The increasing adoption of advanced technology across the European region is not only influencing different industries to maximize their capabilities but also experiencing high adoption of easily automated and energy efficient fiber laser solutions across the manufacturing sector of the region. This is helping the industry to enhance its productivity and increase profitability by availing better quality goods in quickest time. Further, European countries are characterized by the presence of several major manufacturing industries such as aerospace, machinery and equipment, automotive, shipbuilding, and military vehicles. Automotive is considered to be a crucial industry as it contributes significantly to GDPs of different countries and provides employment to huge number of qualified candidates in the region. European countries are the leading producers of motor vehicles, and several premium automotive manufacturers are based in these countries. Moreover, more than 300 vehicle assembly and manufacturing facilities are located in 26 European countries. The European auto industry successfully delivers made in Europe products across the globe, generating EUR 90.3 billion trade surplus. The automotive sector of the EU is considered to be a crucial industry as it significantly contributes to the regions GDP, as well as employs millions of people in the region. Thus, the presence of robust manufacturing plants is increasing the application of fiber laser cutting solutions and simultaneously boosting the market growth in the European region.

In case of COVID-19, Europe is among the worst-hit regions by the pandemic specially Russia. The region represents one of the largest automotive market across the globe. However, the COVID-19 pandemic has slowed down the production of automobiles which has negatively impacted the growth of the fiber laser market in the region. During the pandemic, Germany, Italy, France, the UK, and Ireland have witnessed a huge revenue decline from their manufacturing industries. Also, the COVID-19 has adversely impacted the airline services, which has caused a sudden drop in the aircraft manufacturing due to non-operating of passenger airline services across the world. Moreover, Due to partial cargo transport operations, it has caused disruptions in the supply of raw materials, owing to the limitations in cross-border movements over the first quarter of 2020, thereby triggering supply delays and massive fallouts in production. Hence, the COVID-19 pandemic has had a negative impact on the region’s manufacturing sector, which has also adversely impacted to the fiber laser market in Europe.

Strategic insights for the Europe Fiber Laser provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

