Growing Adoption of Cosmetic Dentistry Drives Europe Dental Milling Machines Market

The dental cosmetic industry has gained substantial traction and popularity. Cosmetic dentistry also includes surgeries involving smile correction and other aesthetic procedures. Cosmetic dentistry aims to improve the appearance of gums, teeth, and bites. Millennials and baby boomers are primarily responsible for the growth of cosmetic dentistry. This has fueled the need for dental milling machines and accessories. Dental implants are widely popular among the geriatric population. However, many younger people are now opting for dental implantation procedures instead of bridges. Dental implants provide natural-looking teeth that are as long-lasting as regular ones. Moreover, advancements in dental materials and computer technology have helped CAD/CAM-fabricated restorations. When using CAD/CAM systems, operators can fabricate restorations from several materials, including ceramics, metal alloys, and composites. In addition, dental service consumers are demanding dental aesthetic procedures that require minimum stay and delays in dental offices. Hence, CAD/CAM technology is used for milling prostheses in dental laboratories and dental offices to fulfill the demands of people opting for cosmetic dentistry. Thus, the vast adoption and growth of cosmetic dental procedures that majorly incorporate the use of dental milling machines for the development and designing of restorations are supporting the growth of the Europe dental milling machine market.

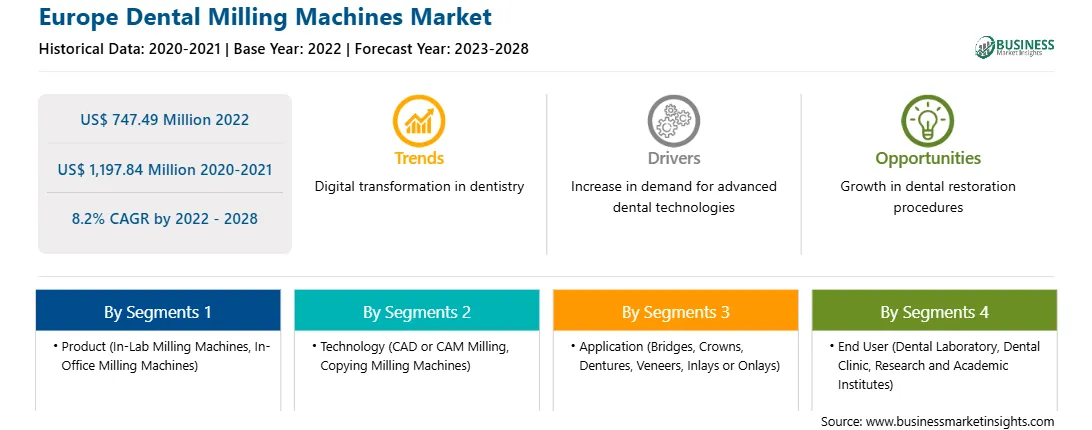

Europe Dental Milling Machines Market Overview

The Europe dental milling machine market is growing due to the presence of key market players and the availability of high-quality services and clinics in the region that incorporates the use of dental milling machines. In addition, lateral factors such as the increasing geriatric population suffering from dental diseases, such as dental caries and periodontal diseases; the growing popularity of cosmetic dentistry, and rising awareness regarding the availability of dental restorations are expected to fuel the market growth in the region in the coming years.

Moreover, according to Statista, in 2022, 23 million people in Germany were aged 40-59 years, making it the largest age group in Germany. Furthermore, people aged 65 years and above have been stated as the next largest age group, with 18.44 million people belonging to this group. A surge in the volume of dental diseases can be directly associated with the ever-increasing geriatric population, thereby boosting the demand for dental services. People are more concerned about the appearance of teeth. Hence, cosmetic dentistry is becoming increasingly popular in the country. In addition, rising initiatives by the German Society of Periodontology to promote research, education, and awareness of periodontal science and practice enhance the dental milling machine market. In July 2019, the 4th international conference on Dental and Clinical Dentistry was conducted in Berlin, Germany, to share insights on the latest dental research and cutting-edge technologies.

Moreover, restoration-based dentistry has been on the rise in the UK for several years. The Association of Dental Implantology estimated more than 130,000 individual implant procedures are performed in the UK on average in a year. The market players in the UK are also investing in offering new and advanced solutions to patients as well as caregivers. For instance, in January 2018, Cybaman Technologies introduced a new high-speed, high-accuracy milling machine that has the capabilities to operate as an additive manufacturing system using laser direct metal deposition.

In addition, according to Statista 2022, there has been a stable trend in the prevalence rate of caries of permanent teeth from 2010 to 2019 in Italy. Furthermore, ~28,400 out of 100,000 Italians suffered from caries of permanent teeth in 2019. In addition, the study titled "Experience and Prevalence of Dental Caries in Migrant and Nonmigrant Low-SES Families’ Children Aged 3 to 5 Years in Italy," published in September 2022, stated that dental caries is more prevalent among children from low-socioeconomic-status groups. The prevalence of caries was found to be 71% among these children.

In addition, in France, as per the European Health Interview Survey (EHIS), ~16% of the population reported deprioritizing their dental treatment needs due to financial reasons in 2014. In response to the issue in 2020, the French Government expanded dental coverage, entailing dental prostheses range capping prices and reducing co-payments for dental implants, such as metallic and ceramic crowns and ceramic bridges. In Spain, the costs of dental treatment and services under dental tourism are much cheaper than in the UK. For instance, the composite dental fillings in Spain cost ~US$ 58 (£50), while it costs ~US$ 174 (£150) in the UK. Thus, the factors mentioned above are likely to increase the growth of the dental milling machine market during the forecast period.

Europe Dental Milling Machines Market Segmentation

The Europe dental milling machines market is segmented into product type, technology, application, end user, and country.

Based on product, the Europe dental milling machines market is segmented into in-lab milling machines and in-office milling machines. The in-lab milling machines segment held the larger Europe dental milling machines market share in 2022.

Based on technology, the Europe dental milling machines market is segmented into CAD or CAM milling and copying milling machines. The CAD or CAM milling segment held the larger Europe dental milling machines market share in 2022.

Based on application, the Europe dental milling machines market is segmented into bridges, crowns, dentures, veneers, and inlays or onlays. The bridges segment held the largest market share in 2022.

Based on end user, the Europe dental milling machines market is segmented into dental laboratory, dental clinic, and research and academic institutes. The dental laboratory segment held the largest Europe dental milling machines market share in 2022

Based on country, the Europe dental milling machines market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. Germany dominated the Europe dental milling machines market share in 2022.

3M Co, Amann Girrbach AG, DATRON Dynamics Inc, Dentium Co Ltd, Dentsply Sirona Inc, imes-icore GmbH, Interdent doo, Ivoclar Vivadent Inc, Mecanumeric SAS, and Zirkonzahn SRL are the leading companies operating in the Europe dental milling machines market.

Strategic insights for the Europe Dental Milling Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 747.49 Million |

| Market Size by 2028 | US$ 1,197.84 Million |

| Global CAGR (2022 - 2028) | 8.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Dental Milling Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe Dental Milling Machines Market is valued at US$ 747.49 Million in 2022, it is projected to reach US$ 1,197.84 Million by 2028.

As per our report Europe Dental Milling Machines Market, the market size is valued at US$ 747.49 Million in 2022, projecting it to reach US$ 1,197.84 Million by 2028. This translates to a CAGR of approximately 8.2% during the forecast period.

The Europe Dental Milling Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Dental Milling Machines Market report:

The Europe Dental Milling Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Dental Milling Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Dental Milling Machines Market value chain can benefit from the information contained in a comprehensive market report.