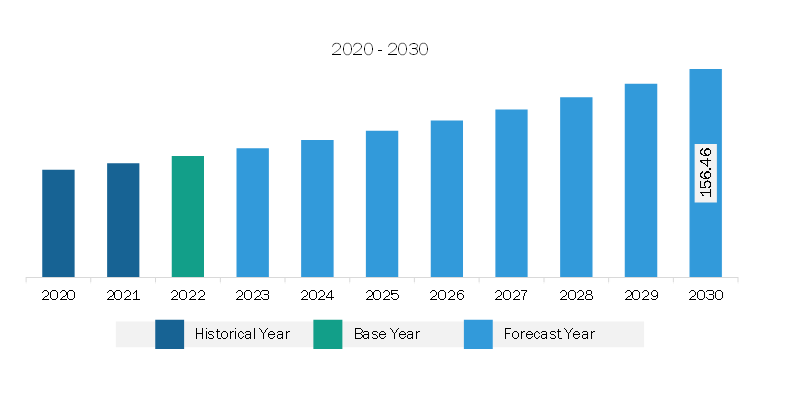

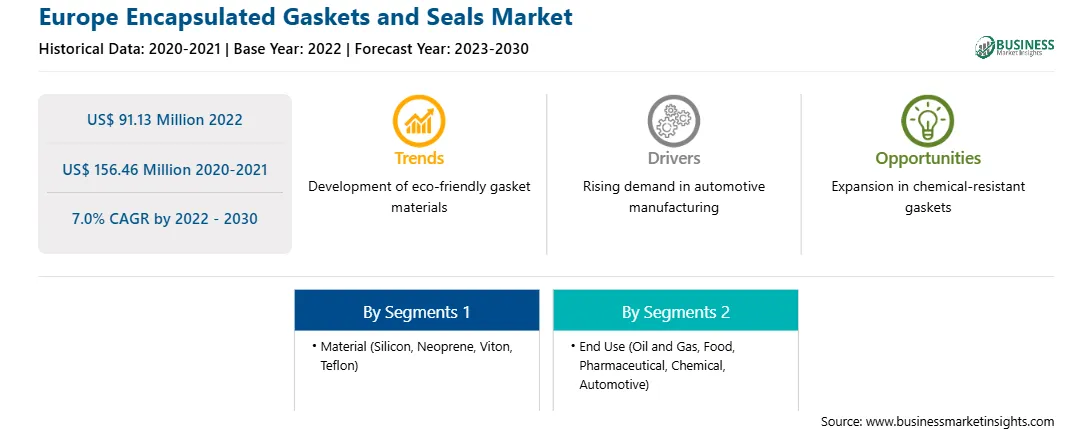

The Europe encapsulated gaskets and seals market was valued at US$ 91.13 million in 2022 and is expected to reach US$ 156.46 million by 2030; it is estimated to register a CAGR of 7.0% from 2022 to 2030.

The chemicals industry stands as a cornerstone of industrial development, encompassing a vast array of processes involved in the production, transformation, and handling of various chemicals. As a critical sector with diverse applications, the chemical industry places stringent demand on equipment and components to ensure safety, efficiency, and regulatory compliance. Encapsulated gaskets and seals play a vital role in meeting these challenges, serving as essential components that contribute to the integrity and reliability of chemical processing equipment. In the chemical industry, where precision and containment are paramount, the choice of sealing solutions is pivotal. Encapsulated gaskets and seals provide a robust defense against the corrosive and aggressive nature of many chemicals involved in industrial processes.

