air Heaters Market value chain can benefit from the information contained in a comprehensive market report.