The European class D audio amplifier market is further segmented into France, Germany, Russia, Italy, the UK, and the Rest of Europe. Western European countries are more advanced than the Nordic and Eastern European countries, and thus, the adoption of technological solutions across industries in countries such as Germany, Italy, the UK, and Spain is high. Growing demand for compact and energy-efficient gadgets for personal and commercial use, and popularity of smartphones, televisions, and home entertainment systems are bolstering the demand for class D audio amplifiers in Europe. Companies present in Europe class D audio amplifier market mainly concentrate on mergers and acquisitions as major strategies to maintain their brand names in the global marketplace. They are also adopting other inorganic strategies such as partnerships to build relationships with other providers to improve their existing market positions. Increasing adoption of class D amplifiers in home audio systems and growing passenger car sales due to elevating disposable incomes and standards of living are the major factor driving the growth of the Europe class D audio amplifier market.

In case of COVID-19, Germany, Spain, Italy, the UK, and France are among the most affected European countries due to the outbreak. Businesses are suffering from financial crises as they had to either suspend their operations or reduce their activities substantially to abide by the social distancing norms and lockdown impositions. Europe is one of the major information technology (IT) hubs. Due to the presence of giant manufacturers, which are known for the high adoption of class D audio amplifier and other automation technologies, the class D audio amplifier market in Europe is expected to gain back its growth pace during the forecast period. Business shutdowns and travel bans have been restricting the growth of various sectors in Europe, which led to an economic slump in many European countries in 2020; this negative effect is likely to persist in 2021 as well. In addition to hampered supply, a fall in demand hit the manufacturing part of the sector’s supply chains including hardware. Demand was further contracted by confinements of industries such as the automobile sector (due to their face-to-face Business-to-Consumer (B2C) character), implying lower demand for class D audio amplifier. Companies in hard-hit countries such as Italy, France and Spain have faced operational disruptions, which further delayed their ability to finalize financial statements; this resulted in slowdown in investments in the class D audio amplifier market in the region.

Strategic insights for the Europe Class D Audio Amplifier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

