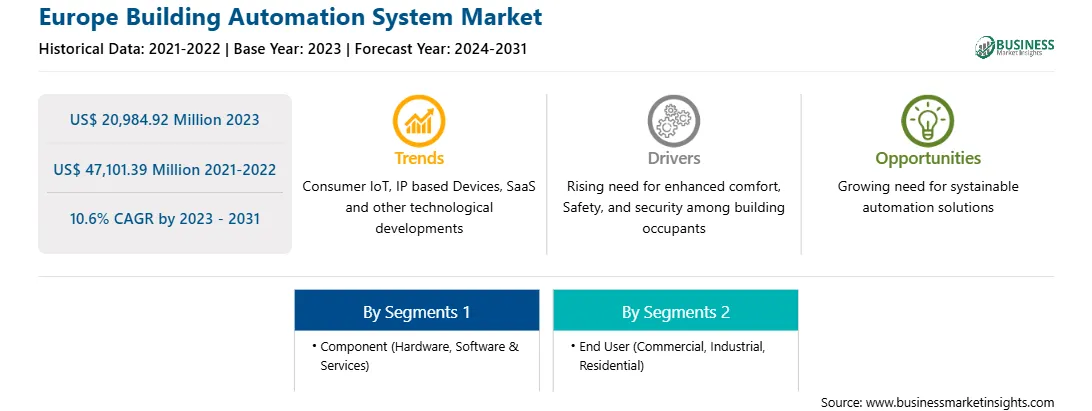

The Europe building automation system market was valued at US$ 20,984.92 million in 2023 and is expected to reach US$ 47,101.39 million by 2031; it is estimated to register a CAGR of 10.6% from 2023 to 2031.

Traditional building automation systems relied heavily on wired infrastructure, which limits flexibility in sensor placement and system expansion. To overcome this limitation, sensors equipped with wireless sensor network (WSN) technology can be deployed wirelessly, allowing for easy reconfiguration and scalability. Wireless sensor networks eliminate the need for large cabling, reducing installation costs and labor. WSN technology enables control of building systems and real-time monitoring, optimizing energy usage based on occupancy and environmental conditions. According to the International Energy Agency reports, in 2022, the building sector represents approximately a third of total energy system emissions, including buildings operations (26%) and embodied emissions (7%) associated with the production of materials used for their construction.

Many wireless protocols and standards, including Z-Wave, 6LoWPAN, ZigBee, and EnOcean, are being implemented that are focused on using wireless technologies and offer innovation within the building automation system ecosystem. Further, the Z-Wave protocol is a simple, wireless, interoperable, RF-based communication-based technology designed particularly for monitoring and controlling and status reading applications in light commercial and residential environments. The protocol allows companies to offer a wide range of home automation options to customers. Therefore, the integration of wireless sensor network technology and wireless protocols with building automation systems drives the building automation market.

A regulatory mandate requires the installation of Building Automation Control Systems (BACS) in tertiary buildings by January 2025 to enhance energy efficiency and decrease CO2 emissions. In 2020, all European Union (EU) member states were obligated to incorporate this mandate into national legislation, as per the EU Energy Performance of Buildings Directive (EPBD). The legislation mandates the installation or retrofit of automation control systems, including building management systems, in existing and under-construction nonresidential buildings with an operational rated output of over 290 kW. This requirement is based on legislation transposed from Directive 2010/31/EU of the European Parliament and Council, with guidance from the EPBD. The BACS decree represents a crucial regulatory measure aimed at enhancing energy efficiency, reducing CO2 emissions, and promoting sustainable practices in the nonresidential building sector, aligning with broader environmental and energy efficiency goals at both the national and EU levels. This regulatory measure boosts the building automation system market in Europe.

Strategic insights for the Europe Building Automation System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Europe Building Automation System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Europe Building Automation System Strategic Insights

Europe Building Automation System Report Scope

Report Attribute

Details

Market size in 2023

US$ 20,984.92 Million

Market Size by 2031

US$ 47,101.39 Million

Global CAGR (2023 - 2031)

10.6%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By End User

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Building Automation System Regional Insights

The Europe building automation system market is categorized into component, end user, and country.

Based on component, the Europe building automation system market is bifurcated into hardware and software & services. The hardware segment held a larger market share in 2023. Furthermore, the hardware segment is sub segmented into security & surveillance system, facility management systems, fire protection systems, and others.

In terms of end user, the Europe building automation system market is segmented into commercial, industrial, and residential. The commercial segment held the largest market share in 2023.

By country, the Europe building automation system market is segmented into France, Germany, the UK, Italy, Russia, and the Rest of Europe. Germany dominated the Europe building automation system market share in 2023.

ABB Ltd; Mitsubishi Electric Corp; Bosch Sicherheitssysteme GmbH; Honeywell international Inc; Schneider Electric SE; Siemens AG; Johnson Controls International Plc; Carrier Global Corp; Lutron Electronics Co., Inc; and Trane Technologies Plc, are some of the leading companies operating in the Europe building automation system market.

The Europe Building Automation System Market is valued at US$ 20,984.92 Million in 2023, it is projected to reach US$ 47,101.39 Million by 2031.

As per our report Europe Building Automation System Market, the market size is valued at US$ 20,984.92 Million in 2023, projecting it to reach US$ 47,101.39 Million by 2031. This translates to a CAGR of approximately 10.6% during the forecast period.

The Europe Building Automation System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Building Automation System Market report:

The Europe Building Automation System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Building Automation System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Building Automation System Market value chain can benefit from the information contained in a comprehensive market report.