The cryogenic control valve market in Europe is segmented into France, Germany, Russia, Italy, the UK, and the Rest of European Countries. The European countries have the presence of several major manufacturing industries, such as aerospace, machinery, and equipment, automotive, shipbuilding, and military vehicles. Automotive is a crucial industry in the region as it contributes significantly to the GDPs of many European countries and provides employment to huge number of qualified candidates in the region. In addition, the governments have a stringent legal and regulatory framework for the activities in the oil and gas E&P. The framework usually sets the rules for the transportation of oil and gas via trunk pipelines, development of natural resources on the continental shelf, and law on environmental protection. The growth in the E&P activities of oil & gas from offshore and onshore sites is providing lucrative growth opportunities for the cryogenic control valve manufacturers in Europe. It is projected that the offshore developments would bring over 84% of the region’s new gas production. Further, the recovery of the economic condition is expected to propel the demand for oil and gas in the region. In addition, Europe has the presence of largest automotive sector. The region is witnessing a rise in demand for natural gas driven cars (increased by around 68% from January to March 2020), which is increasing the demand for natural gas.

In Europe, several countries witnessed an economic hit and a decline in the oil & gas sector activities due to the decrease in oil prices in the first quarter of 2020. Many of the European member states have implemented drastic measures on imports and exports of goods by partially closing their borders, which further lowered the demand for energy in various industry verticals, thereby hindering the cryogenic valves market growth in Europe. Different countries in the region experienced varied impact of COVID-19 pandemic. Italy, France, and Russia among others, witnessed a surge in the number of confirmed cases, and subsequently imposed stringent and extended lockdown period or social isolation. The scenario disrupted oil & gas supply chains and restrained the demand for cryogenic valves. The similar trend has been observed in other oil & gas producing European countries. However, as several countries have begun to reopen industries, demand for energy is rising and the exploration and production of oil & gas activities are resuming subsequently, which is supporting the growth of the cryogenic control valve market.

Strategic insights for the Europe Cryogenic Control Valve provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

