The Europe EV charging cable market is segmented into France, Germany, Italy, the UK, Russia, and the Rest of Europe. Incentives introduced by multiple national governments are expected to drive the growth of the Europe electric vehicle (EV) market in the next five years. Europe has been a fastest region in electric vehicle market: a compound annual growth rate of 60% from 2016 to 2020, compared with increases of 36% in China and 17% in the U.S according to the International Energy Agency (IEA). In the EU's largest market, Germany, several carrot and stick policies have been designed to increase EV demand. Any privately owned EVs registered until the end of 2020 will have a 10-year tax exemption and EVs with a sales price below USD45,300 will qualify for a USD 10,100 subsidy until December 2021. Spain has reduced tax by 75pc for EVs in big cities, such as Madrid and Barcelona. The country also has established a scheme that subsidizes the purchase of EVs by €4,000–5,000, depending on if a vehicle seven years or older is scrapped. In Italy, EVs are tax exempt for five years from registration and get a 75pc reduction in tax after that. Italy also has a bonus-malus scheme. As per the scheme, vehicles are subsidized up to €6,000 per car emitting less than 70g of CO2/km, but penalized by €2,500 per car if they emit above 250g of CO2/km. Such initiatives taken by European countries drive the adoption rate of EVs and eventually fuel the EV charging cable market growth in the region. Increase in EV charging facilities is the major factor driving the growth of the Europe EV charging cable market.

In 2020, the impact of COVID-19 differed from nation to nation across the European region. In the region, major countries which were affected by the pandemic of COVID-19 are the United Kingdom, Italy, Russia, France, Germany, and Spain. Due to increasing number of recorded cases, some of these nations had to impose stringent and longer lockdown along with social isolation in 2020. The lockdown affected electric car sales, but there were early signs of electric vehicle market resilience for two main reasons. First, policy support was strong – in particular in Europe as 2020 was an important target year for emissions standards. Purchase incentives increased, notably in Germany. Second, continued declines in battery costs, upgraded original equipment manufacturer (OEM) offers in both model choice and performance, fleet operators initiating their technology transition and the enthusiasm of electric car buyers (often affluent households less affected by the economic downturn) provided fertile ground for continued EV uptake. But somehow due to COVID-19 pandemic across the globe, the Europe electric vehicle market has been negatively affected as the electric vehicle manufacturing units have been shut down due to the imposed lockdown in major countries across the Europe. In addition, the unavailability of skilled labor has further affected the market growth. In Europe electric vehicles have witnessed a growing trend of acceptance in Europe as charging infrastructure is being improved, the production cost falls, and governments take efforts to bring down the carbon emission generated by the transportation sector. According to the International Council on Clean Transportation report, Europe is now the second-largest electric vehicle market in the world by volume, behind China and ahead of the U.S. This tremendous growth in demand for electric vehicles in Europe is expected to drive the growth of the Europe EV charging cable market over the forecast period.

Strategic insights for the Europe EV Charging Cables provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

