Companies operating in the cell and gene therapy manufacturing services market focus on strategic developments such as collaborations, expansions, agreements, partnerships, and new product launches, which help them improve their sales, expand their geographic reach, and enhance their capacities to cater to a larger than existing customer base. A few of the noteworthy developments in the cell and gene therapy manufacturing services market are mentioned below.

• In May 2023, Lonza launched the TheraPEAK T-VIVO Cell Culture Medium with a novel chemically defined formulation devised to optimize and streamline CAR T-cell manufacturing. The TheraPEAK T-VIVO Cell Culture Medium can exhibit a high performance without the need to add human serum or its components, unlike other serum-free media.

• In October 2022, Pfizer Inc. completed the acquisition of Biohaven Pharmaceutical Holding Company Ltd., the manufacturer of NURTEC ODT (rimegepant), an innovative migraine therapy approved for both acute treatment and prevention of episodic migraine in adults.

• In March 2022, Cellevolve Bio partnered with Seattle Children’s Therapeutics to develop and commercialize new multiplex CARs for paediatric cancers. Under the collaboration, the partners will focus on the BrainChild research program, a suite of five multiplex CARs, to treat pediatric central nervous system (CNS) malignancies. In partnership, they would leverage the Seattle Children’s Cure Factory facility to conduct early clinical GMP research on new CARs.

Thus, these strategic initiatives create significant growth opportunities in the cell and gene therapy manufacturing services market.

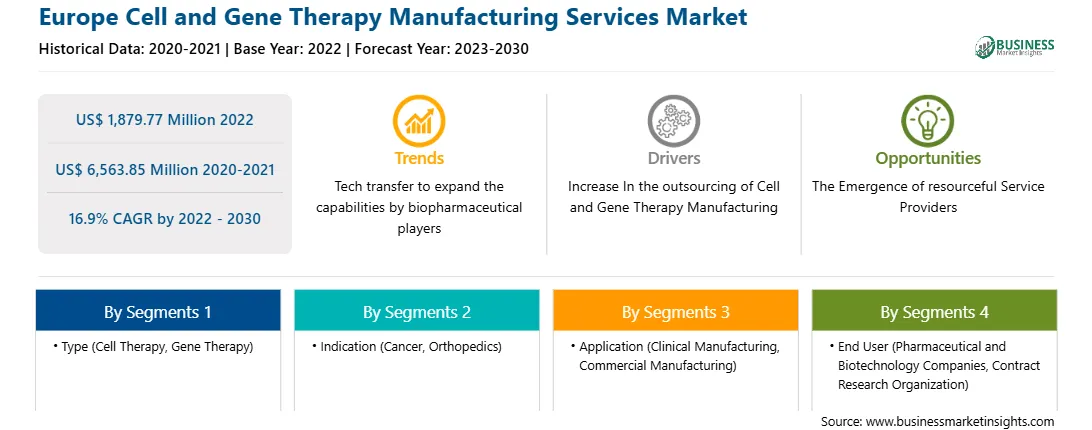

The Europe cell and gene therapy manufacturing services market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. The region will hold a significant market share in the coming years. The European US and Europe cell and gene therapy manufacturing services market is expected to witness significant growth during the forecast period due to factors such as the investment for setup of production capacity, high government support and involvement in the region. Also, presence of top competitive players will further enhance the regional market growth during the forecast period 2022-2030.

Germany has a strong pharmaceutical industry with a notable focus on R&D. The country has 660 biotechnology companies that employ 50,000 employees. Among these, 660 companies are focused on CGT. As per the NecstGen report, more than 29 active clinical trials evaluating CAR-modified immune cells were ongoing in 2021, and the majority of the production involved CAR-T cells. Also, over 50 clinical studies have been conducted in gene therapy in Germany so far. The innovation efforts of German CGT companies are majorly focused on the local or country level, as they lack international presence.