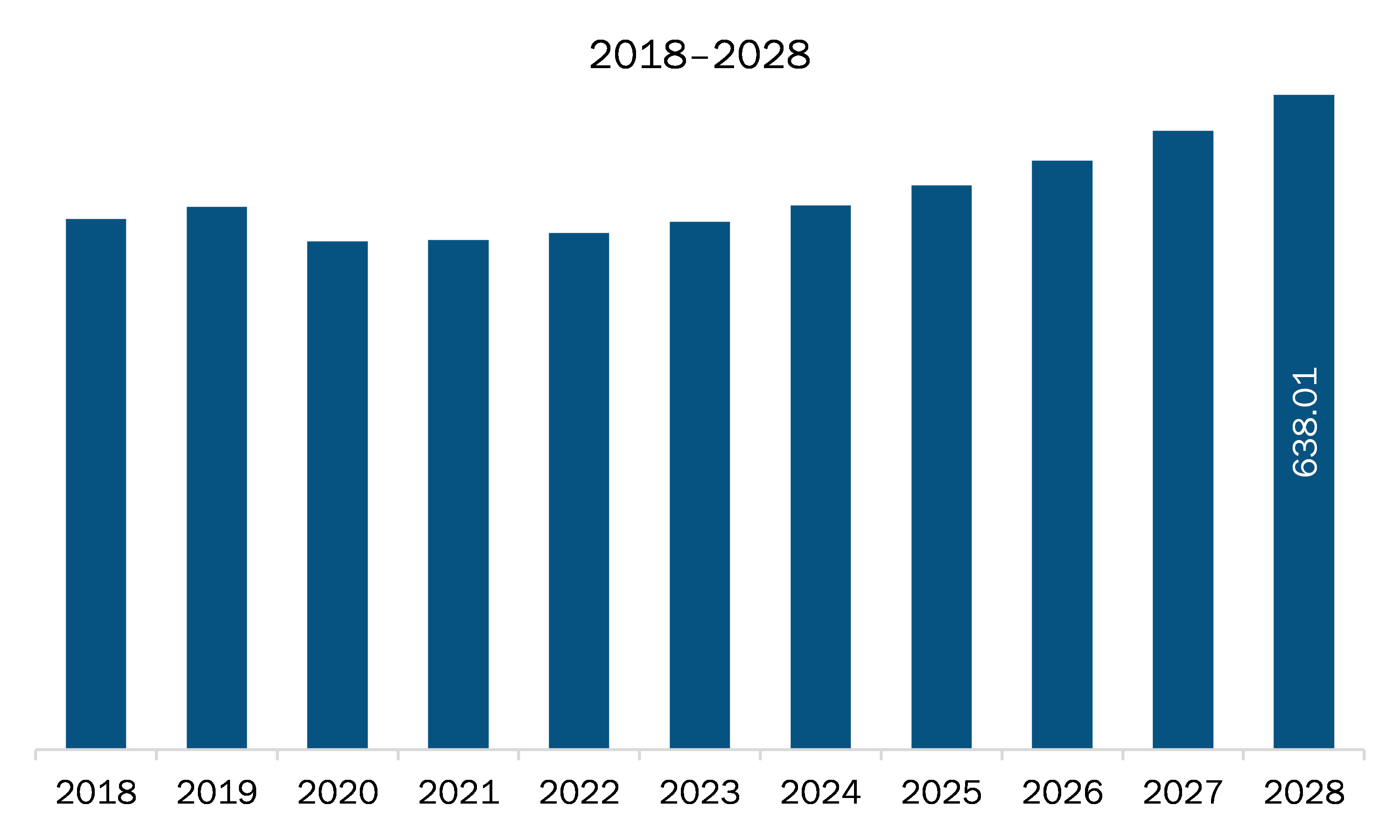

| Market size in 2021 | US$ 469.69 Million |

| Market Size by 2028 | US$ 638.01 Million |

| Global CAGR (2021 - 2028) | 3.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Cryogenic Control Valve refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The cryogenic control valve market in Europe is expected to grow from US$ 469.69 million in 2021 to US$ 638.01 million by 2028; it is estimated to grow at a CAGR of 3.6% from 2021 to 2028. Europe is the second largest producer of oil & gas products globally. Russia is the major contributing country in the region’s overall oil & gas production. As per the US Energy Information Administration data, in 2020, Russia was the second largest country producing natural gas products across the world. Russia produced 22,501 Billion Cubic Feet (BCF) natural gas in 2020. Further, Norway is the second largest natural gas producing country in Europe, and it produced 4,052 Billion Cubic Feet (BCF) natural gas in 2019. Hence, Norway and Russia still maintained their position as the natural gas suppliers, whereas Germany, France, and Italy are the main importers of natural gas. Thus, many offshore projects for oil and gas accelerates the demand for cryogenic storing and transportation tanks and pipeline, which drives the growth of the cryogenic control valves market in Europe.

The Europe cryogenic control valve market is bifurcated on the bases of type, application, and country. The market, based on type, is segmented into globe control valves, ball control valves, butterfly control valves, and others. In 2020, the ball control valves segment accounted for the largest market share. By application, the market is segmented into power generation, oil & gas, food & beverages, and others. The oil & gas segment held substantial market share in 2020. The market, based on country, is segmented into France, Germany, UK, Italy, Russia, and rest of Europe. Germany held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the cryogenic control valve market in Europe are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bac Valves; Baker Hughes Company; Emerson Electric Co.; Flowserve Corporation; KORVAL Co., Ltd.; Larsen & Toubro Limited; Neles Corporation; Richards Industrials; SAMSON USA; and Velan Inc.

The Europe Cryogenic Control Valve Market is valued at US$ 469.69 Million in 2021, it is projected to reach US$ 638.01 Million by 2028.

As per our report Europe Cryogenic Control Valve Market, the market size is valued at US$ 469.69 Million in 2021, projecting it to reach US$ 638.01 Million by 2028. This translates to a CAGR of approximately 3.6% during the forecast period.

The Europe Cryogenic Control Valve Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Cryogenic Control Valve Market report:

The Europe Cryogenic Control Valve Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Cryogenic Control Valve Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Cryogenic Control Valve Market value chain can benefit from the information contained in a comprehensive market report.