The consumption of high-quality convenience food is increasing, which is currently one of the biggest trends in the food industry. Convenience foods, such as RTE products, allow consumers to save time and effort associated with shopping for ingredients, meal preparation and cooking, consumption, and post-meal activities. The development of this food segment is ascribed to many social changes; the most notable of these include the growing number of smaller households and the rising millennial population worldwide. Due to hectic work schedules, millennials prefer to be efficient with their time rather than spend it on tedious tasks. Thus, they are more likely to spend their money on convenience foods, which dives into the popularity of packaged RTE products, such as baked products, snacks, and dairy products. According to the data by Hartman Group, 96% of millennials replace a meal with a snack once a week, while 58% say they snack 4–5 times a day. 91% of all consumers say they eat snacks throughout the day, while 8% say they do not eat meals and consume only snacks. These factors are causing a major shift among millennials toward daily snacking, replacing meals with savory and sweet snacks in various formats. Chilled food packaging enables the safe and convenient consumption of these products, allowing consumers to enjoy meals without extra preparation. In addition, chilled food packaging plays a vital role in maintaining food safety for RTE meals. Packaging acts as a protective barrier, preventing contamination and preserving the hygienic quality of the food. Sealed packaging also provides tamper-evident features, assuring consumers that the product is safe and untouched before opening.

The Europe chilled food packaging market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. In Europe, the market for chilled food packaging is predominantly driven by the growing consumption of ready-to-eat meals (RTE) and the rising number of restaurants and takeaway facilities, where chilled foods are stored and served to customers after processing. Different chilled food packaging products—including cold beverage cups, pouches, trays, bags, and boxes—are widely used for serving or packaging chilled foods. The growing consumption of RTE meals is boosting the chilled food packaging market. Moreover, the rising number of restaurants and takeaway facilities is creating a huge demand for chilled food packaging products in the region.

Players operating in the Europe chilled food packaging market focus on investing in sustainable innovation to cater to consumer demands for packaging solutions that are safe, recyclable, and made from recycled materials. For instance, in 2019, the leading food packaging manufacturer, Sabert Corporation Europe, launched an improved range of food service packaging products made from 100% high-grade, post-consumer polyethylene terephthalate (PET) bottle flakes. PET is highly utilized for packaging chilled food products. Such developments will offer more opportunities for the growth of the Europe chilled food packaging market during the forecast period.

Strategic insights for the Europe Chilled Food Packaging provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Chilled Food Packaging refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Europe Chilled Food Packaging Strategic Insights

Europe Chilled Food Packaging Report Scope

Report Attribute

Details

Market size in 2023

US$ 3,240.43 Million

Market Size by 2030

US$ 4,355.76 Million

Global CAGR (2023 - 2030)

4.3%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Material

By Type

By Application

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Chilled Food Packaging Regional Insights

Europe Chilled Food Packaging Market Segmentation

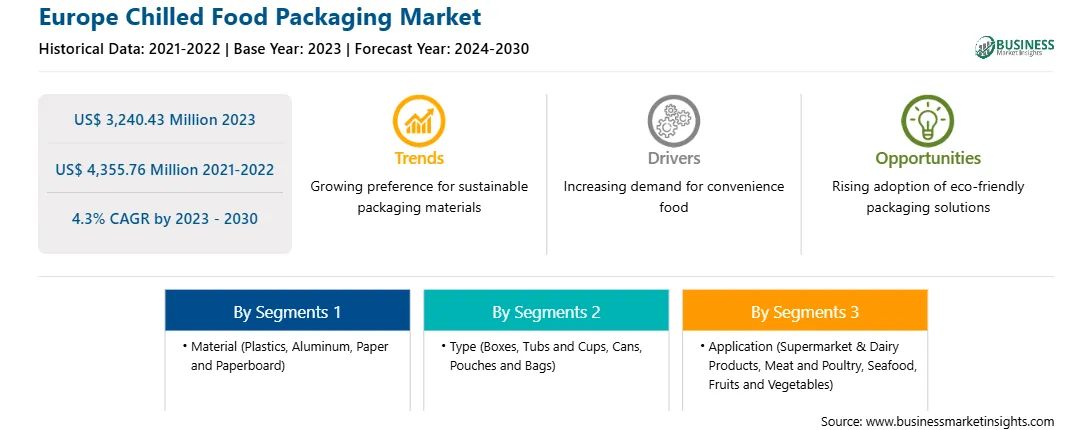

The Europe chilled food packaging market is segmented into material, type, value, application, and country.

Based on material, the Europe chilled food packaging market is segmented into plastic, aluminum, paper and paperboard, and others. the plastic segment held a larger share of the Europe chilled food packaging market in 2023.

Based on type, the Europe chilled food packaging market is segmented into boxes, tubs and cups, cans, pouches and bags, and others. The pouches and bags segment held the largest share of the Europe chilled food packaging market in 2023.

Based on application, the Europe chilled food packaging market is segmented into dairy products, meat and poultry, seafood, fruits and vegetables, and others. The dairy products segment held the largest share of the Europe chilled food packaging market in 2023.

Based on country, the Europe chilled food packaging market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. The Rest of Europe dominated the share of the Europe chilled food packaging market in 2023.

Mondi Plc, Amcor Plc, Sonoco Products Co, Amerplast Ltd, Berry Global Group Inc, WestRock Co, Graphic Packaging Holding Co, Tetra Pak International SA, and Sealed Air Corp are some of the leading companies operating in the Europe chilled food packaging market.

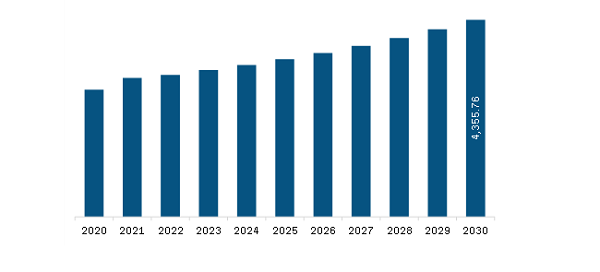

The Europe Chilled Food Packaging Market is valued at US$ 3,240.43 Million in 2023, it is projected to reach US$ 4,355.76 Million by 2030.

As per our report Europe Chilled Food Packaging Market, the market size is valued at US$ 3,240.43 Million in 2023, projecting it to reach US$ 4,355.76 Million by 2030. This translates to a CAGR of approximately 4.3% during the forecast period.

The Europe Chilled Food Packaging Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Chilled Food Packaging Market report:

The Europe Chilled Food Packaging Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Chilled Food Packaging Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Chilled Food Packaging Market value chain can benefit from the information contained in a comprehensive market report.