Europe Digital Twin Market

No. of Pages: 112 | Report Code: BMIRE00030990 | Category: Technology, Media and Telecommunications

No. of Pages: 112 | Report Code: BMIRE00030990 | Category: Technology, Media and Telecommunications

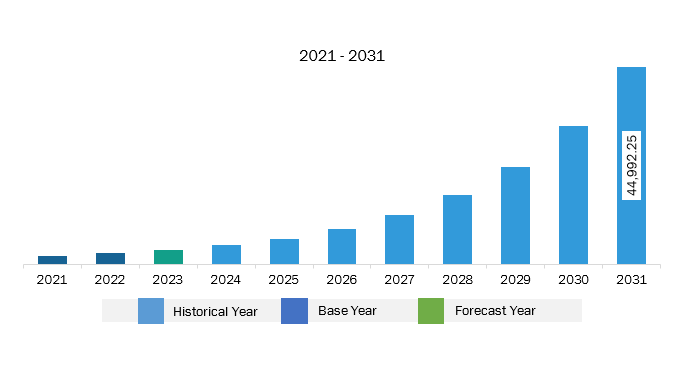

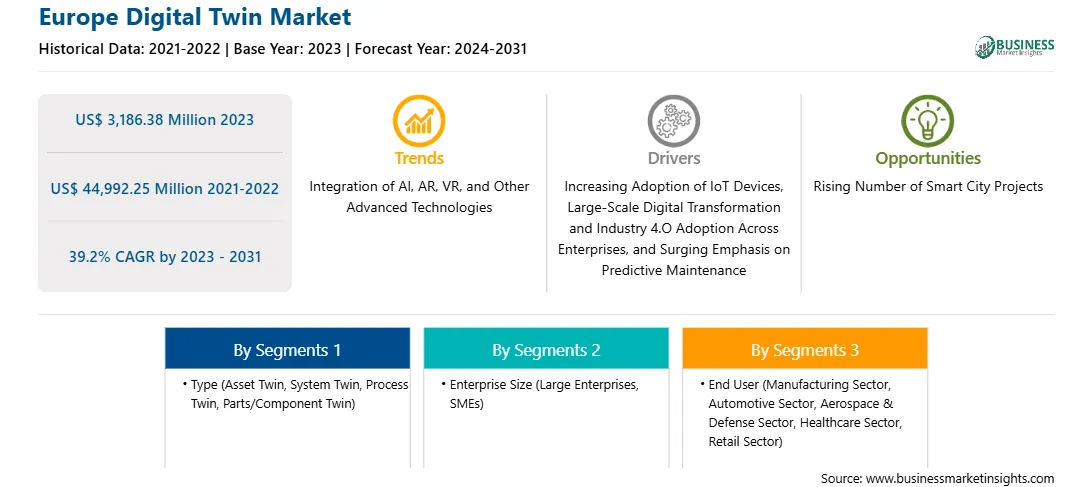

The Europe digital twin market was valued at US$ 3,186.38 million in 2023 and is expected to reach US$ 44,992.25 million by 2031; it is estimated to register a CAGR of 39.2% from 2023 to 2031.

Rising Number of Smart City Projects Drives Europe Digital Twin Market

The reliance on technology for a more comfortable living is increasing with the evolving lifestyles of consumers and communities worldwide. Smart cities have gained huge traction in the last few decades as they can potentially facilitate a new way of living with optimized city functions, in turn enabling economic growth and improved quality of life for consumers by using smart technologies and data analysis. According to TWI Ltd., 54% of the world’s population lives in cities, and the number is expected to rise to 66% by 2050. The projected population growth indicates an increasing need to manage the environmental, social, and economic sustainability of resources with the help of smart cities. Governments of various countries are increasingly investing in smart city projects to improve the quality of life of their citizens and overall public safety. Digital twins can be used to help smart cities meet their environmental, economic, and social sustainability goals. Virtual models guide planning decisions and offer solutions to various complex challenges faced by smart cities. Smart city planners can use digital twin technology to design, monitor, and manage infrastructures such as transportation systems, water and wastewater networks, energy grids, and telecommunications. Thus, the rising number of smart city projects would provide growth opportunities for the digital twin market in the coming years.

