The European region comprises Germany, France, Italy, the UK, Switzerland, and the Rest of Europe. Sweden, the Netherlands, and Belgium, among others, are considered under the Rest of Europe region. The fashion retail industry in the European region is one of the crucial sectors. In 2019, the region showed promising results for tech investments in Europe as, despite the UK and EU economic slowdowns; European tech continued to break records. Furthermore, economically strong countries, such as the UK, Italy, and Spain, are observing significant development in the implementation of express delivery solutions for the optimization of supply chains across various end-user sectors, such as pharmaceuticals, retail and e-commerce, automobile, and food & beverages, across the region. E-commerce and online retail are key drivers for the surge in demand for express delivery or same-day delivery. The global warehouse and storage market in Europe grows annually by 2–3% due to the growth in online retail and e-commerce sectors. In the past 3 years, industrial warehousing properties recorded healthy demand from investors due to huge returns of about 8.5% over other assets.

The impact of COVID-19 differed from country to country across the European region as selected countries witnessed an increase in the number of recorded cases and subsequently attracted strict as well as longer lockdown periods or social isolation. However, Western European countries such as France, Russia, the United Kingdom, Italy, Germany and others have seen a comparatively modest decrease in their growth activities because of the strong healthcare system. In order to protect its citizens from the virus, the European government has made tremendous investments in incorporating technologies in its healthcare systems to help identify signs of the virus. Due the sudden outbreak of the corona virus and lockdown across almost major countries in the Europe, the region has observed a drop in courier and parcel services. The closedown of all activities including ecommerce has slowed down the adoption of express delivery services across the market. The healthcare sector has been continuously using the services even during the temporary closedown phase to ensure availability of medicines and hospitals supplies across the region. Thus, the above mentioned factors implies a negative impact on the express delivery market due to COVID-19.

Strategic insights for the Europe Express Delivery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

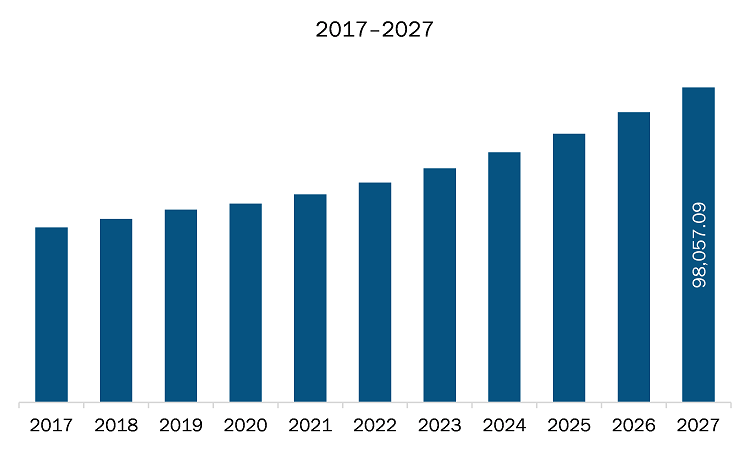

| Market size in 2020 | US$US$ 61,898.13 Million |

| Market Size by 2027 | US$ 98,057.09 Million |

| Global CAGR (2020 - 2027) | 6.8% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Destination

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Express Delivery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The express delivery market in Europe is expected to grow from US$ 98,057.09 million by 2027 from US$ 61,898.13 million in 2020. The market is estimated to grow at a CAGR of 6.8% from 2020 to 2027. High adoption of express delivery has been observed across major essential sectors—such as food & beverages and healthcare—in all major economies worldwide. The demand from global population to receive the items to be delivered in the same day or to be delivered maximum in a day’s time has increased over the years. For instance, the demand for same day deliveries from the population for groceries is about 64%, healthcare products are 46%, specialty snacks are 42%, alcohol is 41%, and other household products is 28%. The highest adoption is noticed across the healthcare sector. In healthcare, proper prioritization reduces misery and saves lives. There must be access to high-tech medical devices and work around the clock, all year round. It is essential to deliver critical samples and medicines on time, without being tempered in the process of transportation. In the healthcare sector, high demands for quality, availability, accuracy, and cost control place similarly high expectations on logistic solutions. Thus, the above-mentioned factors are likely to influence the growth of the Europe express delivery market during the forecast period.

Europe express delivery market is segmented based on destination, business type, and end users Based on destination, the Europe express delivery market based on destination is segmented into domestic and international. The domestic segment accounted for the highest share in the market in 2019 and international segment is expected to be fastest growing during forecast period. Based on business type, is segmented into B2B and B2C. The B2B segment accounted for the highest share in 2019 and B2C sector is expected to be the fastest growing during forecast period. Based on end-user, the market is segmented into automotive, retail and e-commerce, pharmaceuticals, BFSI, IT and telecom, electronics, and others. The automotive segment accounted for the highest share in 2019 and retail and automotive sector is expected to be the fastest growing during forecast period

A few major primary and secondary sources referred to for preparing this report on express delivery market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amazon.com, Inc.; Aramex; DHL International GmbH; FedEx Corporation; koninklijke Postnl

The Europe Express Delivery Market is valued at US$US$ 61,898.13 Million in 2020, it is projected to reach US$ 98,057.09 Million by 2027.

As per our report Europe Express Delivery Market, the market size is valued at US$US$ 61,898.13 Million in 2020, projecting it to reach US$ 98,057.09 Million by 2027. This translates to a CAGR of approximately 6.8% during the forecast period.

The Europe Express Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Express Delivery Market report:

The Europe Express Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Express Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Express Delivery Market value chain can benefit from the information contained in a comprehensive market report.