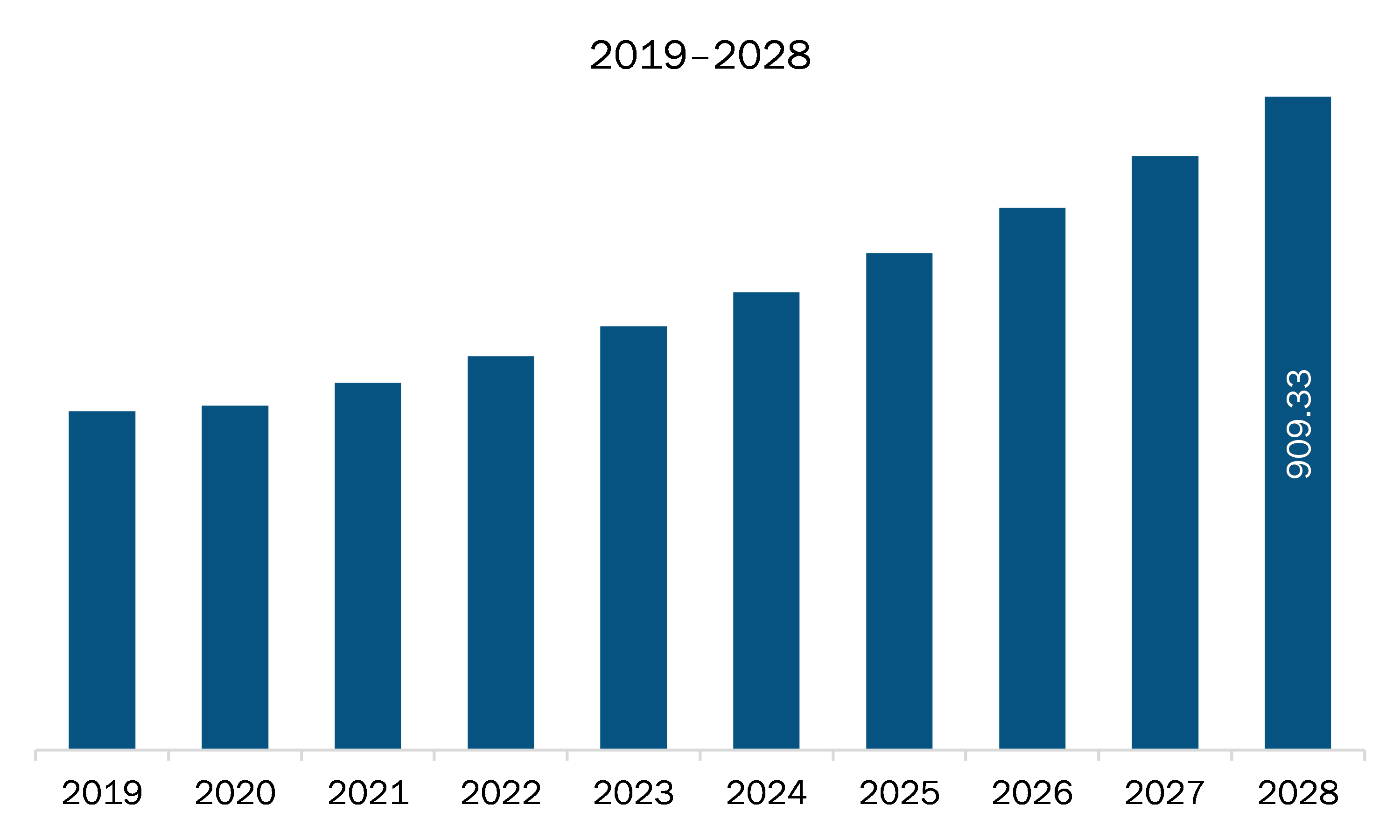

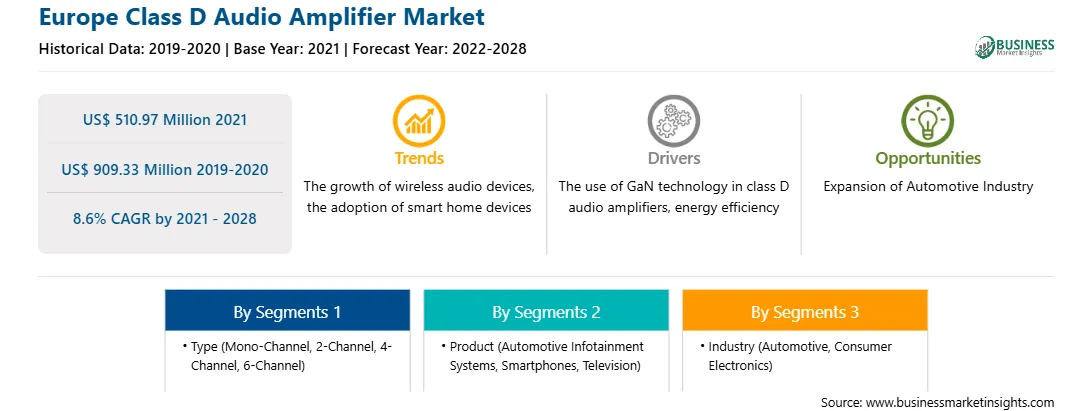

| Market size in 2021 | US$ 510.97 Million |

| Market Size by 2028 | US$ 909.33 Million |

| Global CAGR (2021 - 2028) | 8.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Class D Audio Amplifier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe class D audio amplifier market is expected to grow from US$ 510.97 million in 2021 to US$ 909.33 million by 2028; it is estimated to grow at a CAGR of 8.6% from 2021 to 2028. Surging trend of AI-enabled smart speakers is expected to escalate the market growth. The growing trend of AI-enabled smart speakers can be attributed to technological advancements in consumer electronics and increasing changing customer preferences for automation and advanced features in products. Smart speakers rely on a set of complex artificial intelligence (AI) technology, and they catch sound waves and convert them into words using automatic speech recognition (ASR) feature. Further, they convert the verbal data into meaning using natural language understanding (NLU). Once the meaning is understood, the smart speaker responds using the natural language generation (NLG) technology. The AI-enabled smart speakers are expected to deliver simple operational functions with smooth and high-quality audio experience. The growing trend of AI-enabled smart speakers is likely to be a significant trend for the proliferation of the Europe class D audio amplifier market in the coming years.

In terms of type, the mono-channel segment accounted for the largest share of the Europe class D audio amplifier market in 2020. In terms of product, the others segment held a larger market share of the Europe class D audio amplifier market in 2020. Further, the consumer electronics segment held a larger share of the Europe class D audio amplifier market based on industry in 2020.

A few major primary and secondary sources referred to for preparing this report on the Europe class D audio amplifier market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Analog Devices, Inc; ICEpower a/s; INFINEON TECHNOLOGIES AG; Maxim Integrated; NXP Semiconductors N.V.; ON Semiconductor Corporation; Qualcomm Technologies, Inc.; Silicon Laboratories, Inc.; STMicroelectronics N.V.; and Texas Instruments Incorporated.

The Europe Class D Audio Amplifier Market is valued at US$ 510.97 Million in 2021, it is projected to reach US$ 909.33 Million by 2028.

As per our report Europe Class D Audio Amplifier Market, the market size is valued at US$ 510.97 Million in 2021, projecting it to reach US$ 909.33 Million by 2028. This translates to a CAGR of approximately 8.6% during the forecast period.

The Europe Class D Audio Amplifier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Class D Audio Amplifier Market report:

The Europe Class D Audio Amplifier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Class D Audio Amplifier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Class D Audio Amplifier Market value chain can benefit from the information contained in a comprehensive market report.