Debt collection software offers a variety of features, such as reducing human intervention and automating redundant tasks. The debt collection software has made operations more efficient and reduced the excessive costs incurred by these processes, thereby driving the growth of the debt collection software market. Cloud computing technologies are becoming mainstream, with seamless cloud deployment facilitating access and sharing of data and applications. Therefore, the emergence of cloud technology is also boosting the market's growth. Government regulations on data security are becoming more and more stringent, but the spend analytics market is developing due to government policies and increasing investment in BI analytics tools. Many global companies are working with governments to improve their spending and procurement processes and using spending analytics tools to provide actionable solutions to society. Legal notices no longer threaten debtors, and increasing rules and regulations complicate the debt collection process. As a result, many telecommunications and utility companies are using collections software to take advantage of the vastly increased number of online transactions. Businesses are adopting self-service payment platforms to keep track of customers, track bill payments, and maintain authenticity. Thus, rising automation in the debt collection process is driving the demand for Europe debt collection software market.

The debt collection software market in Europe is spread across Germany, France, Italy, the UK, Russia, and the Rest of Europe. The increasing demand for automating and controlling debt, enhancing the recovery process, and the growing need to increase the productivity in debt collections are the prominent factors driving the debt collection software in Europe. As per Intrum’s 2022 European Payment Report, many European businesses believe that macroeconomic challenges, such as inflation, rising prices, and the war in Ukraine, are influencing their companies’ growth prospects. However, many businesses also admit that late payments, growing debt, and lack of expertise to manage their debt are propelling the need for debt collection software in Europe. Furthermore, in June 2022, The EU had announced to issue more than US$ 52.7 billion of long-term debt in the second half of 2022 to back its pandemic recovery fund. Thus, increasing debts are bolstering the need for debt collection software solutions, boosting the market. Technological advancements, increasing demand for customized debt management, and strict implementation of advisory policies in Europe are expected to drive this regional market over the forecast period. Moreover, it integrates various technologies, such as data mining, artificial intelligence, machine learning, and statistical modelling, to improve the debt collection process. The growing adoption of digital automation technologies for debt collection practices is anticipated to drive the market over the next few years.

Strategic insights for the Europe Debt Collection Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

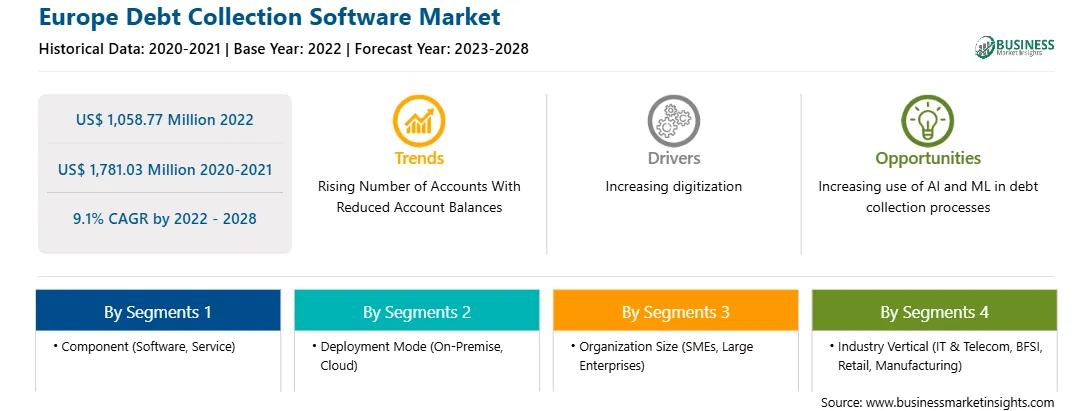

| Market size in 2022 | US$ 1,058.77 Million |

| Market Size by 2028 | US$ 1,781.03 Million |

| Global CAGR (2022 - 2028) | 9.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Debt Collection Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe debt collection software market is segmented on the basis of component, deployment type, organization size, industry vertical, and country. Based on component, the debt collection software market is segmented into software and service. The software segment registered a larger market share in 2022.

Based on deployment type, the Europe debt collection software market is bifurcated into on-premise and cloud. The cloud segment registered a larger market share in 2022.

Based on organization size the Europe debt collection software market is segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment registered a larger market share in 2022.

Based on verticals, the Europe debt collection software market is segmented into IT & Telecom, BFSI, manufacturing, retail, and others. The BFSI segment registered the largest market share in 2022.

Based on country, the Europe debt collection software market is segmented into Germany, France, UK, Italy, Russia, and the Rest of Europe. UK dominated the market share in 2022.

CGI INC.; Chetu, Inc.; Experian Information Solutions, Inc.; Exus; FICO; FIS; Loxon Solutions; and Pegasystems Inc. are the leading companies operating in the Europe debt collection software market.

The Europe Debt Collection Software Market is valued at US$ 1,058.77 Million in 2022, it is projected to reach US$ 1,781.03 Million by 2028.

As per our report Europe Debt Collection Software Market, the market size is valued at US$ 1,058.77 Million in 2022, projecting it to reach US$ 1,781.03 Million by 2028. This translates to a CAGR of approximately 9.1% during the forecast period.

The Europe Debt Collection Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Debt Collection Software Market report:

The Europe Debt Collection Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Debt Collection Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Debt Collection Software Market value chain can benefit from the information contained in a comprehensive market report.