The Europe clear aligners market is expected to reach US$ 2,688.26 million by 2028 from US$ 815.19 million in 2021; it is estimated to grow at a CAGR of 16.3 % from 2021 to 2028.

The growth of the market is attributed to the key driving factors such as the growing prevalence of dental problems, rising incidence of malocclusions in children, and increasing demand for dental cosmetic procedures. However, the high cost of clear aligners hinders the market growth.

The prevalence rate of dental diseases is increasing day by day as a large number of people are diagnosed with dental problems and high cases of oral and dental issues are found in developed countries like Belgium & Netherlands. According to the Platform for Better Oral Health in Europe, more than 50% of the European population may suffer from some form of periodontitis and over 10% have severe dental disease, with prevalence increasing to 70-85% of the population aged 60- 65 years of age. With a 64.0% increase in disability-adjusted life year (DALY) due to oral conditions across the world, the number of people with oral conditions has increased from 2.5 billion in 1990 to 3.5 billion in 2015. By pioneering efforts and potentially different approaches the oral health goal of reducing the oral diseases can be achieved by 2020.

In Germany, there are around 15 suppliers of aligners, including both the internationally established market leaders such as Invisalign or Clear Correct and emerging brands such as DrSmile or Sunshinesmile. In some cases, the leading brands are backed by major corporations such as Straumann, Dentsply or Align Technology, which in turn is a strong indicator that aligners will be an established product in the dental market in the near future.

According to the data availed by WHO, around 3.58 billion people are affected by dental diseases that is almost half of the total global population. Severe periodontal diseases are the 11th most prevalent disease which may result in tooth loss. In European countries including Netherlands and Belgium, 5–20% of middle-aged (35–44 years) adults and up to 40% of older people (65–74 years) are suffering from periodontal (gum) diseases. Around 30% of geriatric patients of age 65–74 years have no natural teeth that reduce their function and quality of life in Europe. The prevalence rate of dental diseases has increased in 15 years. This significant rate of increment of dental diseases and disorders will drive the growth of the market.

Dental cosmetic surgery is one of the most common cosmetic procedures across the Europe. The increasing significance of aesthetics, growth of the aging population, willingness to spend out-of-pocket, and rising awareness of oral hygiene and aesthetics are the primary drivers for the growth of the European markets. According to the European Society of Cosmetic Dentistry (ESCD), cosmetic dentistry experienced a recent boom with an increase in procedures demanded by people of Europe.

The cost of the dental cosmetic procedure is less in Hungary. Hungary has emerged as the top destination in Europe for dental tourism with approximately 7,000 visitors every year. Low price of these procedures is the key factor attributed to this growth. For instance, root canal treatment in U.S. starts from USD 550 while in Hungary it is only around USD 69. Zirconium crowns cost over USD 1,250 in the U.S. while it costs only USD 440 in Hungary.

Germany held the largest market share for the clear aligner market in 2021. The market is expected to grow due to the high prevalence rate of dental problems, along with the rising demand for dental cosmetic procedures. Moreover, increasing incidence of malocclusions in children is also expected to promote growth of clear aligner market across Europe.

Strategic insights for the Europe Clear Aligner provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 815.19 Million |

| Market Size by 2028 | US$ 2,688.26 Million |

| Global CAGR (2021 - 2028) | 16.3 % |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Clear Aligner refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

In recent years, dental treatment has emerged as an increasingly popular type of medical tourism. This trendy treatment involves travel outside of the local healthcare system to receive services at a substantially lower price. The procedure generally takes place at the end of a vacation to make the most of the travel expenses. Moreover, dental tourism is a growing segment in the European medical tourism market.

The dental tourism in Eastern European countries like Hungary has flourished in the coming years due to the high-quality of work at a low price as compared to other developed European countries. Government and industrial infrastructure and developments in the dental industry favor the growth of dental tourism in Hungary. The opportunities, such as less cost with standards treatments and accessibility in Hungary, help in making further progress in dental tourism. Also, in the developed economies like US and UK, the citizens do not have dental insurance, and the low-cost treatment is an attractive factor for most Americans in the region. The vast difference in the cost of treatment may save up to 60% off the US prices. The cost of the dental cosmetic procedure is less in Hungary and Poland. The difference in the amount of standard cosmetic dentist procedure and a top cosmetic dentist procedure in Hungary is around US$ 50 to US$ 150 per crown or veneer. Hungary dentists provide cheap crowns with high-quality laboratories and materials.

Similarly, dental tourism is increasing in European countries such as Spain, Romania, Turkey, Georgia, Slovenia, and others. According to the Medical Tourism and Consulting organization Patients Beyond Borders, Eastern European countries like Hungary and Romania are the top destinations recommended by specialists in the dentistry market. The increasing penetration of patients to the emerging European markets for a dental procedure is likely to offer growth opportunities for the clear aligners market in this region.

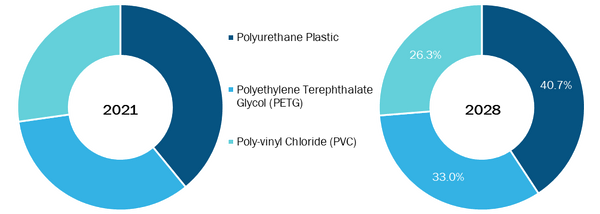

Based on product type, the Europe clear aligners market is segmented into polyurethane plastic, polyethylene terephthalate glycol (PETG), polyvinyl chloride (PVC), and others. The polyurethane plastic segment held the largest share of the market in 2021, and the same segment is expected to register the highest CAGR during the forecast period.

In terms of distribution channels, the Europe clear aligners market is segmented into direct sales, laboratories, and others. The direct sales segment held the largest share of the market in 2021. However, the direct sales segment is anticipated to register the highest CAGR from 2021 to 2028.

Based on age, the Europe clear aligners market is bifurcated into adult and teenagers. The adult segment held a larger share of the market in 2021. However, the teenagers segment is anticipated to register a higher CAGR during 2021–2028.

Companies operating in the Europe clear aligner market adopt the product innovation strategy to meet the evolving customer demands worldwide, permitting them to maintain their brand name in the global clear aligner market. Some companies that are present in the market are 3M, Danaher, Dentsply Sirona, HENRY SCHEIN, INC, Align Technology, Inc., TP Orthodontics, Inc., K Line Europe GmbH, DENTAURUM GmbH & Co. KG, SCHEU DENTAL GmbH, and Orthocaps, amongst others.

The Europe Clear Aligner Market is valued at US$ 815.19 Million in 2021, it is projected to reach US$ 2,688.26 Million by 2028.

As per our report Europe Clear Aligner Market, the market size is valued at US$ 815.19 Million in 2021, projecting it to reach US$ 2,688.26 Million by 2028. This translates to a CAGR of approximately 16.3 % during the forecast period.

The Europe Clear Aligner Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Clear Aligner Market report:

The Europe Clear Aligner Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Clear Aligner Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Clear Aligner Market value chain can benefit from the information contained in a comprehensive market report.