Fiberglass pipes are considered a reliable and cost-effective alternative to steel pipes for onshore and offshore corrosion control in the low to high-pressure oil & gas sector. The diverse range of pipeline applications in the sector include oil separation, enhanced oil recovery systems, oil production processes, transportation, and underground piping. The wide range of applications of fiberglass pipes such as fiberglass-reinforced epoxy pipes and fiberglass-reinforced polyester pipes can be attributed to its properties such as corrosion and pressure resistance, long service life, lightweight, high strength, nontoxic nature, and other mechanical properties.

The oil & gas industry is reporting increasing fuel demand due to rapid economic growth and rising oil utilization for applications such as feedstock and power generation. In 2021, Russia was among the top five largest energy producers and consumers in the world, producing 595.2 million tons of crude oil, of which 286.6 million tons were exported, according to the report published by Bruegel AISBL in 2023. The report also revealed that crude oil is exported by two main routes—pipeline and oil tanker at sea. According to the report released by Center for Eastern Studies in 2023, the government of Russia planned to boost the gas exports to China accounting for shipment of 98 billion cubic meters of gas per year, partially achieved through a planned Power of Siberia-2 pipeline, by 2030.

Russia is the top country with a significant number of proposed and in-development pipeline projects.

The Europe fiberglass pipes market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The increasing utilization of fiberglass pipes from various industries, including oil & gas, chemicals, and water & wastewater treatment, is propelling the market growth in Europe. According to the European Commission, the chemical industry represents ~7.5% of European Union manufacturing by turnover in the year 2018. The strong presence of the chemical industry in countries such as Germany, France, the UK, and Italy creates a huge demand for fiberglass pipes. According to the European Chemical Industry Council, AISBL, in 2022, Europe was the world's second-largest producer of chemical products. Germany is the largest producer of chemical products, followed by France, the UK, and Italy. In addition, the strong presence of major chemical manufacturers such as BASF SE and INEOS in the European region is expected to provide growth opportunities to the Europe fiberglass pipes market over the coming years. In addition, according to the European Commission, crude oil and petroleum products account for the largest share of gross inland energy consumption in the EU. Despite decreasing production and fluctuating consumption through the years, crude oil and its derived products still play a significant role in the Europe’s economy. In Norway, a key European non-EU crude oil producer, oil production increased from a record low of 70.0 Mt in 2019 to 87.4 Mt in 2021. Thus, the increasing consumption of oil and gas in Europe is further advancing the demand for transport mediums. For instance, in October 2022, Spain and France signed a new deal to build an underwater gas pipeline from Barcelona to Marseille. The pipeline will allow Spain and Portugal, two leading liquefied natural gas (LNG) importers, to transport their additional supplies to France and other European countries. Such government initiatives and the growing chemical industry are a few factors driving the fiberglass pipes market growth in the region.

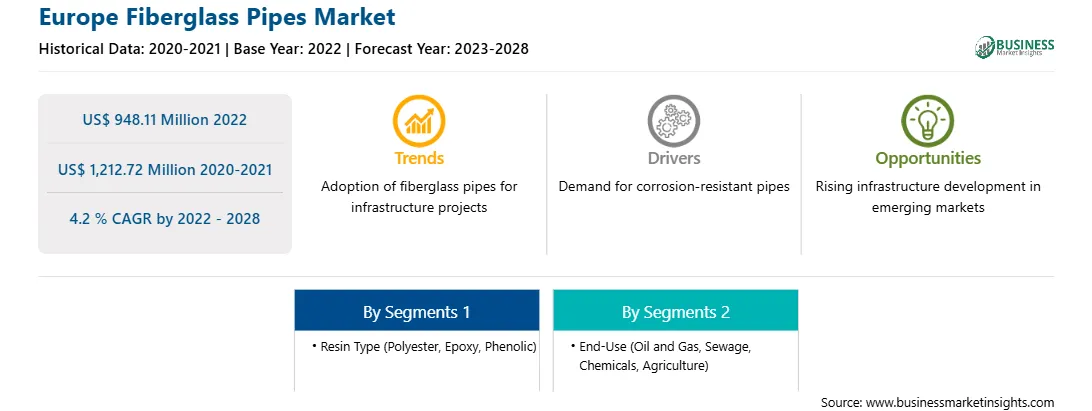

The Europe fiberglass pipes market is segmented into resin type, end use, and country.

Based on resin type, the Europe fiberglass pipes market is segmented into polyester, epoxy, phenolic, and others. The polyester segment held a largest Europe fiberglass pipes market share in 2022.

Based on end use, the Europe fiberglass pipes market is segmented into oil and gas, sewage, chemicals, agriculture, and others. The oil and gas segment held the largest Europe fiberglass pipes market share in 2022.

Based on country, the Europe fiberglass pipes market has been categorized into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the Europe fiberglass pipes market in 2022.

Amiblu Holding GmbH, EPP Composites Pvt Ltd, Future Pipe Industries LLC, Gruppo Sarplast Srl, Kurotec-KTS GmbH, Kuzeyboru AS, Lianyungang Zhongfu Lianzhong Composites Group Co Ltd, NOV Inc, Plasticon Germany GmbH, Poly Plast Chemi Plants (I) Pvt Ltd, Saudi Arabian Amiantit Co, and Sunrise Industries (India) Ltd are some of the leading companies operating in the Europe fiberglass pipes market.

Strategic insights for the Europe Fiberglass Pipes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 948.11 Million |

| Market Size by 2028 | US$ 1,212.72 Million |

| Global CAGR (2022 - 2028) | 4.2 % |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Resin Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Fiberglass Pipes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Some of the leading companies are:

The Europe Fiberglass Pipes Market is valued at US$ 948.11 Million in 2022, it is projected to reach US$ 1,212.72 Million by 2028.

As per our report Europe Fiberglass Pipes Market, the market size is valued at US$ 948.11 Million in 2022, projecting it to reach US$ 1,212.72 Million by 2028. This translates to a CAGR of approximately 4.2 % during the forecast period.

The Europe Fiberglass Pipes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Fiberglass Pipes Market report:

The Europe Fiberglass Pipes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Fiberglass Pipes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Fiberglass Pipes Market value chain can benefit from the information contained in a comprehensive market report.