A condition that affects fewer than 200,000 people nationwide is termed as orphan disease. Fabry's disease, Pompe disease, and Hunter syndrome are among a few examples. European Medicines Agency (EMA) deals with approving orphan drugs. For instance, according to EMA, if a product that has an orphan drug designation receives EMA marketing approval for the indication, the product is entitled to orphan market exclusivity; this means the EMA may not approve any other application to market a similar drug for the same indication for 10 years. Furthermore, in March 2016, the EMA launched the Priority Medicines ("PRIME") scheme to facilitate the development of product candidates in indications for which few or no therapies currently exist. The PRIME scheme also provides several benefits to drug producers once a candidate medicine is selected. Below mentioned are the benefits provided by the EMA:

• Appoints a rapporteur from the Committee for Medicinal Products for Human Use (CHMP) and help to build knowledge ahead of a marketing-authorization application

• Early and proactive regulatory dialogue with the EMA to guide the overall development plan and regulatory strategy

• Offers scientific advice at key development milestones, involving additional stakeholders, such as health-technology-assessment bodies, to facilitate quicker access for patients to the new medicine

• Confirms potential for accelerated assessment at the time of an application for marketing authorization

Therefore, owing to the benefit and incentives associated with drugs designated as orphan drugs, key players operating in the market are putting efforts into developing drugs for orphan diseases. For instance, Amicus Therapeutics, Inc. recently obtained an orphan medicinal product designation in Europe from the EMA for Galafold to treat Fabry disease and the combination product—ATB200/AT2221—for treating Pompe disease. Additionally, in September 2020, Amicus Therapeutics, Inc. was granted PRIME designation for AT-GTX-501 for the treatment of CLN6 or Batten disease. Thus, the rapid regulatory approval with other marketing benefits for the drug with orphan drug designation is driving the market growth.

The Europe enzyme replacement therapy market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. Germany is considered among the fastest-growing enzyme replacement therapy markets in Europe. The growing importance of enzyme replacement therapy is due to rising healthcare expenditure, which is aiding the market growth in Germany. The federal statistical office reported an increase in the health expenditure in Germany, which aids in research and development in the healthcare sector. For instance, in April 2022, the Federal Statistical Office (Destatis) confirmed that health spending in 2020 was 26.8 billion euros, or 6.5% higher than in 2019. Moreover, according to German Trade and Invest (GTAI), on average, more than 710 companies are engaged in the biotechnology sector. Germany has experienced a boom in innovative pharmaceutical companies, drug manufacturers, contract research organizations (CROs), and small-medium-sized biopharmaceutical companies over the years. In February 2020, as per the paper “Developments in the treatment of Fabry disease” published in Wiley Online Library, a new form of ERT- moss-aGal, for the treatment of Fabry Disease (FD) was developed by Greenovation biopharmaceuticals, in Germany. Moreover, the rising government health expenditure and increasing biotechnology and pharmaceutical companies are boosting the enzyme replacement therapy market, which is also boosting the growth of the Europe enzyme replacement therapy market.

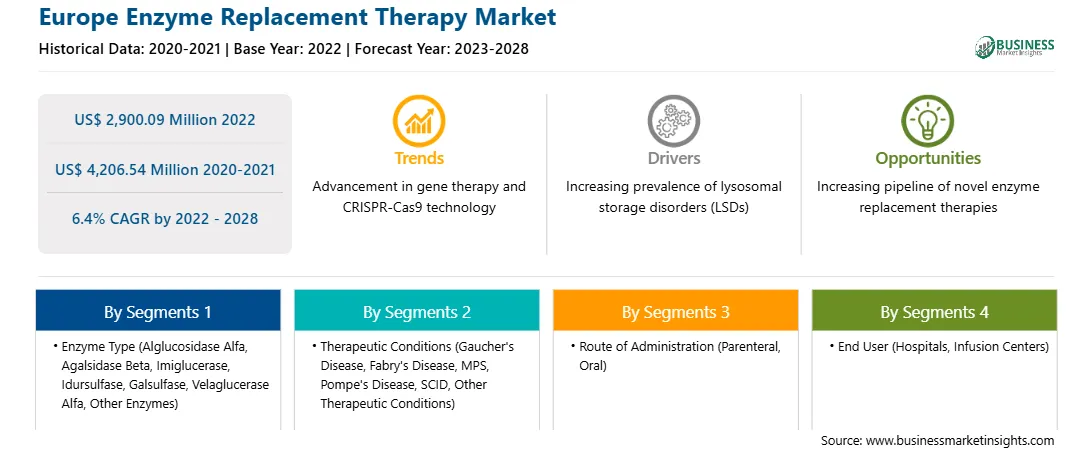

Strategic insights for the Europe Enzyme Replacement Therapy provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,900.09 Million |

| Market Size by 2028 | US$ 4,206.54 Million |

| Global CAGR (2022 - 2028) | 6.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Enzyme Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Enzyme Replacement Therapy refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe enzyme replacement therapy market is segmented into enzyme type, therapeutic conditions, route of administration, end user, and country.

By therapeutic conditions, the market is segmented into Gaucher's disease, Fabry's disease, MPS, Pompe's disease, SCID, and other therapeutic conditions. The Gaucher's disease segment held the largest market share in 2022.

In terms of route of administration, the market is bifurcated into parenteral and oral. The parenteral segment held a larger market share in 2022.

From end user point of reference, the market is segmented into hospitals, infusion centers, and others. The hospitals segment held the largest market share in 2022.

Sanofi; BioMarine Pharmaceutical Inc; Takeda Pharmaceutical Company Limited; AbbVie Inc; Janssen Pharmaceutical (Johnson & Johnson Services, Inc.); Alexion Pharmaceutical, Inc. (AstaZeneca); Amicus Therapeutics; Recordati S.p.A; Recordati S.p.A; CHIESI farmaceutici S.p.A; and Pfizer Inc are the leading companies operating in the enzyme replacement therapy market in Europe.

The Europe Enzyme Replacement Therapy Market is valued at US$ 2,900.09 Million in 2022, it is projected to reach US$ 4,206.54 Million by 2028.

As per our report Europe Enzyme Replacement Therapy Market, the market size is valued at US$ 2,900.09 Million in 2022, projecting it to reach US$ 4,206.54 Million by 2028. This translates to a CAGR of approximately 6.4% during the forecast period.

The Europe Enzyme Replacement Therapy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Enzyme Replacement Therapy Market report:

The Europe Enzyme Replacement Therapy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Enzyme Replacement Therapy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Enzyme Replacement Therapy Market value chain can benefit from the information contained in a comprehensive market report.