As the chemical industry continues to expand in developed and developing economies, there is an increasing need for reliable sealing solutions that can withstand the harsh and corrosive nature of many chemicals. Encapsulated gaskets and seals provide an effective barrier, preventing the escape of hazardous materials and ensuring the safety of both the processes and personnel. The chemical resistance of materials such as PTFE, commonly used in encapsulated seals, makes them particularly suitable for applications in this demanding industry. Moreover, the chemical industry strongly emphasizes regulatory compliance and adherence to safety standards. Encapsulated gaskets and seals contribute to meeting these stringent requirements and offer benefits such as reduced maintenance needs and increased equipment reliability. This becomes especially crucial in preventing costly downtime and minimizing the risk of environmental contamination or accidents. Thus, the chemical industry relies heavily on encapsulated gaskets and seals to ensure the integrity and safety of its processes. The symbiotic relationship between the chemical industry and the manufacturers of sealing solutions underscores the pivotal role of encapsulated gaskets and seals in supporting the growth, efficiency, and sustainability of this critical sector.

The encapsulated gaskets and seals market in Europe is majorly driven by a combination of technological advancements, stringent regulatory standards, and the region's robust industrial infrastructure. These specialized components play a crucial role in preventing leaks and ensuring the integrity of mechanical systems across various sectors, including automotive, chemical, pharmaceutical, and oil & gas.

The increasing demand for high-performance and durable sealing solutions in critical applications drives the demand for encapsulated gaskets and seals in Europe. The automotive industry, in particular, is increasingly adopting these solutions due to the need for reliable seals in engines, transmissions, and other vital components. As per the European Commission, Europe is the biggest manufacturer of motor vehicles worldwide. The automobile industry directly and indirectly employs ?13.8 million people, resulting in 6.1% of overall employment in the European Union (EU). As per the International Organization of Motor Vehicle Manufacturers (OICA), the EU produced 16.2 million vehicles in 2022. Additionally, the emphasis on environmental sustainability has led to a growing preference for encapsulated gaskets that offer enhanced resistance to harsh chemicals and extreme temperatures.

Stringent regulatory standards regarding emissions and safety in Europe have further fueled the market as manufacturers strive to meet and exceed these requirements. The pharmaceutical and food processing industries also contribute to the demand for encapsulated gaskets and seals, given the stringent hygiene and contamination control measures in these sectors. Further, market players in Europe are actively investing in research and development to introduce innovative materials and designs, catering to the evolving needs of diverse industries. The competitive landscape is characterized by collaborations and strategic partnerships to expand product portfolios and geographic reach.

Strategic insights for the Europe Encapsulated Gaskets and Seals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 91.13 Million |

| Market Size by 2030 | US$ 156.46 Million |

| Global CAGR (2022 - 2030) | 7.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Encapsulated Gaskets and Seals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe encapsulated gaskets and seals market is categorized into material, end use, and country.

Based on material, the Europe encapsulated gaskets and seals market is segmented into silicon, neoprene, Viton, Teflon, and others. The Viton segment held the largest market share in 2022.

Based on end use, the Europe encapsulated gaskets and seals market is segmented into oil and gas, food, pharmaceutical, chemical, automotive, and others. The oil and gas segment held the largest market share in 2022.

By country, the Europe encapsulated gaskets and seals market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Russia dominated the Europe encapsulated gaskets and seals market share in 2022.

AS Aston Seals SPA, Gasco Inc, MCM SPA, Polymax Ltd, Trelleborg AB, VH Polymers, and Vulcan Engineering Ltd are some of the leading companies operating in the Europe encapsulated gaskets and seals market.

The Europe Encapsulated Gaskets and Seals Market is valued at US$ 91.13 Million in 2022, it is projected to reach US$ 156.46 Million by 2030.

As per our report Europe Encapsulated Gaskets and Seals Market, the market size is valued at US$ 91.13 Million in 2022, projecting it to reach US$ 156.46 Million by 2030. This translates to a CAGR of approximately 7.0% during the forecast period.

The Europe Encapsulated Gaskets and Seals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Encapsulated Gaskets and Seals Market report:

The Europe Encapsulated Gaskets and Seals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Encapsulated Gaskets and Seals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Encapsulated Gaskets and Seals Market value chain can benefit from the information contained in a comprehensive market report.