Europe is a prominent market for the electronics and semiconductor industry. Europe launched an electronics policy in May 2013, to maintain Europe at the forefront of micro and nanoelectronics design and manufacturing while delivering economic benefits. The strategy will promote US$ 119 in industry investments and the creation of 250,000 jobs in Europe. The objective is to reverse Europe's falling share of micro and nanoelectronics supply and reach a level of production in the EU that is more in line with the size of its economy in 10 years. The suggested strategy follows the approach of the initiative's Key Enabling Technologies (KETs). These factors have a favorable impact on the present sampling resistance market's growth. Further, the European Union, as well as numerous national, provincial, and local governments across Europe, are actively encouraging the use of plug-in electric vehicles. Several policies have been put in place to give direct financial assistance to customers and producers, as well as non-monetary incentives, subsidies for the deployment of charging infrastructure, and long-term rules with objectives. By the end of 2020, Europe had over 3.2 million plug-in electric passenger cars and light commercial vehicles on the road. After China, Europe has the world's second-largest stock of plug-in cars, accounting for about 30% of the global stock in 2020, up from 25% in 2019. As a result, additional semiconductors are anticipated to be required as electric vehicles become more widespread. As manufacturers add more electric vehicles to their fleets, demand for semiconductor components like current sensing resistors will rise in the region.

In case of COVID-19, Europe is highly affected specially the UK. In Europe, the COVID-19 pandemic has a different impact on different countries, as only selective countries have witnessed the rise in the number of cases and subsequently attracted strict, as well as prolonged, lockdown periods or social isolation norms. However, Western European countries such as Germany, France, Russia, and the UK have seen a comparatively modest decrease in their growth activities because of their strong healthcare systems. These countries have been investing significantly to make the diagnosis and treatment of the disease more effective and less time-consuming. Despite the fact that Europe is in a state of emergency, many nations are beginning to see the light at the end of the tunnel. Traditional corporate frameworks have been swiftly replaced by more innovative business concepts. Despite the fact that everything is unlikely to return to normal very soon, the electronic industry is projected to rebound quickly.

Strategic insights for the Europe Current Sampling Resistance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

