Market Introduction

The Europe embolization agents market includes the consolidated markets for Germany, France, UK, Spain, Italy, and rest of Europe. Europe occupies a significant position in the global embolization agents market and is estimated to register a robust growth rate over the forecast period. The market growth in the region is expected due to aging population, increasing prevalence of cancers and brain aneurysms, and rising numbers of product launches are likely to be the major factors driving the growth of this market in the Europe. Brain aneurysms may further lead to bleeding in the brain which is known as hemorrhagic stroke. The prevalence of stroke in Germany has been recorded during the recent years. As per the data published in The Burden of Stroke in Europe report conducted by King’s College London for the Stroke Alliance for Europe, the incidence of stroke is around 88,922 cases of stroke, which is 51.7 strokes per 100,000 inhabitants annually in Germany. The prevalence of stroke in Germany was around 526,774, accounting for 338.5 strokes per 100,000 inhabitants. The country also has a significant mortality rate of stroke, i.e., 75,861 deaths due to stroke per year. Estimates reveal, the incidence of strokes in Germany is expected to increase by 30% by the end of 2035. Also, the prevalence and mortality rates are expected to rise to 19% and 40%, respectively by 2035. Some of the prevalent risk factors leading to stroke are, high blood pressure, smoking, high cholesterol, and raised glucose level. Market players in the country are also focusing on launch of innovative products. Such developments are also projected to accelerate market growth. For instance, in April 2020, Phenox GmbH, a pioneer of innovative technologies for neurovascular diseases, launched the new p64 MW Flow Modulation Device. The p64 MW Flow Modulation device, a next-generation stent-like device and is intended to divert blood flow away from the aneurysm

In Europe, Italy, Spain, and France have reported the highest number of COVID-19 cases. According to the European Centre for Disease Prevention and Control (ECDC), as of June 2021, Europe has registered 736,553 deaths so far due to COVID-19. Countries across Europe are witnessing a resurgence in COVID-19 cases after successfully mitigating outbreaks early in the year. Many countries are declaring more cases each day than the daily case count reported during the first wave of the pandemic. As per the ECDC, lockdowns are being reintroduced in the UK, Spain, Italy, and Ireland. Moreover, many country governments are working towards boosting up their cell therapy, gene therapy, and regenerative medicine capabilities. Additionally, in the UK, the practice of cancer and neurological diseases has changed. Increasing COVID-19 has affected the diagnosis and treatment of diseases, due to the diversification of the medical workforce and decision to focus on treating the critically ill. Many research organizations are focusing more on COVID studies and are working hard to better understand the virus. The European Academy of Neurology (EAN) has launched a survey on neurological symptoms in COVID-19 patients to better understand the neurological manifestations of the disease. Thus, the growing focus on SARS-CoV-2 has limited the Europe embolization agents market growth in the last two years.

Strategic insights for the Europe Embolization Agents provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Embolization Agents refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Embolization Agents Strategic Insights

