Europe Corn and Wheat-Based Feed Market

No. of Pages: 88 | Report Code: BMIRE00030672 | Category: Food and Beverages

No. of Pages: 88 | Report Code: BMIRE00030672 | Category: Food and Beverages

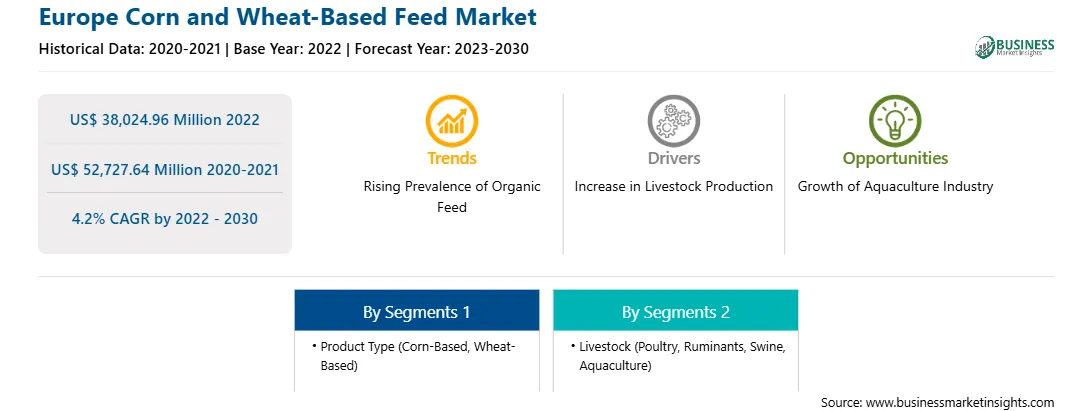

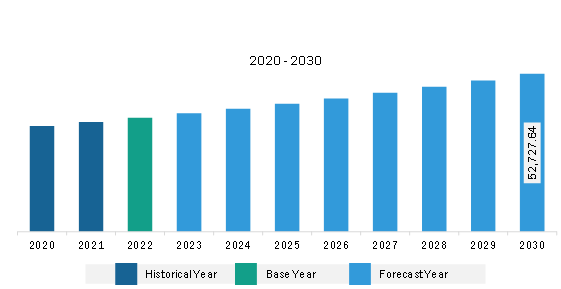

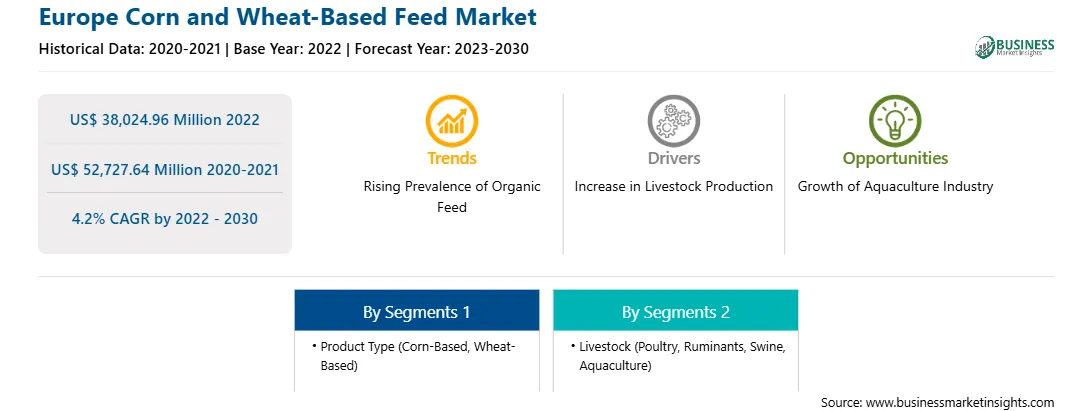

The Europe corn and wheat-based feed market was valued at US$ 38,024.96 million in 2022 and is expected to reach US$ 52,727.64 million by 2030; it is estimated to register a CAGR of 4.2% from 2022 to 2030.

Growth of Aquaculture Industry Feed Drive Europe Corn and Wheat-Based Feed Market

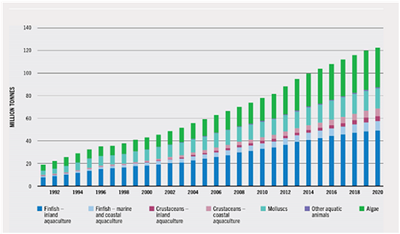

The fishery industry is expanding due to changing cultural preferences, improving aquaculture production, and rising demand for fish and seafood. Fish has a high protein content and low cholesterol; therefore, the demand for fish and fish-related products has increased across the globe. Thus, aquaculture production has surged to cater to the increasing demand. As per the FAO, global aquaculture production of animal species grew by 2.7% in 2020 compared with 2019.