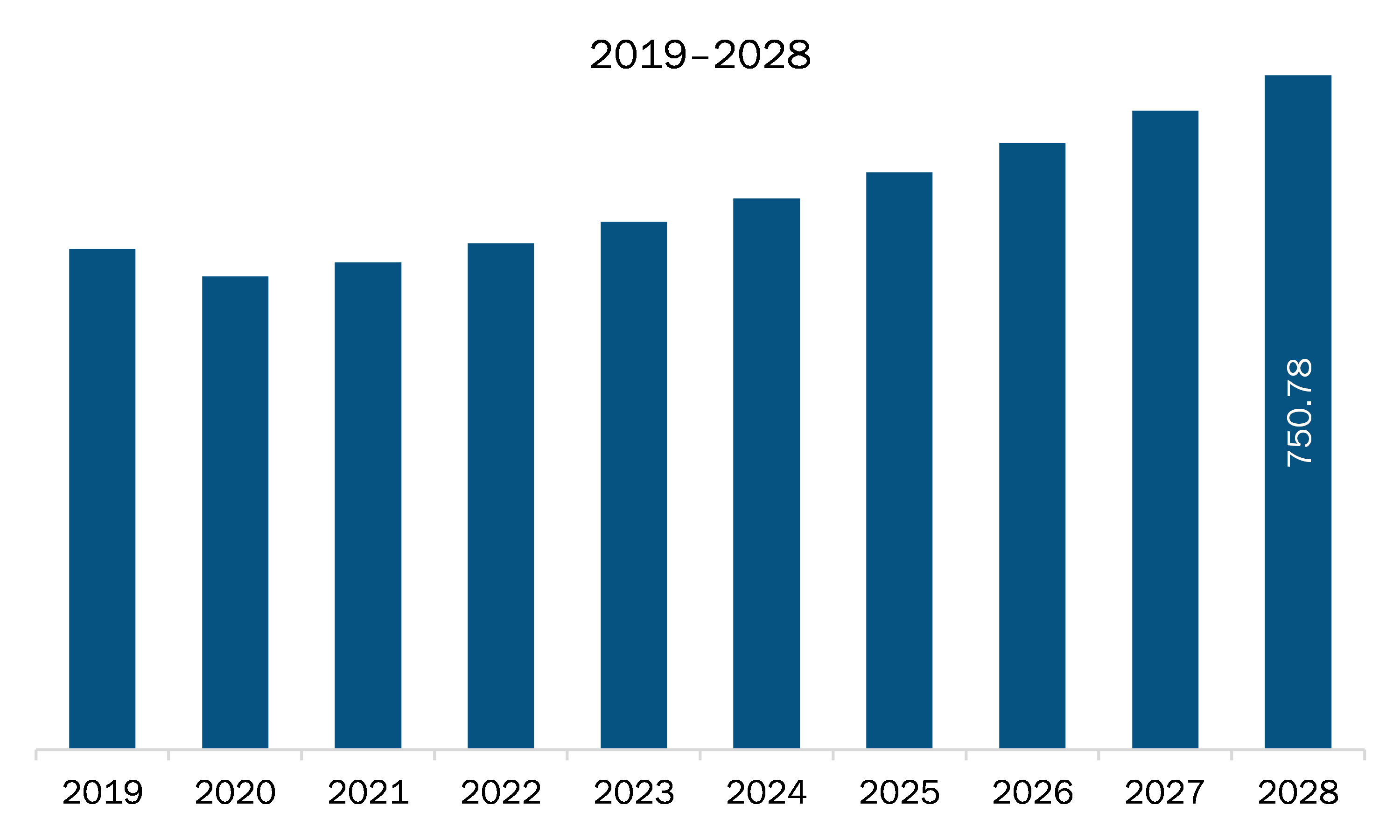

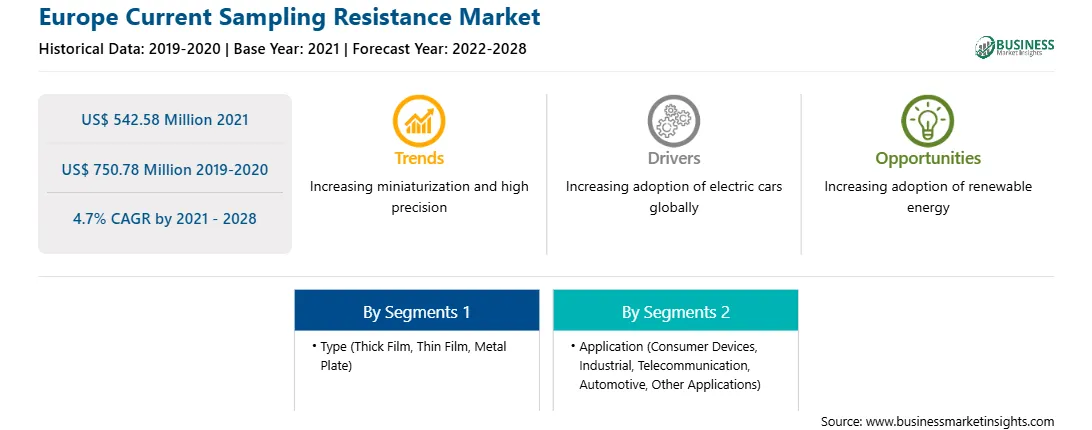

| Market size in 2021 | US$ 542.58 Million |

| Market Size by 2028 | US$ 750.78 Million |

| Global CAGR (2021 - 2028) | 4.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Current Sampling Resistance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe current sampling resistance market is expected to grow from US$ 542.58 million in 2021 to US$ 750.78 million by 2028; it is estimated to grow at a CAGR of 4.7% from 2021 to 2028. The use of high-density mounting resistors in a variety of applications is expected to accelerate, as the practice of greater performance in a smaller space has become important. The resistors of 01005-inch sizes (0.0160.08 inch) are currently utilized in smartphones and wearable devices. Fillet less mounting, which provides fine-pitch mounting, and via-in-pad, in which holes are created on the component pad to eliminate patterns on the surface layer, have both enhanced mounting density in various applications. To meet the need, companies across Europe are creating high-density mounted resistors. For instance, KOA Corporation provides KOA's thick film type low resistance resistors: UR73, UR73V, SR73, WK73S, and WU73, which have resistance values ranging from 10m to 10m and T.C.R. of 75 x10-6/K. Metal plate chip low resistance resistors with extremely low parasitic inductance and high accuracy current sensing are made available from various companies. In addition, resistor reduction is nearing its limit, and modularization is likely to expand across all types of equipment in the future for Europe region.

In terms of type, the thick film segment accounted for the largest share of the Europe current sampling resistance market in 2020. In terms of application, the industrial segment held a larger market share of the Europe current sampling resistance market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe current sampling resistance market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Cyntec Co., Ltd.; KOA Speer Electronics, Inc.; Panasonic Corporation; ROHM CO., LTD.; Samsung Electro-Mechanics Co, Ltd.; Susumu Co., Ltd; TT Electronics; Viking Tech Corporation; and Vishay Intertechnology, Inc.

The Europe Current Sampling Resistance Market is valued at US$ 542.58 Million in 2021, it is projected to reach US$ 750.78 Million by 2028.

As per our report Europe Current Sampling Resistance Market, the market size is valued at US$ 542.58 Million in 2021, projecting it to reach US$ 750.78 Million by 2028. This translates to a CAGR of approximately 4.7% during the forecast period.

The Europe Current Sampling Resistance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Current Sampling Resistance Market report:

The Europe Current Sampling Resistance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Current Sampling Resistance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Current Sampling Resistance Market value chain can benefit from the information contained in a comprehensive market report.