Europe comprises various well-established economies, such as France, Germany, Russia, the UK, and Italy, with powerful military forces. To further empower them, governments of these countries invest a significant amount in military technologies, such as drone simulators. According to SIPRI data, Germany, France, Italy, the UK, and Russia spent US$ 52,765 million, US$ 52,747 million, US$ 28,921 million, US$ 59,238 million, and US$ 61,713 million, respectively, in military operations in 2020. In addition, increasing initiatives promoting the adoption of advanced technologies bolster the growth of the drone simulator market in European countries. Moreover, France, one of the members of NATO, is raising its budget to push defense spending to about 2% of the GDP. Further, the ongoing geopolitical tensions in the region, mainly due to Russia, is expected to create a strong demand for drone simulator in the coming years.

In Europe, the COVID-19 pandemic has a different impact on different countries, as only selective countries have witnessed the rise in the number of cases and subsequently attracted strict, as well as prolonged, lockdown periods or social isolation norms. However, Western European countries such as Germany, France, Russia, and the UK have seen a comparatively modest decrease in their growth activities because of their strong healthcare systems. These countries have been investing significantly to make the diagnosis and treatment of the disease more effective and less time-consuming. According to the Centre for Strategic and International Studies (CSIS), military spending in in European countries is likely to decrease amid the global financial crisis caused by COVID-19. According to CSIS, France, the UK, and Germany pay for a substantial portion of Europe's overall military budget, and these countries are likely to bring down their military budget allocations in 2021 due to macroeconomic situations. For instance, Germany has proposed a cut in defense spending from US$ 20.3 billion in 2020 to US$ 18.7 billion in 2024, which is likely to stymie military modernization and other armament programs. As a result, the drone simulator industry in Europe is likely to struggle in the coming years.

Strategic insights for the Europe Drone Simulator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

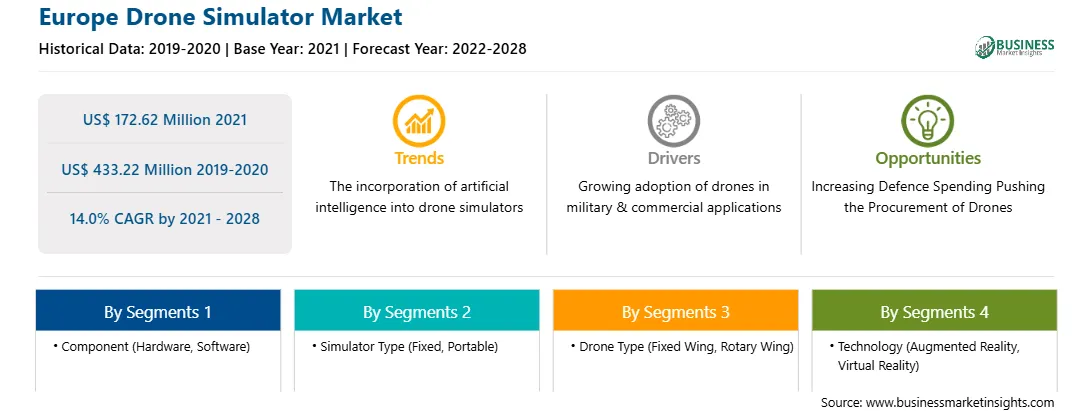

| Market size in 2021 | US$ 172.62 Million |

| Market Size by 2028 | US$ 433.22 Million |

| Global CAGR (2021 - 2028) | 14.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Drone Simulator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The drone simulator market in Europe is projected to US$ 433.22 million by 2028 from US$ 172.62 million in 2021; it is estimated to grow at a CAGR of 14.0% from 2021 to 2028. The increasing research and development activities in the field of military simulation also propel the demand for drone simulators. The research and development activities help test the efficiency of drones in critical environments, check the technical infrastructure and re-develop it (if required), and provide education & training to raise the level of awareness and expertise regarding war zones. Moreover, the European Union (EU) is expected to drastically increase its spending on military research, following a vote by the European Parliament to approve €4.1 billion (US$ 4.6 billion) for this purpose for the period 2021 to 2027. The fund would increase cash for fields from materials science to artificial intelligence and make the EU the fourth-largest spender on defense R&D in Europe.

Europe drone simulator market is segmented into component, simulator type, drone type, technology, and country. Based on component, the Europe drone simulator market is bifurcated into hardware and software. Hardware segment held the largest market share in 2020. Based on simulator type, the Europe drone simulator market is bifurcated into fixed and portable. Fixed segment held the largest market share in 2020. Based on drone type, Europe drone simulator market is bifurcated into fixed wing and rotary wing. Fixed wing segment held the largest market share in 2020. Similarly based on technology the Europe drone simulator market is bifurcated into augmented reality and virtual reality. Virtual reality segment held the largest market share in 2020. Based on country, the Europe drone simulator market is segmented into France, Germany, Italy, UK, Russia, rest of Europe. Russia held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the drone simulator market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are CAE Inc.; HAVELSAN A.S.; Israel Aerospace Industries Ltd.; L3Harris Technologies, Inc.; Leonardo S.p.A.; and SINGAPORE TECHNOLOGIES ELECTRONICS LIMITED.

The Europe Drone Simulator Market is valued at US$ 172.62 Million in 2021, it is projected to reach US$ 433.22 Million by 2028.

As per our report Europe Drone Simulator Market, the market size is valued at US$ 172.62 Million in 2021, projecting it to reach US$ 433.22 Million by 2028. This translates to a CAGR of approximately 14.0% during the forecast period.

The Europe Drone Simulator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Drone Simulator Market report:

The Europe Drone Simulator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Drone Simulator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Drone Simulator Market value chain can benefit from the information contained in a comprehensive market report.