Europe Digital Twin Market Overview

The Europe digital twin market is segmented into Germany, the UK, Italy, France, Russia, and the Rest of Europe. Benefits of digital twins such as enhanced maintenance, improved operational efficiency, and reduction in downtime encourage the players in various industries to adopt digital twin solutions, which leads to the market growth in the region. In May 2024, Kongsberg Digital, a leading provider of industrial software, and Yara International, a global fertilizer company and the world's largest distributor of ammonia, entered into a two-year agreement. Under the agreement, Kongsberg Digital will develop digital twin technology for Yara's factories in Herøya, Norway and Sluiskil, the Netherlands. The agreement includes an operational twin for Yara's production facilities at Herøya and a project twin for the carbon capture project in Sluiskil. Kongsberg Digital announced its ambition to deploy the solution to Yara's production facilities across the world.

Europe homes various digital twin market players who are continuously engaged in various inorganic and organic business growth strategies. Rapidly growing digitalization in the region leads to the adoption of digital solutions, including digital twin, by several market players across industries such as manufacturing, automotive, oil & gas, and others. Thus, the digital twin market players are focused on expanding their business and product offerings to cater to the demand for digital twins. In February 2024, Capgemini and Unity, the platform for creating and growing real-time 3D (RT3D) content, announced an expansion of their strategic alliance. Per the agreement, Unity’s Digital Twin Professional Services team will join and embedded within Capgemini, forming one of the largest pools of Unity enterprise developers in the world. The transaction will accelerate the iteration and implementation of the market-leading real-time 3D (RT3D) visualization software for the industrial application of digital twins. It will allow end users to envision, understand, and interact with physical systems – a key enabler for intelligent industry. The deal is expected to close in the second quarter of 2024.

Strategic insights for the Europe Digital Twin provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Digital Twin refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Digital Twin Strategic Insights

Europe Digital Twin Report Scope

Report Attribute

Details

Market size in 2023

US$ 3,186.38 Million

Market Size by 2031

US$ 44,992.25 Million

Global CAGR (2023 - 2031)

39.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Enterprise Size

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Digital Twin Regional Insights

Europe

Digital Twin Market Segmentation

The Europe digital twin market is categorized into type, enterprise size, end user, and country.

Based on type, the Europe digital twin market is segmented into asset twin, system twin, process twin, and parts/component twin. The asset twin segment held the largest share of Europe digital twin market share in 2023.

In terms of enterprise size, the Europe digital twin market is bifurcated into large enterprises & SMES. The large enterprises segment held a larger share of Europe digital twin market in 2023.

Based on end user, the Europe digital twin market is categorized into manufacturing, automotive, aerospace & defense, healthcare, retail, and others. The manufacturing segment held the largest share of Europe digital twin market in 2023.

By country, the Europe digital twin market is segmented into the UK, Germany, France, Italy, Russia, and the Rest of Europe. The UK dominated the Europe digital twin market share in 2023.

General Electric Co; Microsoft Corp; Siemens AG; Dassault Systemes SE; PTC Inc.; Robert Bosch GmbH; International Business Machines Corp; Oracle Corp; Ansys, Inc.; and Autodesk, Inc. are some of the leading companies operating in the Europe digital twin market.

The Europe Digital Twin Market is valued at US$ 3,186.38 Million in 2023, it is projected to reach US$ 44,992.25 Million by 2031.

As per our report Europe Digital Twin Market, the market size is valued at US$ 3,186.38 Million in 2023, projecting it to reach US$ 44,992.25 Million by 2031. This translates to a CAGR of approximately 39.2% during the forecast period.

The Europe Digital Twin Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Digital Twin Market report:

The Europe Digital Twin Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Digital Twin Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Digital Twin Market value chain can benefit from the information contained in a comprehensive market report.