Unmanned aerial vehicles (UAV) have been designed and developed for military and civilian applications. The UAV manufacturing sector in Europe is in the growth phase of its life cycle. These vehicles are widely used for fighter combat, surveillance, aircraft carrier operations, stealth missions, and military communications applications. The production of UAVs requires a substantial number of electronic components for the data recording and transmission applications, and also for avionic functions. The antennas are among the most vital electronic components of any UAV, as these antennas enable the vehicle to transmit data to and receive data from other systems, as well as the people on the ground. The antennas which are utilized on unmanned vehicles are, in general, flexible, rugged dipole or blade antennas with the omnidirectional coverage. Thus, as UAVs' demand increases across Europe, the need for a broader range of antennas will also increase for data communications systems, payloads, command and control systems. Factors such as increasing interest in circular omni-directional antennas and rise in drone procurement by military forces due to higher defense budgets are expected to drive the Europe defense drone antenna market. Furthermore, in case of COVID-19, Europe is highly affected specially the UK. The European defense contractors enjoy a significant number of contracts year on year from customer (military forces/governments) across the globe. The UK, Germany, and France have the highest density of defense contractors in the region. The COVID-19 outbreak has interrupted the manufacturing process and supply chain in these countries. Due to the massive outbreak and governmental regulations, the manufacturers are forced to operate with very limited personnel, which resulted in limited production of drones and its related components like antennas. Several European defense contractors are heavily dependent on the US, China, and Indian defense forces. The international supply chain disruptions coupled with lower military spending has been adversely affecting these European defense contractors’ businesses. The drone antenna manufacturers are also among the European defense equipment manufacturers to witness shock created by the COVID-19 crises.

Strategic insights for the Europe Defense Drone Antenna provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

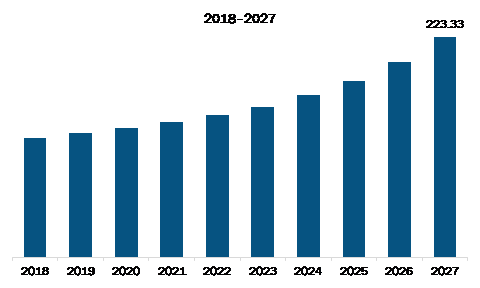

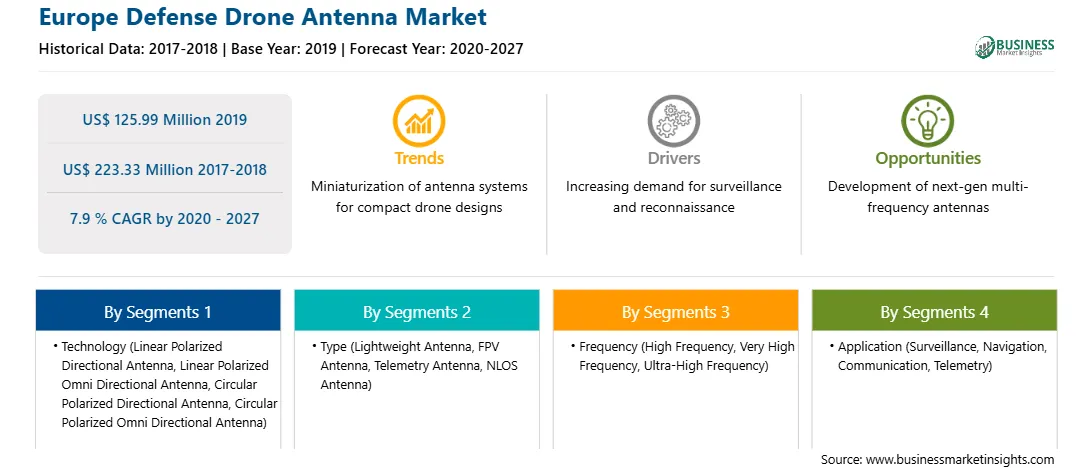

| Market size in 2019 | US$ 125.99 Million |

| Market Size by 2027 | US$ 223.33 Million |

| Global CAGR (2020 - 2027) | 7.9 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Defense Drone Antenna refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe defense drone antenna market is expected to grow from US$ 125.99 million in 2019 to US$ 223.33 million by 2027; it is estimated to grow at a CAGR of 7.9 % from 2020 to 2027. Upsurge in research and development to introduce newer variants such as low-weight and 360° multibeam antenna is expected to escalate the Europe defense drone antenna market. Unmanned aerial vehicles (UAVs) technologies are witnessing tremendous technological advancements in terms of miniaturization, antenna design, cameras, and navigation technology, among others. The continuous enhancements in drone antenna technology are anticipated to boost the Europe defense drone antenna market. Several defense drone market players across Europe are continuously emphasizing reducing the antenna weight, leading to an increase in the fuel efficiency of UAVs. The time on station is a critical mission parameter directly influenced by the UAV's payload weight and aerodynamics. With an objective to enhance the time on station parameters, the value chain players, including antenna manufacturers, are continually investing substantial resources in the reduction of the size and weight of antennas without compromising on their capability and frequency bandwidth. So the constant R&D and introduction of newer products is expected to fuel the Europe defense drone antenna market growth in the coming years.

In terms of technology, the linear polarized omni directional antenna segment accounted for the largest share of the Europe defense drone antenna market in 2019. In terms of type, the lightweight antenna segment held a larger market share of the Europe defense drone antenna market in 2019. Similarly, in terms of frequency, the ultra-high frequency segment held a larger market share of the Europe defense drone antenna market in 2019. Further, the communication segment held a larger share of the market based on application in 2019.

A few major primary and secondary sources referred to for preparing this report on Europe defense drone antenna market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Alaris Holdings Limited; Antenna Research Associates, Inc.; Cobham Limited; PPM Systems; TE Connectivity; Trimble Inc.

The Europe Defense Drone Antenna Market is valued at US$ 125.99 Million in 2019, it is projected to reach US$ 223.33 Million by 2027.

As per our report Europe Defense Drone Antenna Market, the market size is valued at US$ 125.99 Million in 2019, projecting it to reach US$ 223.33 Million by 2027. This translates to a CAGR of approximately 7.9 % during the forecast period.

The Europe Defense Drone Antenna Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Defense Drone Antenna Market report:

The Europe Defense Drone Antenna Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Defense Drone Antenna Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Defense Drone Antenna Market value chain can benefit from the information contained in a comprehensive market report.