The European continent comprises several developing countries, including Germany, France, the United Kingdom, and Italy, among others. Further, the western part of Europe is known for having higher living standards and a higher level of income. It is also one of the wealthiest regions on the European continent, with a higher per capita Gross Domestic Product (GDP) than the other parts. Europe is a well-established and mature market for adsorbents used in drinking water. Companies are constantly improving their overall business processes to meet the demands of their customers in the best possible way. Several domestic and international corporations have established a strong presence in this region. The region broadly supports the growth of the drinking water adsorbents market through effective manufacture and trade policies. Drinking water adsorbents are used for the purification of water. They are synthesized to eliminate micro-organisms of all life stages and sizes. They are formulated to control the microbial growth in potable water, process water, open cooling systems, down water services, etc. Further, adsorbents obtained from carbon, alumina, zeolite, clay minerals, iron ores, industrial byproducts, and natural products such as plant parts, herbs, and algal biomass have promising removal potential. Further, water treatment regulations are strictly enforced in the region. The presence of strict norms and regulations to foster sustainable development, as well as high demand from manufacturing industries for water filtration processes, are the main factors contributing to the demand for adsorbents in Europe. Also, beneficial government initiatives regarding drinking water are a major factor driving the Europe drinking water adsorbents market.

Spain, Italy, Germany, the UK, and France are a few of the worst-affected European countries by the COVID-19 outbreak. Businesses in the region are facing severe economic difficulties as they had either to suspend their operations or downsize their operations substantially. Owing to prolonged business shutdown or irregularities, the region is anticipated to witness an economic slowdown in 2021. In Europe, France is the hardest-hit country by the COVID-19 outbreak. It is expected to suffer an economic crisis due to the lack of revenue from various industries. Many countries have implemented drastic measures and travel restrictions, including partially closing their borders. The impact of COVID-19 varies from country to country in Europe, as selected countries witnessed a surge in number of confirmed cases and subsequently attracted stringent as well as longer lockdown periods or social isolation norms. Thus, these factors are also limiting the growth of other markets related to the European chemical & materials industry, including the drinking water absorbents market.

Strategic insights for the Europe Drinking Water Adsorbents provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

