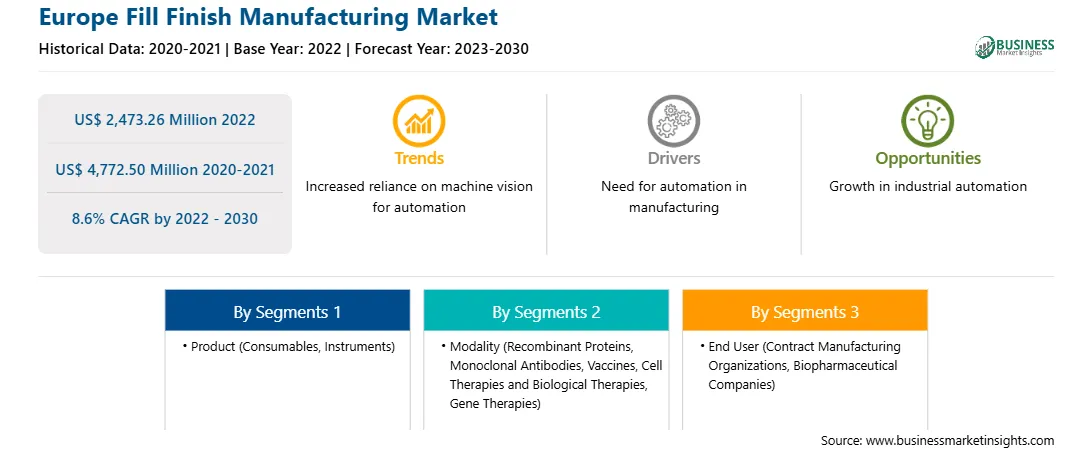

The Europe fill finish manufacturing market was valued at US$ 2,473.26 million in 2022 and is expected to reach US$ 4,772.50 million by 2030; it is estimated to grow at a CAGR of 8.6% from 2022 to 2030.

Biologics constitute a majority of the top-selling drugs, and they represent one of the fastest-growing pharmaceutical industry segments. Since the launch of recombinant protein-based therapies ~30 years ago, the overall biologics market has grown at an annual rate of more than 12%. Further, over 5,000 biopharmaceutical product candidates are currently under development. Although biopharmaceuticals offer significant profit margins, high development costs and complex production protocols are the key concerns of the sponsors of these pharmacological interventions. As a result, several start-ups and pharmaceutical giants have begun outsourcing different processes of their business operations to contract service providers. Moreover, outsourcing jobs to contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) reduces the requirement of capital investments, provides access to larger production capacities, decreases the time-to-market of products, and lowers risks associated with the commercialization of products.

Fill finish is the final step in the production process, and it is one of the most crucial stages of drug manufacturing. Biologics require special procedures and equipment for fill finish operations to ensure product integrity and safety. Thus, the rise in demand for biologics has resulted in an equivalent need for flexible aseptic fill finish technologies. Pharmaceutical drug manufacturers collaborate with contract service providers to leverage their experience and expertise in the latest fill finish technologies. Fill finish manufacturing services are currently provided by approximately 180 companies for a variety of biologics. They are located in over 350 fill finish factories for these contract manufacturing companies across various geographic regions.

The market players in Germany are adopting organic and inorganic growth strategies for market expansion and growth. For instance, in July 2020, Vetter, the contract development and manufacturing organization (CDMO), headquarters in Ravensburg, Germany, announced that it is investing in additional fill/finish capacity with the purchase of a clinical manufacturing site in Austria.

Similarly, The Siegfried Group signed a cooperation and supply agreement with Biopharmaceutical New Technologies, a German immunotherapy company, for the large-scale filling and packaging of commercial quantities of BNT162b2, an innovative COVID-19 vaccine candidate. Following successful approval, the vaccine developed by BioNTech in cooperation with Pfizer, an American pharmaceutical company, will be filled by Siegfried at its Hameln site from mid-2021 onwards. Also, Rentschler Biotechnologie GmbH, leading contract development and manufacturing organization (CDMO) for biopharmaceuticals located in Germany, and Rentschler Fill Solutions GmbH, an independent specialist for aseptic fill and finish services, announced a strategic partnership to provide new state-of-the-art fill and finish facilities and one-stop solutions for biopharmaceutical products to meet the requirements of Rentschler Biotechnologie's clients.

Strategic insights for the Europe Fill Finish Manufacturing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,473.26 Million |

| Market Size by 2030 | US$ 4,772.50 Million |

| Global CAGR (2022 - 2030) | 8.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Fill Finish Manufacturing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe fill finish manufacturing market is segmented based on product, modality, end user, and country. Based on product, the Europe fill finish manufacturing market is bifurcated into consumables and instruments. The consumables segment held a larger market share in 2022. Furthermore, the consumables is sub segmented into prefilled syringes, glass vial/plastic vials, cartridges, and others.

By modality, the Europe fill finish manufacturing market is segmented into recombinant proteins, monoclonal antibodies, vaccines, cell therapies and biological therapies, gene therapies, and others. The vaccines segment held the largest market share in 2022.

In terms of end user, the Europe fill finish manufacturing market is categorized into contract manufacturing organizations, biopharmaceutical companies, and others. The contract manufacturing organizations segment held the largest market share in 2022.

Based on country, the Europe fill finish manufacturing market is segmented into the UK, Germany, France, Italy, Spain, and the Rest of Europe. Germany dominated the Europe fill finish manufacturing market share in 2022.

Becton Dickinson and Co, Gerresheimer AG, Groninger and Co GmbH, IMA Industria Macchine Automatiche SpA, Maquinaria Industrial Dara SL, Nipro Medical Europe NV, NNE AS, Optima Packaging Group Gmbh, Schott AG, SGD SA, Stevanato Group SpA, Syntegon Technology GmbH, and West Pharmaceutical Services Inc are some of the leading players operating in the Europe fill finish manufacturing market.

The Europe Fill Finish Manufacturing Market is valued at US$ 2,473.26 Million in 2022, it is projected to reach US$ 4,772.50 Million by 2030.

As per our report Europe Fill Finish Manufacturing Market, the market size is valued at US$ 2,473.26 Million in 2022, projecting it to reach US$ 4,772.50 Million by 2030. This translates to a CAGR of approximately 8.6% during the forecast period.

The Europe Fill Finish Manufacturing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Fill Finish Manufacturing Market report:

The Europe Fill Finish Manufacturing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Fill Finish Manufacturing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Fill Finish Manufacturing Market value chain can benefit from the information contained in a comprehensive market report.