Packaging food materials ensure smooth logistics, also provides adequate product protection, and significantly influences consumer purchasing behaviour. Packaging, therefore, fulfils many different functions, plus it also meets an endless diversity of customer requirements. The recent increase in incomes in developed countries has led to a rise in living standards that includes significantly higher consumption of packaged, and convenient foods. As a result, food safety guidelines have been more stringent than ever. Since packaging first became a “vital” on the internet of most searched things, its role in the customer journey has extended far beyond the shelf. This has had a transformative effect in several ways, including smart, and sustainable packaging, which helps cut down food waste in global supply chains. Technology is also improving the packaging industry. Advancements in plastic and paper chemistry now allow recycling to be more comfortable and more convenient than ever. Hence, major manufacturers are extensively taking strategic initiatives in order to fulfil the consumers needs and demands, and to protect environment. For instance, on September 25, 2020, Mondi, a leading global packaging and paper manufacturer, has collaborated with BIOhof Kirchweidach, to design a sustainable packaging solution for 500g packs of tomatoes on the vine to be distributed to PENNY supermarkets, owned by major German retailer REWE Group. Thus, advancement and development in the packaging industry by the key players have boosted the Europe compostable foodservice packaging market in the forecast period.

Europe Compostable Foodservice Packaging Market Overview

The Europe compostable foodservice packaging market is categorized into Germany, France, Italy, Russia, the UK, and the rest of Europe. The market is competitive in these countries as the region is home to major global market players such as SABERT S.A, Vegware Ltd, and Versupack. Considering ongoing growth of the market, and commitment to sustainability global players are focus on innovations, and new product launches in the region. For instance, On November 1, 2022, SABERT S.A., a global leader in sustainable food packaging solutions, announced the launch of five new packaging and catering products. These environmentally friendly products have unique sustainability benefits, including compostability, recyclability, and recycled content usage. Therefore, such initiatives by the manufacturers boosting the market growth, also, encourage consumers to opt for such sustainable solutions. The region has been experiencing the demand for carryout, catering, and on-the-go food delivery, which continues to trend upward; it anticipates massive opportunities for the key players to expand their portfolio of packaging products and offerings. Over the past few years, the European Union (EU) acknowledge environmental, and climate benefits of compostable food service packaging, which has resulted into proposed new packaging rules, on November 30, 2022. In this, European Bioplastics (EUBP) commends the Commission’s endorsement of the critical role of compostable plastic packaging in the proposed packaging rules in reaching the ambitious waste and climate targets. Hence, such amendments by EU Commission have led to a substantial dynamic, which will strengthen more in the coming decades. As a result, there is an increasing implementation of a legal framework for plastics use across the region. This offers new opportunities for compostable foodservice packaging that can be essential in executing a resource-efficient and low-carbon circular economy in Europe.

Strategic insights for the Europe Compostable Foodservice Packaging provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

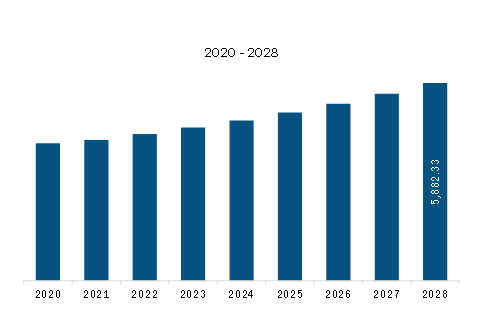

| Market size in 2022 | US$ 4,359.96 Million |

| Market Size by 2028 | US$ 5,882.33 Million |

| Global CAGR (2022 - 2028) | 5.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Compostable Foodservice Packaging refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe compostable foodservice packaging market Segmentation

The Europe compostable foodservice packaging market is segmented into product material, and country.

Based on product, the Europe compostable foodservice packaging market is segmented into trays, cups and plates, cutlery, clamshell, bowls, pouches and sachets, and others. In 2022, the cups and plates segment registered a largest share in the Europe compostable foodservice packaging market.

Based on material, the Europe compostable foodservice packaging market is segmented into paper and paperboard, compostable plastic {bio-plastic}, and others. In 2022, the compostable plastic segment registered a largest share in the Europe compostable foodservice packaging market.

Based on country, the Europe compostable foodservice packaging market is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. In 2022, the Rest of Europe segment registered a largest share in the Europe compostable foodservice packaging market.

Anchor Packaging Pty Ltd; BioBag Americas Inc; Dart Container Corp; Graphic Packaging Holding Co; Pactiv LLC; and WestRock Co are the leading companies operating in the Europe compostable foodservice packaging market.

The Europe Compostable Foodservice Packaging Market is valued at US$ 4,359.96 Million in 2022, it is projected to reach US$ 5,882.33 Million by 2028.

As per our report Europe Compostable Foodservice Packaging Market, the market size is valued at US$ 4,359.96 Million in 2022, projecting it to reach US$ 5,882.33 Million by 2028. This translates to a CAGR of approximately 5.1% during the forecast period.

The Europe Compostable Foodservice Packaging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Compostable Foodservice Packaging Market report:

The Europe Compostable Foodservice Packaging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Compostable Foodservice Packaging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Compostable Foodservice Packaging Market value chain can benefit from the information contained in a comprehensive market report.