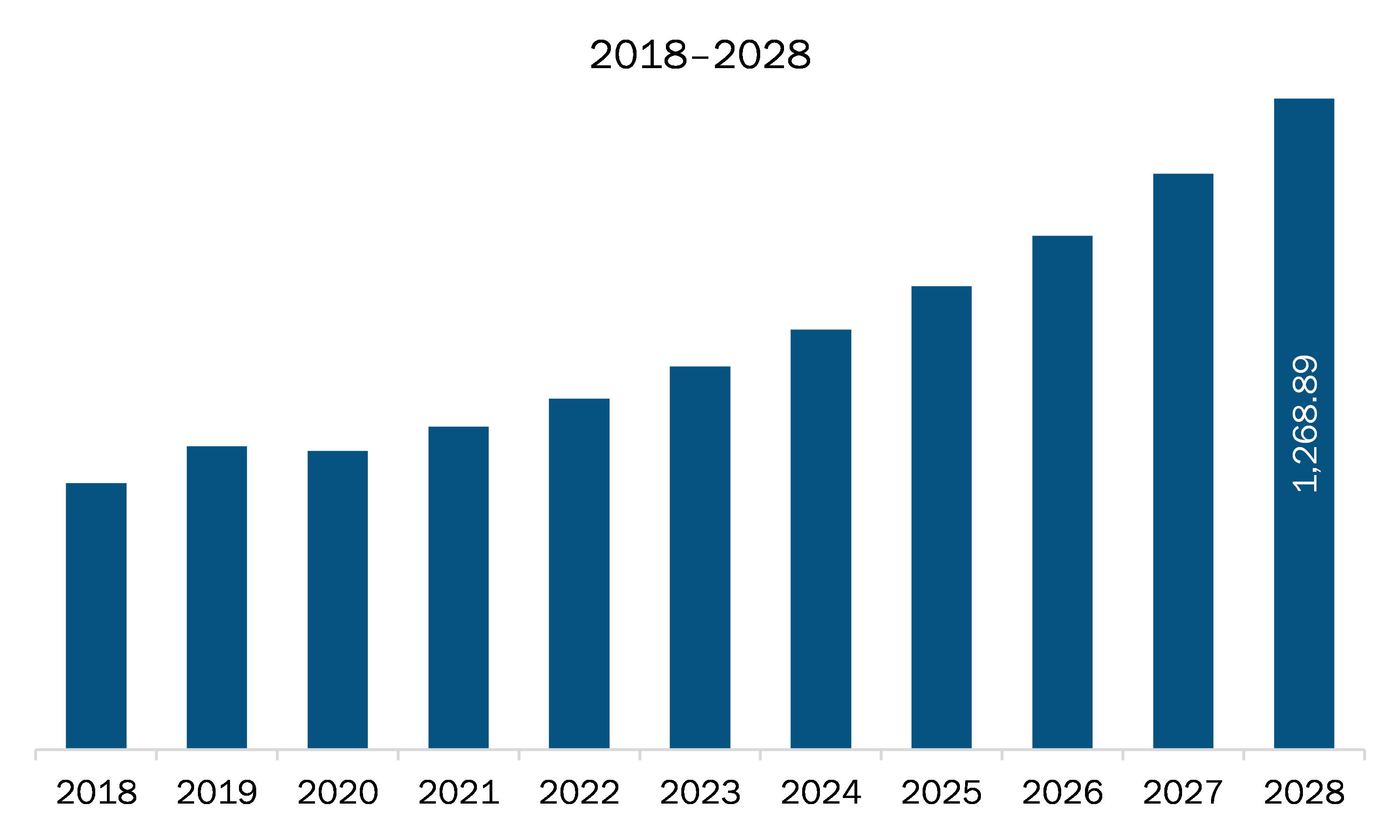

| Market size in 2021 | US$ 629.14 Million |

| Market Size by 2028 | US$ 1,268.89 Million |

| Global CAGR (2021 - 2028) | 10.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Fiber Laser refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe fiber laser market is expected to grow from US$ 629.14 million in 2021 to US$ 1,268.89 million by 2028; it is estimated to grow at a CAGR of 10.5% from 2021 to 2028. With the growing end-use industries across the region, there is a continuous need of fiber lasers in industries to accomplish high level of product quality, which is boosting the demand for fiber lasers. Fiber lasers are being employed in several industries such as manufacturing, aerospace, automotive, and semiconductor & electronics for applications such as marking, engraving, printing, welding, and cutting. For example, ultraviolet (UV) fiber lasers are used for marking on white plastics and cabling in electronics and aerospace industries. Further, the UV fiber lasers are increasingly adopted for precise cutting and marking of brittle materials, owing to ease of integration, high performance, and precise tuning. Owing to the growing need for optimization of resources, manufacturers are exploring various options to streamline their manufacturing and distribution operations. Manufacturers are getting inclined toward the adoption of automation solutions for the optimization of business resources. Industrial automation uses various robots and advanced information technologies to carry out various manufacturing and distribution processes. High productivity, high output quality, flexibility, information accuracy, and safety are among the major advantages of industrial automation. The rise of industrial automation, coupled with the advent of new technologies such as computer numerical control (CNC), computer-aided manufacturing (CAM), and fiber laser technology, is subsequently fueling the adoption of fiber lasers in multiple industries. Thus, surge in demand for fiber lasers in different industries and emergence of industrial automation are likely to encourage the future growth of the Europe fiber laser market.

In terms of type, the infrared fiber laser segment accounted for the largest share of Europe fiber laser market in 2020. In terms of application, the high power cutting and welding segment held a larger market share of the Europe fiber laser market in 2020.

A few major primary and secondary sources referred to for preparing this report on Europe fiber laser market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Active Fiber Systems GmbH; Coherent, Inc.; Convergent Photonics; Fujikura Ltd.; IPG Photonics Corporation; Jenoptik AG; Maxphotonics Co,.Ltd; nLIGHT, Inc.; TRUMPF GmbH + Co. KG; and Wuhan Raycus Fiber Laser Technologies Co., Ltd.

The Europe Fiber Laser Market is valued at US$ 629.14 Million in 2021, it is projected to reach US$ 1,268.89 Million by 2028.

As per our report Europe Fiber Laser Market, the market size is valued at US$ 629.14 Million in 2021, projecting it to reach US$ 1,268.89 Million by 2028. This translates to a CAGR of approximately 10.5% during the forecast period.

The Europe Fiber Laser Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Fiber Laser Market report:

The Europe Fiber Laser Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Fiber Laser Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Fiber Laser Market value chain can benefit from the information contained in a comprehensive market report.