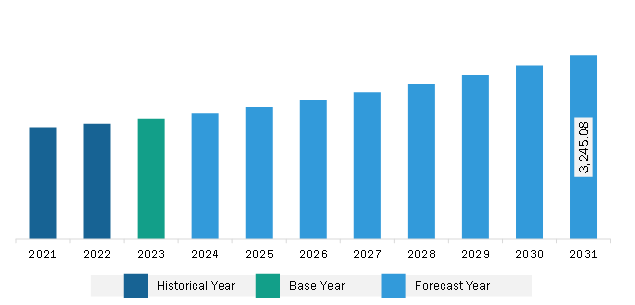

The Europe explosion proof equipment market was valued at US$ 2,122.33 million in 2023 and is expected to reach US$ 3,245.08 million by 2031; it is estimated to register a CAGR of 5.5% from 2023 to 2031.

During the initial stages of LED lights, the LED solutions were expensive. Over the years, manufacturers have developed innovative and cost-effective technologies in order to lower the price of LED solutions. Increasing awareness of energy efficiency among end users and growing government regulations restricting certain energy sources are resulting in additional demand for energy-efficient products. Further, the market is going through a transition from traditional lighting technology systems to connected lighting systems based on user requirements. The shift in the market toward innovative technologies is supporting the LED market growth.

Companies in the market are engaged in launching explosion-proof LEDs. For instance, in January 2023, ARCHON Industries Inc. revealed its new explosion-proof light: EX20-100. The company indicated that the EX20-100 luminaire is designed to continuously illuminate process vessels, tanks, distillation columns, and other industrial items in hazardous and nonhazardous areas. Built with a high-power CREE COB LED and a proven LED driver for ultimate reliability, EX20-100 provides high-grade optics for exceptional performance.

Moreover, as easy availability and energy efficiency are the key benefits of explosion-proof LED lighting its demand is increasing in the market. Additionally, these lighting systems come with simpler maintenance requirements compared to fluorescent and other conventional lighting solutions. The increasing awareness of energy efficiency among end users and stringent regulations imposed by governments to favor certain energy sources propel the demand for energy-efficient products. The demand for lighting systems is rapidly evolving from traditional lighting technology to connected lighting systems with the surging popularity of handheld lighting. Thus, considering the above factors, the increasing use of explosion-proof LED lights is driving the Europe explosion-proof equipment market growth globally.

The explosion-proof equipment market in Europe is segmented into the UK, Germany, Italy, France, Russia, Austria, Switzerland, and the Rest of Europe. The explosion-proof equipment market in the region is expected to grow because of the growth of the mining industry. Initially, there were several mining industries present in the region, including Complexul Energetic Oltenia, Leonhard Nilsen & Sonner, Czech Coal, Hellenic Copper Mines, Boliden, and JP Elektroprivreda BiH. Additionally, the pharmaceutical industry plays a significant role in the healthcare sector, as it is known for the production, development, and distribution of medications and drugs. This industry thrives in Europe, contributing significantly to the region’s economic growth. As countries invest more in their healthcare systems, there is a higher demand for pharmaceutical products and services. For instance, in May 2024, Pfizer and AstraZeneca announced new investments in France worth nearly US$ 1 billion to build up their research and development work in the country. This has created a favorable environment for companies to develop and introduce new medications, pharmaceutical drugs, and treatments. Pharmaceutical drugs are produced through mixing, emulsifying, filtration, distillation, etc, and chemical reactions of organic and inorganic compounds may generate potentially explosive atmospheres. Due to this, the demand for the explosion-proof equipment is increasing in the market. The need for explosion-proof equipment is important in these hazardous areas as this equipment helps maintain the safety of workers and the operators in the factories. Therefore, industries such as mining and pharmaceutical are implementing explosion-proof equipment to maintain the safety of the operators and workers. Furthermore, the water and wastewater industry is taking flight in Europe. The government in the region is investing in the water and wastewater plant. For instance, in March 2023, the European Investment Bank (EIB) signed a US$ 76.32 million EU investment grant with the government of North Macedonia to build a wastewater treatment plant in Skopje.

This is the largest EU investment grant allocated to the country under the Western Balkans Investment Framework (WBIF). As the water and wastewater treatment produce flammable gases such as methane, explosion-proof equipment helps to prevents ignition, reducing the risk of explosion in these hazardous environments, which is fueling the growth of the market in the region. Europe has many manufacturers of explosion-proof equipment, including ABB Ltd, BARTEC Group, Cortem S.p.A., Eaton Corporation plc, Extronics Ltd, R. STAHL AG, and Siemens AG. The presence of well-known explosion-proof equipment market players in the region is fueling the growth of the market.

Strategic insights for the Europe Explosion-Proof Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Explosion-Proof Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Explosion-Proof Equipment Strategic Insights

Europe Explosion-Proof Equipment Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,122.33 Million

Market Size by 2031

US$ 3,245.08 Million

Global CAGR (2023 - 2031)

5.5%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Systems

By Protection Method

By Industry

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Explosion-Proof Equipment Regional Insights

The Europe explosion proof equipment market is categorized into systems, protection method, industry, and country.

Based on systems, the Europe explosion proof equipment market is segmented into junction boxes and enclosures, lighting system, monitoring system, signaling devices, automation system, cable glands, HVAC systems, and others. the cable glands segment held the largest market share in 2023. The monitoring system segment is further sub segmented into cameras, data loggers, sensors, and others.

In terms of protection method, the Europe explosion proof equipment market is segmented into explosion prevention, explosion containment, and explosion segregation. The explosion prevention segment held the largest market share in 2023.

By industry, the Europe explosion proof equipment market is segmented into oil and gas, manufacturing, mining, chemical and petrochemical, energy and power, pharmaceutical, water and wastewater management, and others. The mining segment held the largest market share in 2023.

By country, the Europe explosion proof equipment market is segmented into Germany, the UK, France, Italy, Russia, Austria, Switzerland, and the Rest of Europe. Germany dominated the Europe explosion proof equipment market share in 2023.

ABB Ltd; Cortem S.p.A.; Emerson Electric Co; Pepperl+Fuchs SE; Honeywell International Inc; Xylem Inc.; OMEGA Engineering, Inc.; BARTEC Top Holding GmbH; Rockwell Automation Inc; Siemens AG; Schneider Electric SE; and Detector Electronics, LLC. are some of the leading companies operating in the Europe explosion proof equipment market.

The Europe Explosion-Proof Equipment Market is valued at US$ 2,122.33 Million in 2023, it is projected to reach US$ 3,245.08 Million by 2031.

As per our report Europe Explosion-Proof Equipment Market, the market size is valued at US$ 2,122.33 Million in 2023, projecting it to reach US$ 3,245.08 Million by 2031. This translates to a CAGR of approximately 5.5% during the forecast period.

The Europe Explosion-Proof Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Explosion-Proof Equipment Market report:

The Europe Explosion-Proof Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Explosion-Proof Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Explosion-Proof Equipment Market value chain can benefit from the information contained in a comprehensive market report.