World Aquaculture Production, 1091–2020

Strategic insights for the Europe Corn and Wheat-Based Feed provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Corn and Wheat-Based Feed refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Corn and Wheat-Based Feed Strategic Insights

Europe Corn and Wheat-Based Feed Report Scope

Report Attribute

Details

Market size in 2022

US$ 38,024.96 Million

Market Size by 2030

US$ 52,727.64 Million

Global CAGR (2022 - 2030)

4.2%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Livestock

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Corn and Wheat-Based Feed Regional Insights

With growing aquaculture, the demand for aquafeed is increasing. Fish meal is the major feed used in the aquaculture segment. Corn gluten meal has recently been used as a plant-based alternative to fishmeal. Corn gluten meal contains a high protein and low fiber content with low anti-nutritional factors (ANF). They are rich in minerals, vitamin B, and vitamin E. Corn gluten meal in shrimp feed significantly enhances digestibility and energy.

Moreover, with the rising sustainability concern, aquaculture farmers are significantly replacing animal-sourced feed with plant-sourced feed. Thus, the demand for wheat and corn-based feed is increasing due to their high quality and nutritional performance. Roquette Frères, a key market player in the Europe corn and wheat-based feed market, offers wheat-based feed for aquaculture. Thus, the growth of aquaculture is expected to create massive opportunities in the Europe corn and wheat-based feed market across the world in the coming years.

Europe Corn and Wheat-Based Feed Market Overview

Europe has a huge livestock population, in November/December 2022, there were 134 million pigs, 75 million bovine animals, 59 million sheep, and 11 million goats in the region. The presence of livestock population along with the increasing awareness of benefits of corn and wheat in animal feed is surging the market growth in the region. Wheat is used in the diets of ruminants as an energy source. It is a high-energy ingredient in concentrates. Wheat bran is an important source of minerals (such as zinc, selenium, iodine, potassium) and vitamins (such as thiamine, B6, folate, vitamin E, and carotenoids), which are important elements in the animal feed for strengthening the immune system. Additionally, policy measures and government initiatives also play a crucial role in driving the demand for feed grains in Europe. The Common Agricultural Policy (CAP) of the European Union (EU) provides subsidies and incentives to support agricultural production, including livestock farming. These subsidies often influence farmers' decisions regarding crop choices and production practices. Additionally, EU regulations on animal welfare, such as restrictions on using certain feed additives and antibiotics, may influence the composition of animal feed formulations. Corn and wheat-based feed are produced without the use of extensive additives and thus, comply with EU regulations. This factor contributes to the market growth in the region.

Europe Corn and Wheat-Based Feed Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Europe Corn and Wheat-Based Feed provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Corn and Wheat-Based Feed refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Corn and Wheat-Based Feed Strategic Insights

Europe Corn and Wheat-Based Feed Report Scope

Report Attribute

Details

Market size in 2022

US$ 38,024.96 Million

Market Size by 2030

US$ 52,727.64 Million

Global CAGR (2022 - 2030)

4.2%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Livestock

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Corn and Wheat-Based Feed Regional Insights

Europe Corn and Wheat-Based Feed Market Segmentation

The Europe corn and wheat-based feed market is categorized into product type, livestock, and country.

Based on product type, the Europe corn and wheat-based feed market is bifurcated corn-based and wheat-based. The corn-based segment held a larger market share in 2022. The corn-based segment is further sub segmented into corn gluten meal, corn gluten feed, and other corn-based feed. The wheat-based segment is further sub segmented into wheat gluten, wheat bran, and other wheat-based feed.

In terms of livestock, the Europe corn and wheat-based feed market is categorized into poultry, ruminants, swine, aquaculture, and others. The poultry segment held the largest market share in 2022.

By country, the Europe corn and wheat-based feed market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. The Rest of Europe dominated the Europe corn and wheat-based feed market share in 2022.

Agrana Beteiligungs AG, Archer Daniels Midland Company, Associated British Foods Plc, BENEO GmbH, International Nutritionals Ltd, Interstarch Ukraine LLC, Jungbunzlauer Suisse AG, and Roquette Freres SA are some of the leading companies operating in the Europe corn and wheat-based feed market.

1. Agrana Beteiligungs AG

2. Archer Daniels Midland Company

3. Associated British Foods Plc

4. BENEO GmbH

5. International Nutritionals Ltd

6. Interstarch Ukraine LLC

7. Jungbunzlauer Suisse AG

8. Roquette Freres SA

The Europe Corn and Wheat-Based Feed Market is valued at US$ 38,024.96 Million in 2022, it is projected to reach US$ 52,727.64 Million by 2030.

As per our report Europe Corn and Wheat-Based Feed Market, the market size is valued at US$ 38,024.96 Million in 2022, projecting it to reach US$ 52,727.64 Million by 2030. This translates to a CAGR of approximately 4.2% during the forecast period.

The Europe Corn and Wheat-Based Feed Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Corn and Wheat-Based Feed Market report:

The Europe Corn and Wheat-Based Feed Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Corn and Wheat-Based Feed Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Corn and Wheat-Based Feed Market value chain can benefit from the information contained in a comprehensive market report.