Europe Embolization Agents Report Scope

Report Attribute

Details

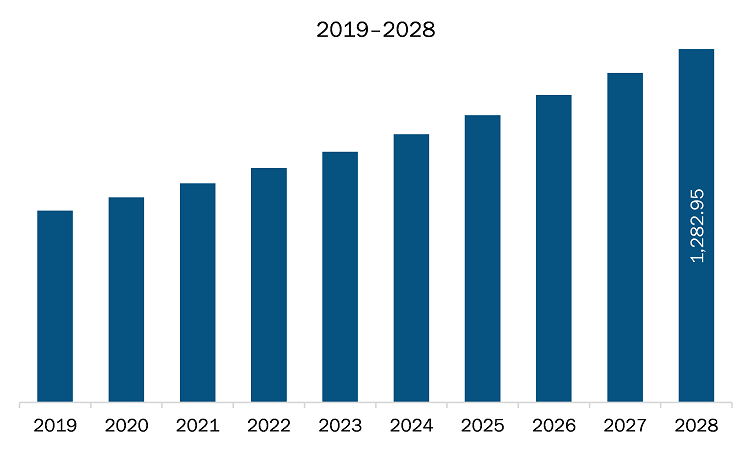

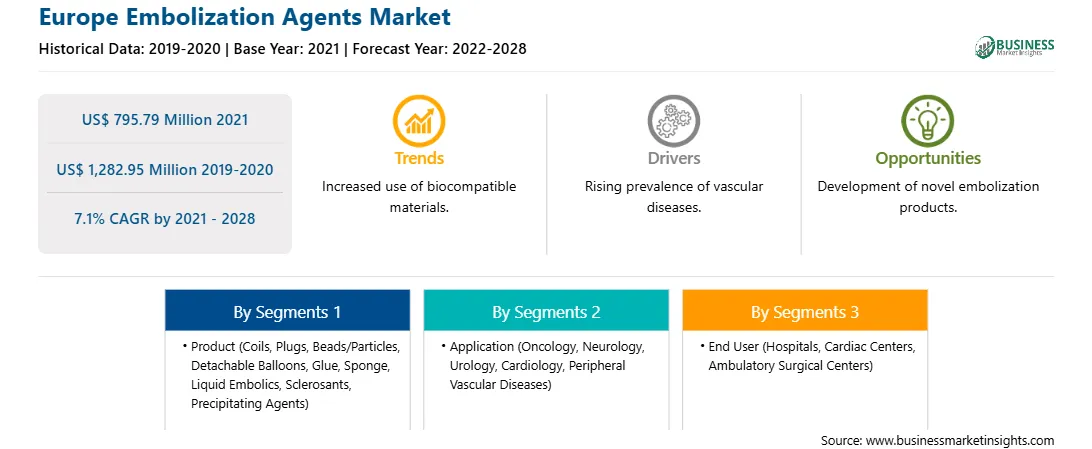

Market size in 2021

US$ 795.79 Million

Market Size by 2028

US$ 1,282.95 Million

Global CAGR (2021 - 2028)

7.1%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Product

By Application

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Embolization Agents Regional Insights

Market Overview and Dynamics

The embolization agents market in Europe is expected to grow from US$ 795.79 million in 2021 to US$ 1,282.95 million by 2028; it is estimated to grow at a CAGR of 7.1% from 2021 to 2028. In September 2021 Medtronic embolization device hit with another Class I recall detached coils. FDA has classified another recall of Medtronic's Pipeline Flex embolization device for treating brain aneurysms as a Class I event after receiving reports of 59 malfunctions, 10 serious injuries and two deaths. In July 2021 Terumo Introduces New AZUR Vascular Plug and PG Pro Peripheral Microcatheter Embolization System the first and only plug compatible with a microcatheter and capable of occluding arteries up to 8mm in diameter. The newest addition to Terumo's extensive embolization portfolio is recommended for use in arteries of the peripheral vasculature to limit or stop blood flow. Further, in May 2021, Shanghai MicroPort NeuroTech Co., Ltd. received CE approval from the European Union for its Numen Coil Embolization System (Numen) and Numen FR Coil Detachment System (Numen FR). These are used for coil embolization procedures for the treatment of intracranial aneurysm. The company focuses on research and development activities to develop innovative solutions on cerebrovascular and neuro interventions. Additionally, in December 2020, Terumo Corporation launched WEB Embolization System (Product name in Japan: Woven EndoBridge Device), an intrasaccular aneurysm treatment device, in Japan. The WEB device is an innovative intrasaccular flow disruptor device and provides new treatment options for brain aneurysm cases. Such advancements based on modern technologies are likely to introduce new future trends in the Europe embolization agents market the coming years.

Key Market Segments

Based on product, the market is segmented into coils, beads/particles, plugs, detachable balloons, glue, sponge, liquid embolics, sclerosants, precipitating agents, others. The beads/particles segment held the largest share of the market in 2020. Based on coils the market is divided into detachable coils and pushable coils. The pushable coils segment held the largest share of the market in 2020. Based on beads/particles the market is divided into spherical and non-spherical. The pushable non-spherical segment held the largest share of the market in 2020. Based on application, the market is segmented into neurology, oncology, cardiology, peripheral vascular diseases, and others. In 2020, the oncology segment is likely to hold the largest share of the market. The embolization agents market by end user, is segmented into hospitals, ambulatory surgical centers, cardiac centers, and others. The hospitals segment held the largest share of the market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the embolization agents market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Abbott; Boston Scientific Corporation; Cook Medical LLC; DePuy Synthes; KANEKA CORPORATION; Medtronic; Merit Medical Systems Inc; Penumbra, Inc.; Stryker Corporation; and Terumo Corporation among others.

Reasons to buy report

EUROPE EMBOLIZATION AGENTS MARKET SEGMENTATION

By Country

Company Profiles

The Europe Embolization Agents Market is valued at US$ 795.79 Million in 2021, it is projected to reach US$ 1,282.95 Million by 2028.

As per our report Europe Embolization Agents Market, the market size is valued at US$ 795.79 Million in 2021, projecting it to reach US$ 1,282.95 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The Europe Embolization Agents Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Embolization Agents Market report:

The Europe Embolization Agents Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Embolization Agents Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Embolization Agents Market value chain can benefit from the information contained in a comprehensive market report.