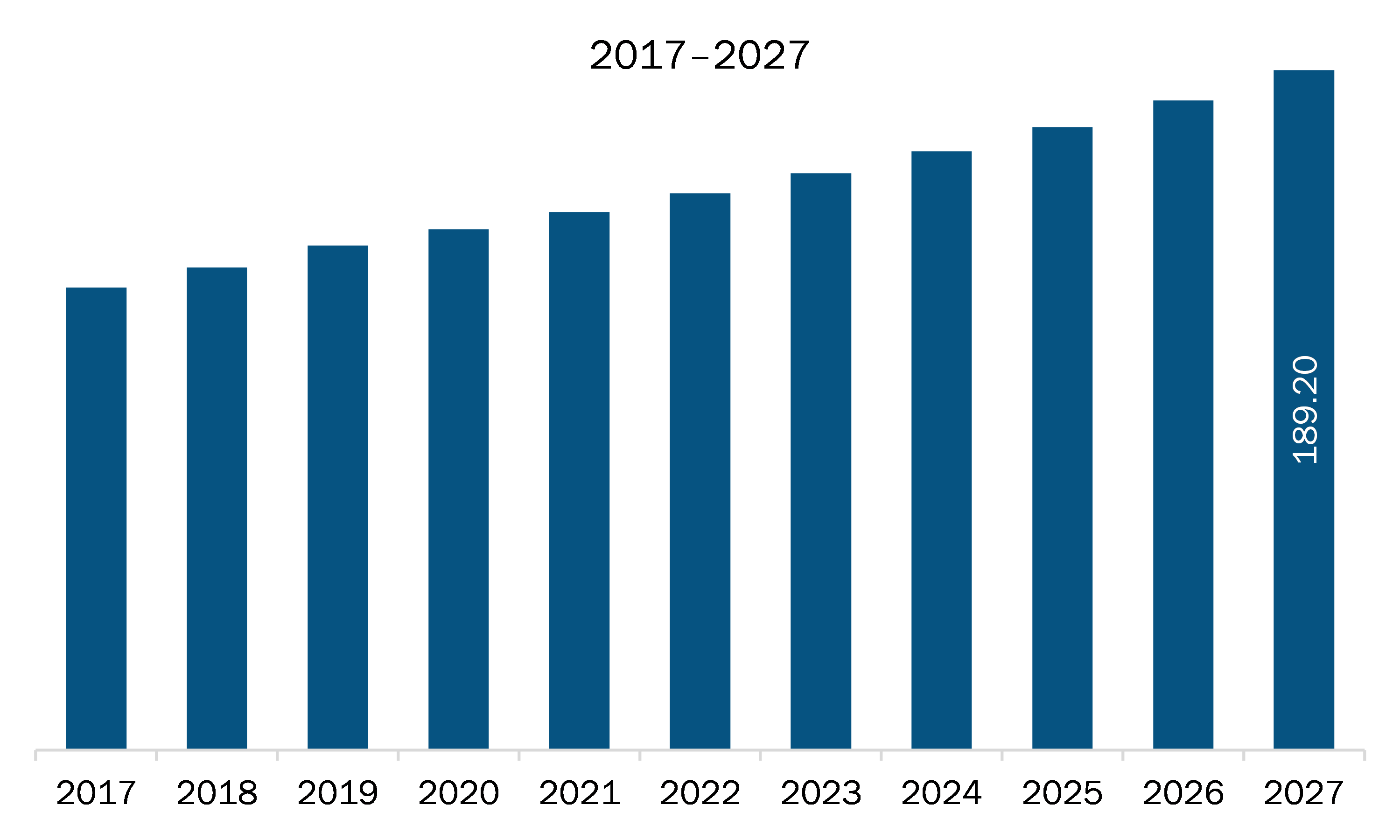

| Market size in 2019 | US$ 140.34 Million |

| Market Size by 2027 | US$ 189.20 Million |

| Global CAGR (2020 - 2027) | 3.9% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Drinking Water Adsorbents refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The drinking water adsorbents market in Europe is expected to grow from US$ 140.34 million in 2019 to US$ 189.20 million by 2027; it is estimated to grow at a CAGR of 3.9% from 2020 to 2027. Water quality has deteriorated over time, owing to the factors such as anthropogenic activity, unplanned urbanization, rapid industrialization, and unskilled use of natural water supplies. Further, increased awareness of the importance of providing impacts because of current environmental policies has moved the research community toward the creation of robust, economically viable, and environmentally sustainable processes capable of extracting pollutants from water while still protecting the health of populations. Owing to this, the demand for a few bio-based or organic adsorbents such as coconut shells, coal, and wood is growing in the drinking water adsorbents industry. Because of their superior adsorption performance, these products are highly useful in water quality management and purification. Further, they can also be used in a variety of applications for environmental preservation and regeneration. Moreover, bio-based adsorbents (also known as bio sorbents) are useful for purifying water as they can be generated from low-cost feedstocks, such as waste agricultural biomass or byproducts, have adsorption capacities comparable to other chemical adsorbents, and can be disposed of safely. Thus, the increasing focus on environment, which paves the way for the adoption of bio-based adsorbents, is emerging as a crucial trend in the Europe drinking water adsorbents market.

Based on product, the Europe drinking water adsorbents market is categorized into zeolite, clay, activated alumina, activated carbon, manganese oxide, cellulose, and others. In 2019, the activated carbon segment dominated the market by accounting for highest market share.

A few major primary and secondary sources referred to for preparing this report on the drinking water adsorbents market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are BASF SE, Cyclopure Inc., Dupont, Evoqua Water Technologies LLC, Geh Wasserchemie, KURARAY CO. LTD, Lenntech B.V., and Purolite.

The Europe Drinking Water Adsorbents Market is valued at US$ 140.34 Million in 2019, it is projected to reach US$ 189.20 Million by 2027.

As per our report Europe Drinking Water Adsorbents Market, the market size is valued at US$ 140.34 Million in 2019, projecting it to reach US$ 189.20 Million by 2027. This translates to a CAGR of approximately 3.9% during the forecast period.

The Europe Drinking Water Adsorbents Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Drinking Water Adsorbents Market report:

The Europe Drinking Water Adsorbents Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Drinking Water Adsorbents Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Drinking Water Adsorbents Market value chain can benefit from the information contained in a comprehensive market report.