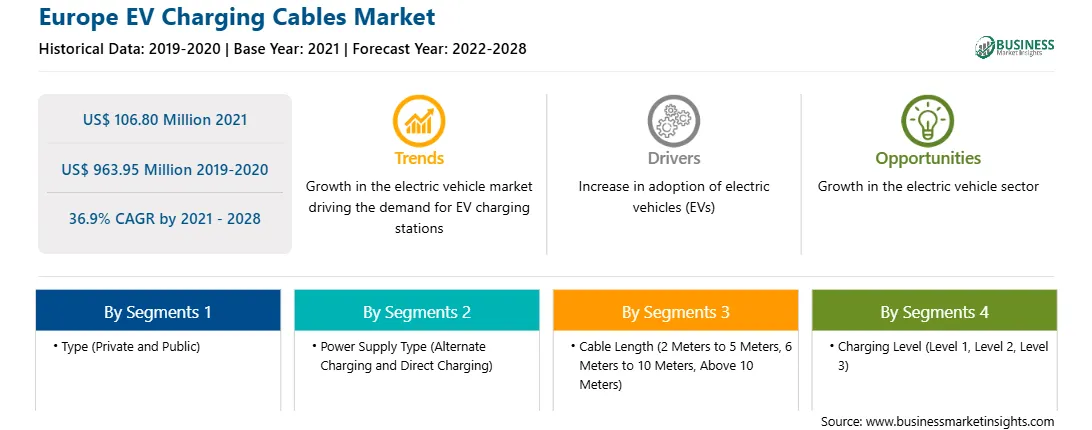

| Market size in 2021 | US$ 106.80 Million |

| Market Size by 2028 | US$ 963.95 Million |

| Global CAGR (2021 - 2028) | 36.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe EV Charging Cables refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The EV charging cables market in Europe is expected to grow from US$ 106.80 million in 2021 to US$ 963.95 million by 2028; it is estimated to grow at a CAGR of 36.9% from 2021 to 2028. Government bodies are focusing on electric mobility or e-mobility with enhanced vehicle safety systems to adapt to the new normal, overcome the economic slowdown, and stabilize the revenue losses caused by the COVID-19 pandemic. E-mobility is also expected to contribute toward balancing the energy demand and environmental sustainability, providing lucrative growth potential and employment generation in this market. The primary factors driving the global EV charging cables market are expanding demand for hybrid and electric vehicles and increasing electrification of vehicles. Stringent emission norms for vehicles are forcing OEMs to manufacture hybrid and electric vehicles to reduce the emission of harmful gases. Electric vehicle adoption stays as a key within automotive market developments and decarbonizing in the transport sector. The government's focus on improving e-mobility adoption will create more demand for EVs. The transition to electrified mobility is the government's main focus for lowering carbon emissions. With government bodies looking ahead to electrify their buses, trains, and other public transportation, the demand for EVs is also increasing. Widespread and reliable public infrastructure would help the EV to hit on roads rapidly. Deployment of EV charging stations at bus depots and railway stations will rise. The presence of such market players will help in is boosting the manufacturing of charging stations for public transportation, is thereby playing a key role in accelerating the growth of EV charging stations.

The Europe EV charging cables market has been segmented based on type, power supply type, cable length, charging level, jacket material, and country. Based on type, the Europe EV charging cables market is segmented into private charging and public charging. The private segment dominated the market in 2020 and public segment is expected to be the fastest growing during the forecast period. Based on power supply type, the market is segmented into alternate charging and direct charging. The alternate charging segment dominated the market in 2020 and direct charging segment is expected to be the fastest growing during the forecast period. Based on cable length, the market is segmented into 2 metres to 5 metres, 6 metres to 10 metres, and above 10 metres. The 2 metres to 5 metres segment dominated the market in 2020 and 6 metres to 10 metres is expected to be the fastest growing during the forecast period. Based on charging level, the EV charging cables market is segmented into level 1, level 2, and level 3. The level 2 dominated the market in 2020 and level 3 segment is expected to be the fastest growing during the forecast period. In terms of jacket material, the EV charging cables market is segmented into all-rubber jacket, thermoplastic elastomer jacket, polyvinyl chloride jacket. All rubber segment dominated the market in 2020 and segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on EV charging cables market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aptiv PLC; Coroplast Group; General Cable Technologies Corporation; Phoenix Contact E-Mobility; SINBON Electronics Co., Ltd.; and TE Connectivity Corporation are among others.

The Europe EV Charging Cables Market is valued at US$ 106.80 Million in 2021, it is projected to reach US$ 963.95 Million by 2028.

As per our report Europe EV Charging Cables Market, the market size is valued at US$ 106.80 Million in 2021, projecting it to reach US$ 963.95 Million by 2028. This translates to a CAGR of approximately 36.9% during the forecast period.

The Europe EV Charging Cables Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe EV Charging Cables Market report:

The Europe EV Charging Cables Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe EV Charging Cables Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe EV Charging Cables Market value chain can benefit from the information contained in a comprehensive market report.