The UK is one of the world's best ecosystems for research, development, manufacturing, clinical adoption, and reimbursement of advanced therapeutics. Currently, over 85 clinical trials are ongoing in the UK, and 70 CGTs companies are operating for the development of potentially curative therapies. In 2018, National Health Services (NHS) England announced the availability of CAR-T cell treatment for cancer patients, which was the first time when this therapy was made available to these patients.

Catapult is another top company that has been contributing significantly to the CGT ecosystem in the UK; it stands as one of the top five companies in developing manufacturing processes in the country. The company is developing smarter automated CGT manufacturing processes that can automatically adapt to changing environments and process requirements with minimal intervention. Therefore, efforts made by these companies for enhancing productivity and reducing the final costs are the major factors driving the growth of the Europe cell and gene therapy manufacturing services market in the UK. Moreover, the UK holds a strong position in the Europe cell and gene therapy manufacturing services market in Europe owing to sustained and targeted investment in research.

The Europe cell and gene therapy manufacturing services market is segmented into type, indication, application, end user, and country.

Based on type, the Europe cell and gene therapy manufacturing services market is bifurcated into cell therapy and gene therapy. In 2022, the cell therapy segment registered a larger share in the Europe cell and gene therapy manufacturing services market. The cell therapy segment is further segmented into autologous and allogenic. The gene therapy segment is further segmented into viral and non-viral vector.

Based on indication, the Europe cell and gene therapy manufacturing services market is segmented into cancer, orthopedics, and others. In 2022, the cancer segment registered the largest share in the Europe cell and gene therapy manufacturing services market.

Based on application, the Europe cell and gene therapy manufacturing services market is segmented into clinical manufacturing and commercial manufacturing. In 2022, the commercial manufacturing segment registered the largest share in the Europe cell and gene therapy manufacturing services market.

Based on end user, the Europe cell and gene therapy manufacturing services market is bifurcated into pharmaceutical and biotechnology companies and contract research organization (CROs). In 2022, the pharmaceutical and biotechnology companies segment registered a larger share in the Europe cell and gene therapy manufacturing services market.

Based on country, the Europe cell and gene therapy manufacturing services market is segmented into the UK, France, Germany, Spain, Italy, and the Rest of Europe. In 2022, the UK registered the largest share in the Europe cell and gene therapy manufacturing services market.

Catalent Inc, Charles River Laboratories International Inc, FUJIFILM Holdings Corp, Lonza Group AG, Merck KgaA, Nikon Corp, Oxford BioMedica Plc, Takara Bio Inc, Thermo Fisher Scientific Inc, and WuXi AppTec Co Ltd are some of the leading companies operating in the Europe cell and gene therapy manufacturing services market.

Strategic insights for the Europe Cell and Gene Therapy Manufacturing Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,879.77 Million |

| Market Size by 2030 | US$ 6,563.85 Million |

| Global CAGR (2022 - 2030) | 16.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

The geographic scope of the Europe Cell and Gene Therapy Manufacturing Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Catalent Inc

2. Charles River Laboratories International Inc

3. FUJIFILM Holdings Corp

4. Lonza Group AG

5. Merck KgaA

6. Nikon Corp

7. Oxford BioMedica Plc

8. Takara Bio Inc

9. Thermo Fisher Scientific Inc

10. WuXi AppTec Co Ltd

The Europe Cell and Gene Therapy Manufacturing Services Market is valued at US$ 1,879.77 Million in 2022, it is projected to reach US$ 6,563.85 Million by 2030.

As per our report Europe Cell and Gene Therapy Manufacturing Services Market, the market size is valued at US$ 1,879.77 Million in 2022, projecting it to reach US$ 6,563.85 Million by 2030. This translates to a CAGR of approximately 16.9% during the forecast period.

The Europe Cell and Gene Therapy Manufacturing Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Cell and Gene Therapy Manufacturing Services Market report:

The Europe Cell and Gene Therapy Manufacturing Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Cell and Gene Therapy Manufacturing Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Cell and Gene Therapy Manufacturing Services Market value chain can benefit from the information contained in a comprehensive market report.